Oct 24

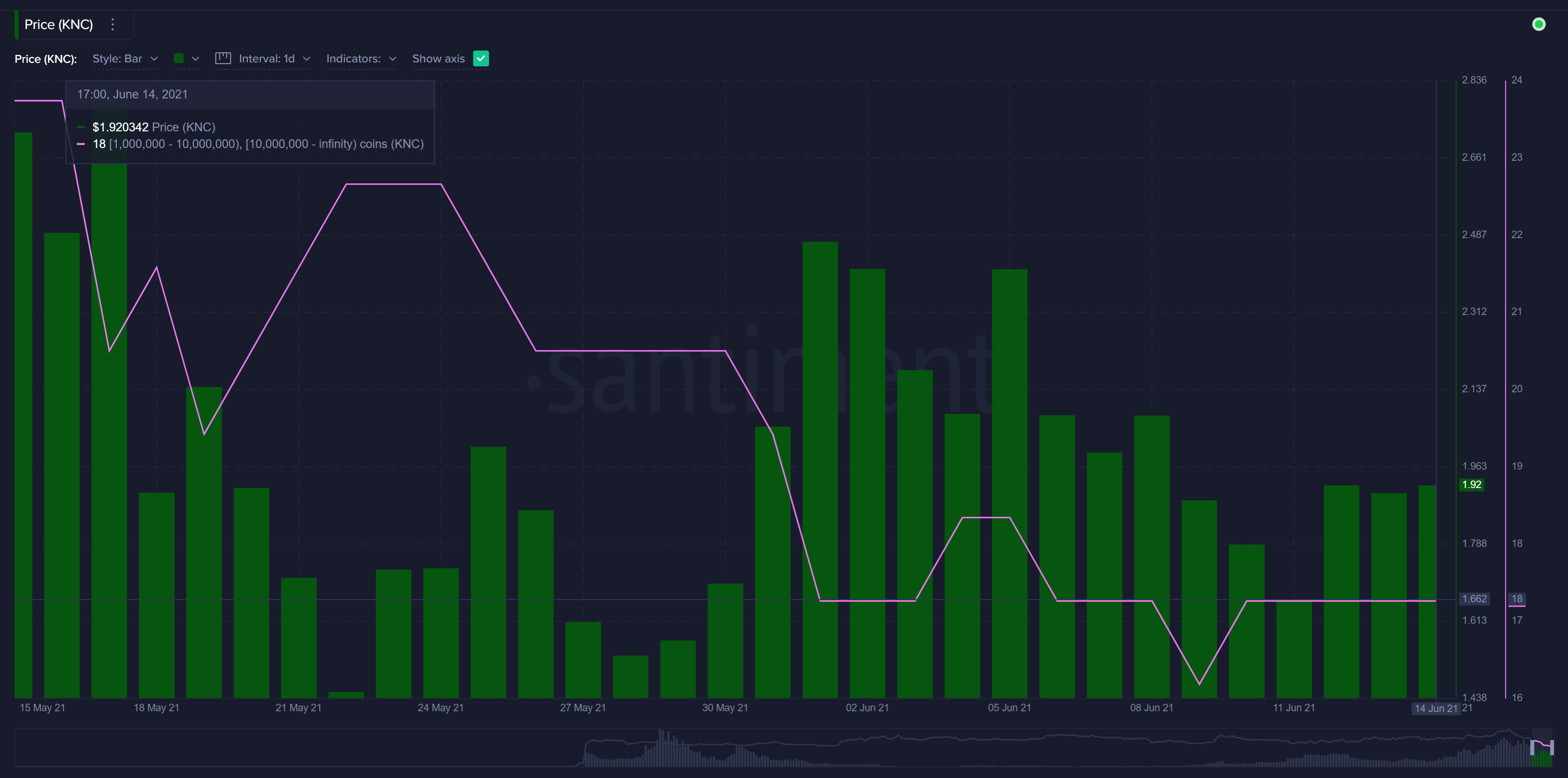

KNC whales chart shows a strong accumulation:

Kyber, you have our curiosity. We'll keep watching.

Jul 7

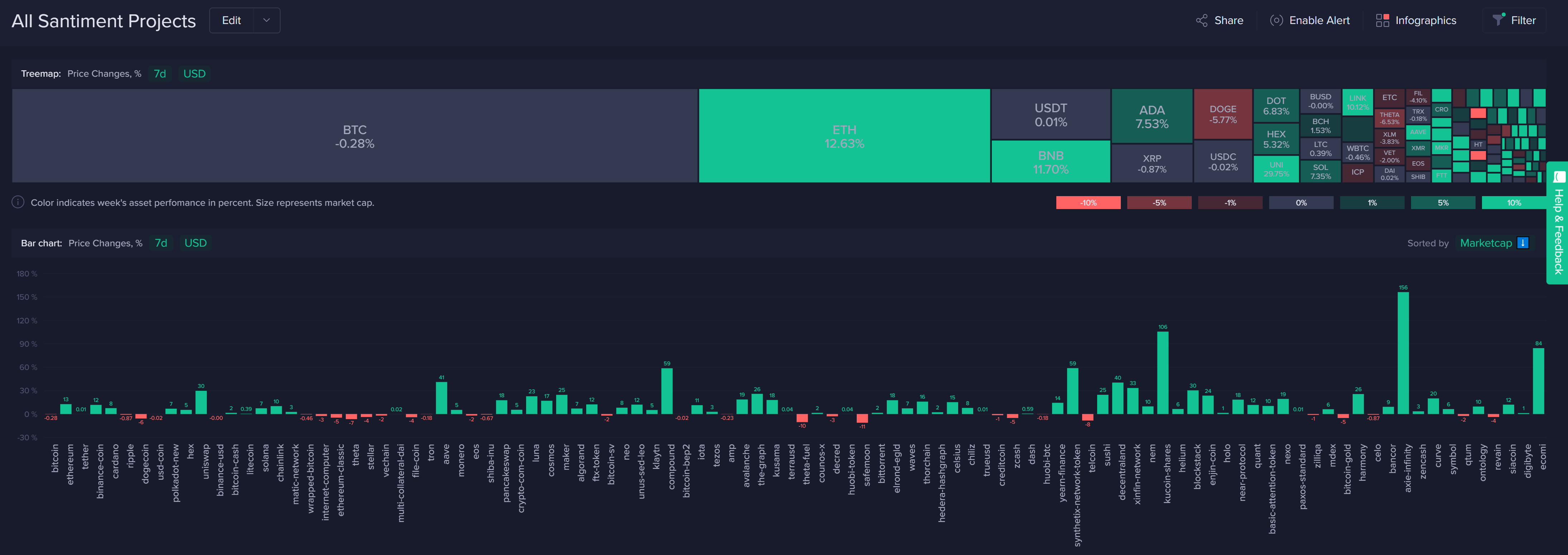

Bitcoin, over the past week, has been nothing short of a snoozefest over the past week, as the ranging pattern between $33k to $36k has turned many traders' attention to altcoins as the more exciting option. And the increased volume and action being seen by many assets that had been pummeled just one month ago, are now showing encouraging signs once again.

Top whale holder numbers are decreasing for many of these surging assets, and this article will take a look at which assets are seeing whale accumulation, and which are seeing whales dumping their bags.

With your Sanbase PRO account, get our Whale Holders Distribution Model here.

Freely open it, go to File -> Make a Copy, then Download Sansheets, and plug in your API: https://docs.google.com/spreadsheets/d/1v41I4Kb1Fl6rwBwYIuCsmXqtQZw5I_fEbsjU7QsH_x0/view

⬆️ Increasing Number of Whale Address

Yearn Finance ($YFI)

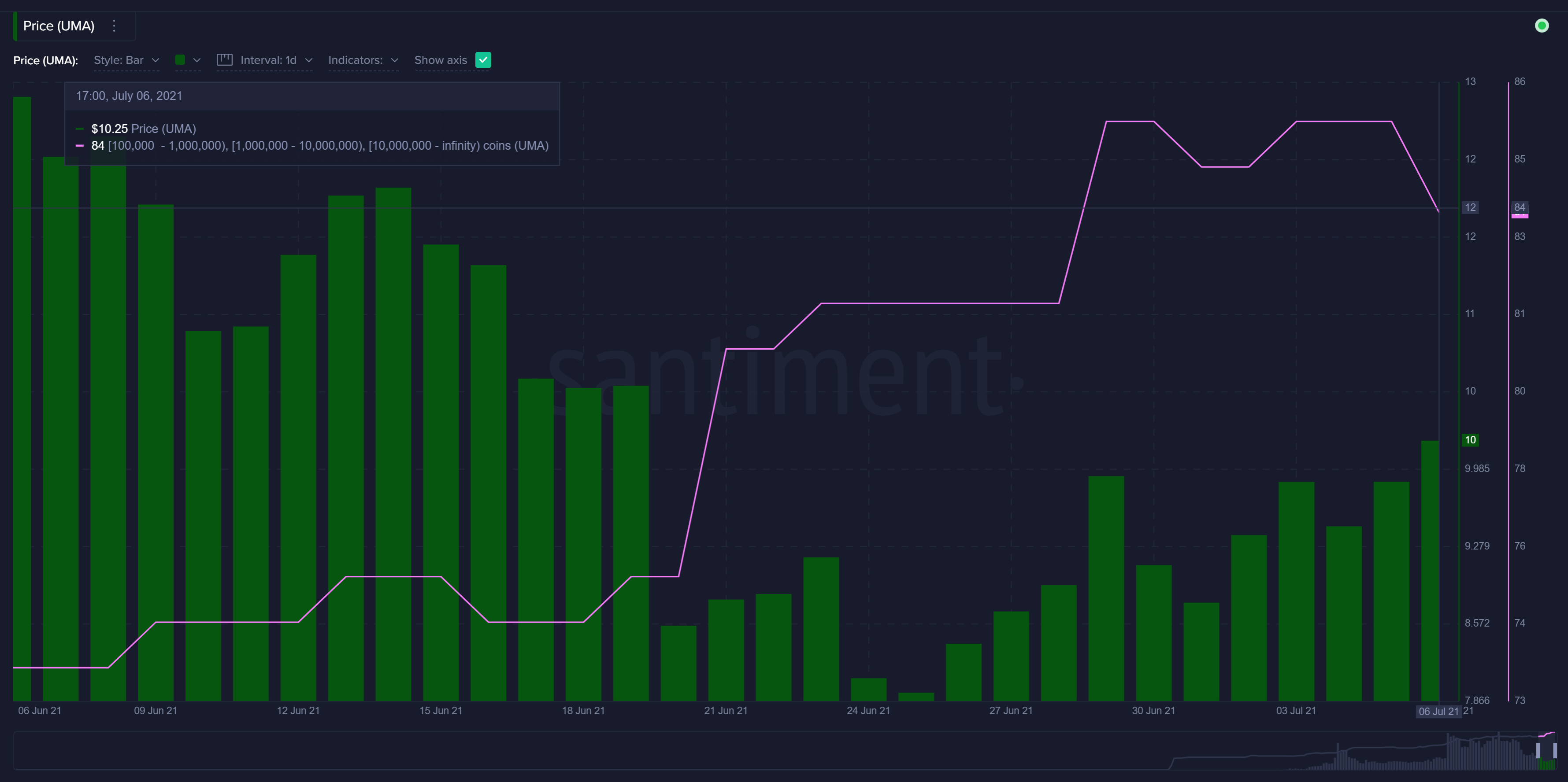

Uma ($UMA)

Maker ($MKR)

⬇️ Decreasing Number of Whale Address

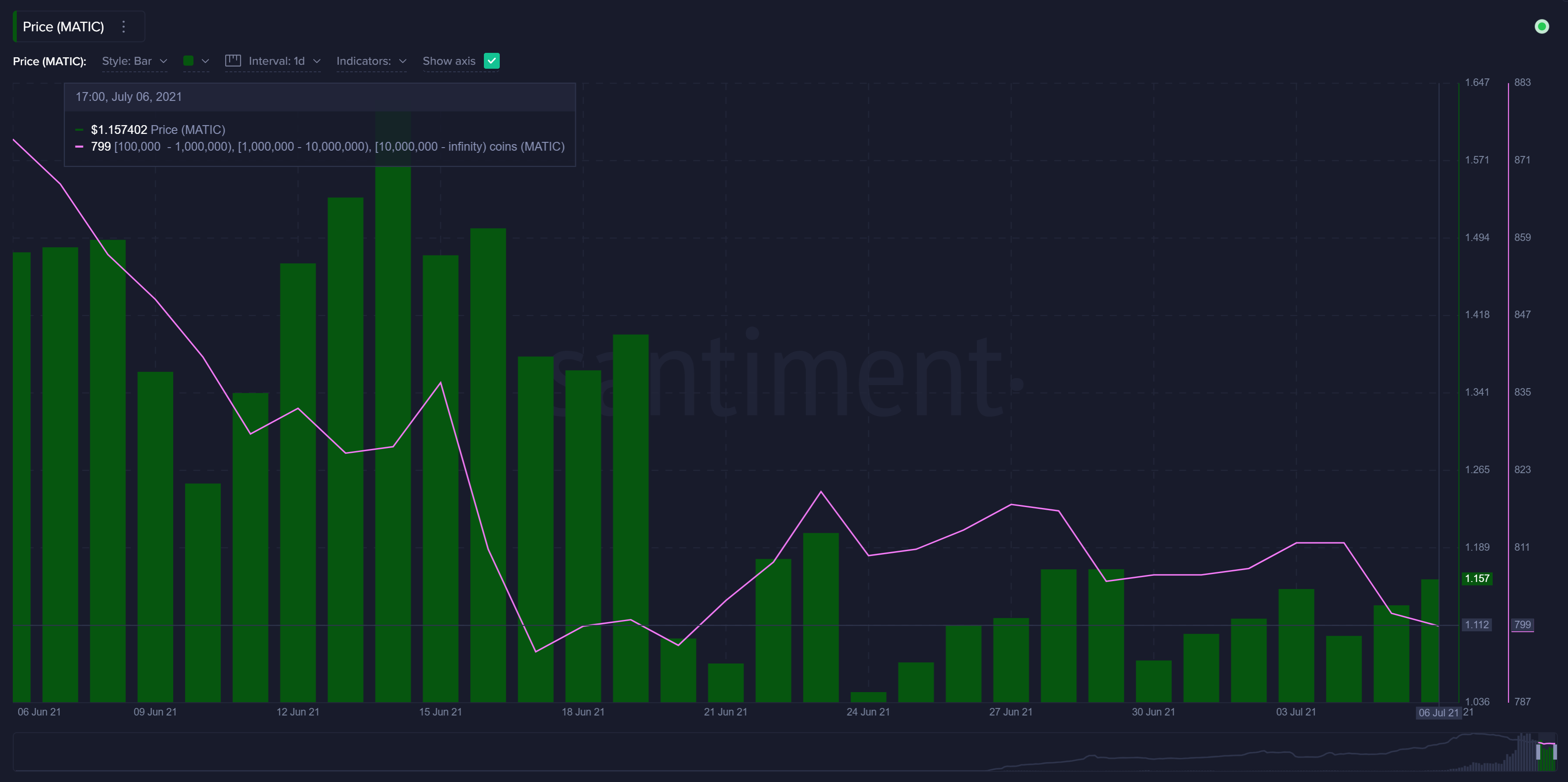

Polygon ($MATIC)

Aragon ($ANT)

Kyber Network ($KNC)

Jun 15

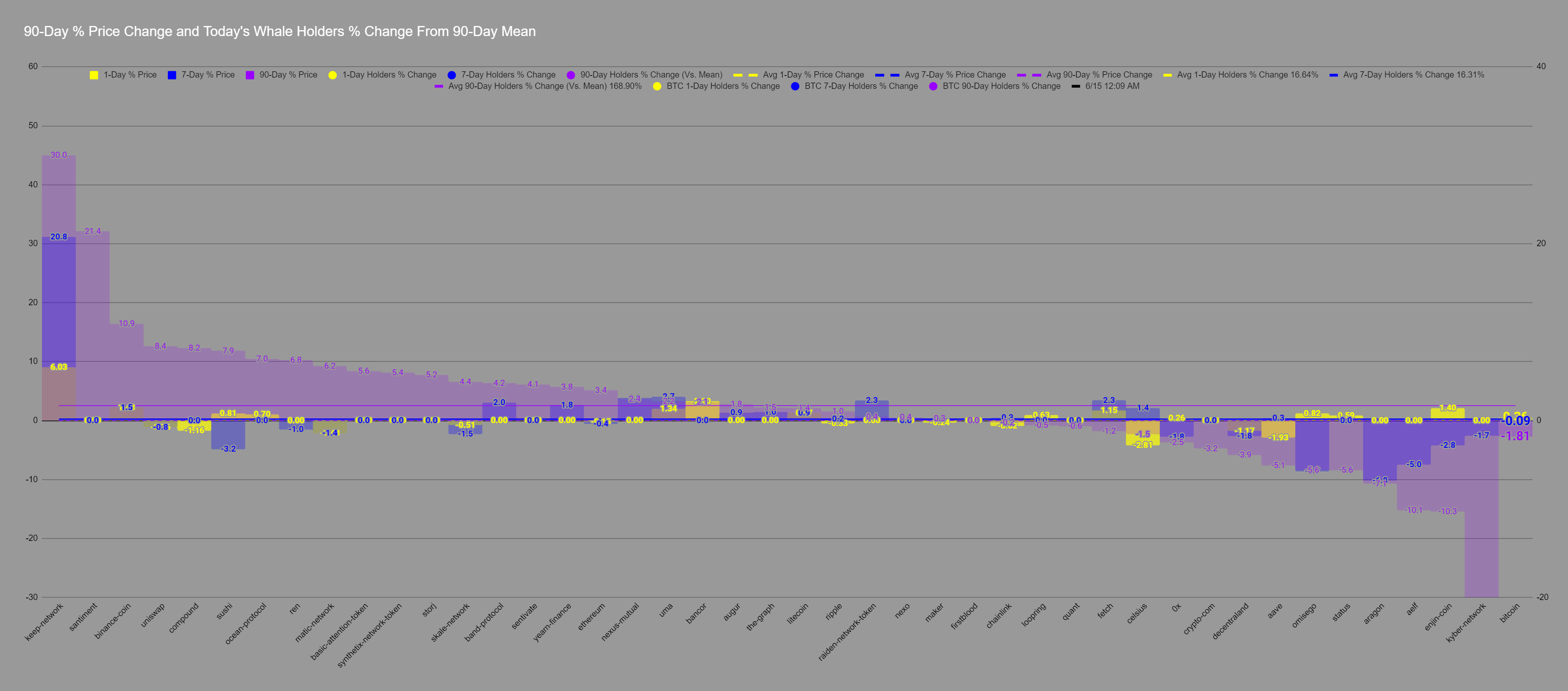

Altcoins are jumping all over the place in the previous week, with key stakeholders separating asset prices from one another quickly by dictating which should be pumped next.

Luckily, Santiment has a model to indicate when the number of whale addresses of ERC-20 and notable altcoins are increasing or decreasing. How do we identify which projects are gaining the fastest steam among crypto millionaires? By using our Whale Holders Distribution Model here. Freely open it, go to File -> Make a Copy, then Download Sansheets, and plug in your API: https://docs.google.com/spreadsheets/d/1v41I4Kb1Fl6rwBwYIuCsmXqtQZw5I_fEbsjU7QsH_x0/view

Give it a spin with your Sanbase PRO account, and you'll quickly find how intuitive it is:

Below are three projects with notable rises in whale numbers, as well as three with notable drops:

⬆️ Increasing Number of Whale Address

Binance Network ($BNB)

Band Protocol ($BAND)

Uma ($UMA)

⬇️ Decreasing Number of Whale Address

Aelf ($ELF)

Kyber Network ($KNC)

Enjin Coin ($ENJ)

Feb 27

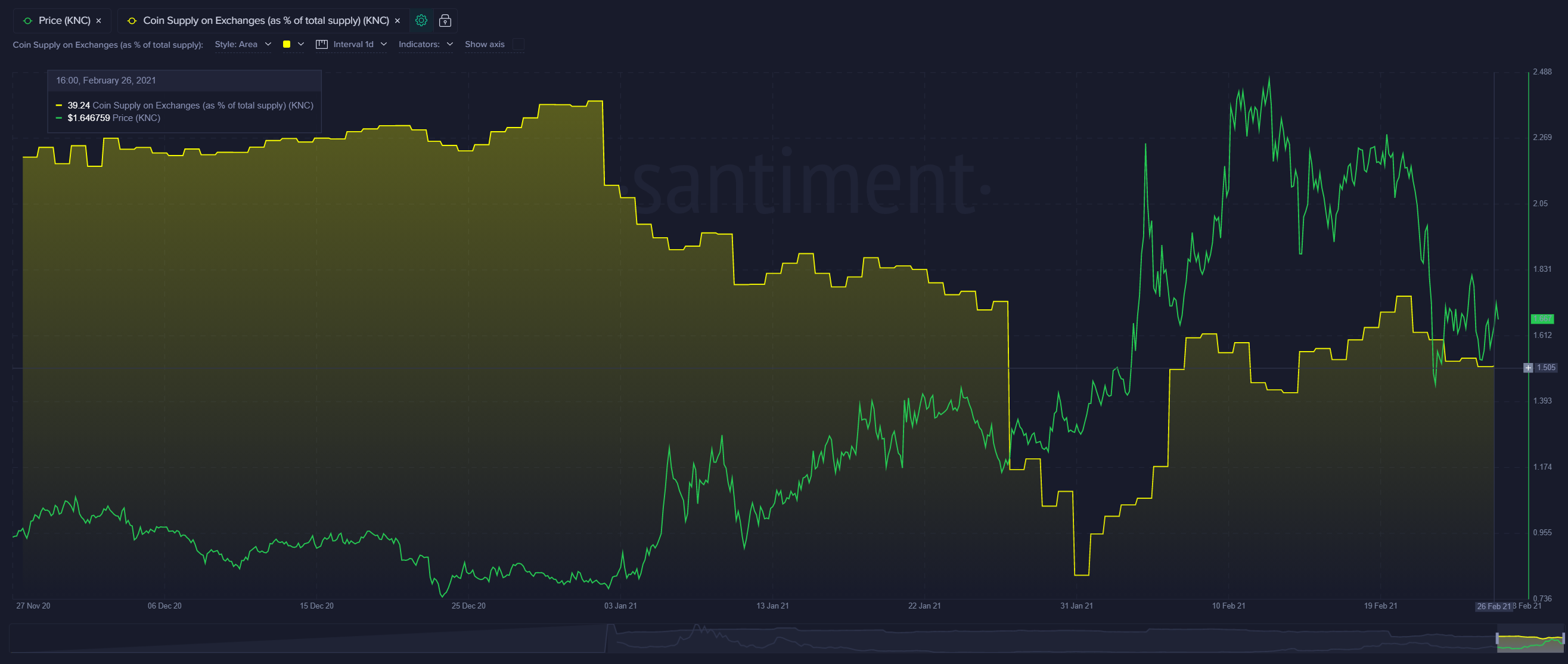

Though the ratio of a crypto asset's supply on exchanges may not seem to have an immediate impact on prices, the long-term correlations between coins moving away from exchanges while prices move up, is quite evident.

Let's take a look at three ERC-20 assets that are showing this pattern as a volatile week in crypto full of price retracements is coming to an end:

Ethereum

Crypto's #2 market cap asset has seen quite the pullback since its retrace from above $2k last week. However, ETH's supply isn't budging away from offline wallets.

Bancor

Bancor's supply moving away from exchanges had a lot to do with its ability to hit a 2-year high $6.17 last week. BNT supply is now 71.7% below its one-year average.

Kyber Network

KNC's supply has jumped to 39.2% after being as low as 36.1% on January 31st. On the long-term scale, the amount of tokens is still 17% lower than its one-year average.

Feb 25

Sometimes one or two major individual transactions alone are enough to reveal that a whale selloff may send an asset spiraling.

Here are a couple assets seeing HUGE transactions the last few days:

Kyber Network - $26M (2/22)

KNC had a flurry of large transactions Monday, including 13m tokens swapping exchange addresses.

The spike in on-chain transaction volume and exchange inflow has predictably sent KNC downward.

0x Protocol - $44M (2/19)

The 28M ZRX tokens sent from a whale to exchange address marked the highest USD value transfer in the token's 3.5-year history.

Prices have been very volatile since, but it did drop massively during the market-wide correction Monday. Note the major exchange inflow spikes highlighted!

Feb 8

Token Age Consumed has been a steadfast metric our community has relied upon to spot mid to long-term price direction reversals. This extremely useful Santiment metric reveals the amount of tokens changing addresses, multiplied by the time since they last moved.

This metric is often used to spot local tops, but it can also be used to see signs of dormant tokens moving with the intention of pushing UP prices. Some examples of some recent spikes on this metric are given in the following assets below:

Chainlink ($LINK)

Chainlink's pattern of Friday age consumed spikes continued with its largest occurring a couple days ago. Be careful with one occurring at a local top.

Kyber Network ($KNC)

Kyber Network is seeing the beginnings of a rebound, and some major dormant token movement appears to be supporting it!

0x ($ZRX)

Without an age consumed spike supporting 0x's price rebound, we're a bit pessimistic about a higher high.

Jul 14

Binance has introduced staking for Kyber. If we see exchange inflow spikes for KNC, it isn't necessary a bad thing, creating strong sell pressure. Binance staking seems hassle free and does not lock up KNC like the KyberDAO, very convenient for users that want to be able to react to market conditions.

This in the long run though, isn't good for Kyber itself, defeating the purpose of staking.