Jul 2

📈🧑💻 Ethereum (+5%) and Cardano (+9%) are both thriving on a nice rebound day for crypto. The two top cap assets have been consistent leaders in development activity, where the $ETH team is currently #13 and $ADA team is #4 in terms of notable github events.

Jun 24

📊 Here is the Percent of Total Supply in Profit for six top-cap cryptocurrencies. This metric tracks the percentage of each asset’s circulating supply currently held at a profit (meaning the market price is higher than the average on-chain acquisition price). As of the latest data point, the percent of supply in profit is approximately:

🪙 Bitcoin $BTC: 94.5%

🪙 Ethereum $ETH: 88.7%

🪙 XRP $XRP: 65.1%

🪙 Dogecoin $DOGE: 64.7%

🪙 Chainlink $LINK: 59.4%

🪙 Cardano $ADA: 46.5%

📈A high percentage, such as Bitcoin’s 94.5%, indicates that the vast majority of holders are in profit, which making an argument for slight overvaluation in the short term. When roughly 19 out of every 20 coins are in profit like this, it will typically lead to strong market confidence. However, it also suggests that there's a greater risk of profit-taking and corrections.

📉On the flip side, a low percentage, like Cardano’s 46.5%, means that more than half of holders are at a loss, which can reflect undervaluation and more of a bearish sentiment from jaded investors who bought at a higher price than where ADA sits currently. Its low supply in profit does suggest greater potential for growth, though, if crypto has another bull cycle later this year.

📑 Bookmark this chart to assess relative value and positioning. Coins with a low percent of supply in profit, like ADA and LINK, may appeal to contrarian or long-term investors looking for assets that haven’t experienced a strong rally in quite some time.

Jun 16

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's rank rise or fall since last month:

📈 1) Internet Computer $ICP 🥇

📉 2) Chainlink $LINK 🥈

📉 3) Starknet $STRK 🥉

📉 4) Cardano $ADA

➡️ 5) Polkadot $DOT

📉 T5) Kusama $KSM

📈 7) Optimism $OP

📈 8) Deepbook $DEEP

📉 9) Sui $SUI

📈 10) Ethereum $ETH

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading.

May 28

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

Apr 29

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's rank rise or fall since last month:

📈 1) iExec RLC $RLC 🥇

📉 2) Internet Computer $ICP 🥈

📉 3) Chainlink $LINK 🥉

📉 4) Starknet $STRK

➡️ 5) Cardano $ADA

📉 6) Optimism $OP

📈 7) Deepbook $DEEP

📈 8) Sui $SUI

📉 9) Ethereum $ETH

📈 10) zkSync $ZK

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Apr 1

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

➡️ 2) Chainlink $LINK 🥈

📈 3) Starknet $STRK 🥉

📉 4) Optimism $OP

📉 5) Cardano $ADA

📈 6) iExec RLC $RLC

➡️ 7) Ethereum $ETH

📈 8) Avalanche $AVAX

📉 T9) Polkadot $DOT

📉 T9) Kusama $KSM

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Mar 28

📉 Trading volume among crypto's 10 largest stablecoins has dropped to roughly 1/4th of the level we saw in the midst of the bull cycle in early December. Several factors are contributing to this:

📌 Trader Fatigue: Following the all-time high top back on January 19th, both institutional and retail traders have increasingly moved capital and taken profits while awaiting new catalysts.

📌 There have been new regulatory announcements in major markets, raising the level of uncertainty and causing traders of all sizes to take more of a 'hodling' approach for the time being

📌 Bitcoin's supply on exchanges recently reached a 7-year low, indicating trader contentment with executing less on-chain trading on a daily basis

Mar 7

🐳 With altcoins continuing to increase their market caps as the week draws to a close, pay attention to the networks seeing the highest rises in the amount of $100K+ whale transactions:

🪙 1) Aave (On Polygon) $AAVE: +267%

🪙 2) HEX $HEX: +256%

🪙 3) OKX $OKB: +200%

🪙 4) Cardano $ADA: +193%

🪙 5) Optimism $OP: +140%

🪙 6) Trillioner $TLC: +133%

🪙 7) Bitcoin Cash $BCH: +128%

🪙 8) Curve $CRV: +100%

🪙 9) Bitdao $BIT: +100%

🪙 10) Gate $GT: +100%

These projects could see significant over-performances throughout the next few weeks if markets continue to rally due to signs of potential accumulation coming from many of these increased whale transfers.

Feb 24

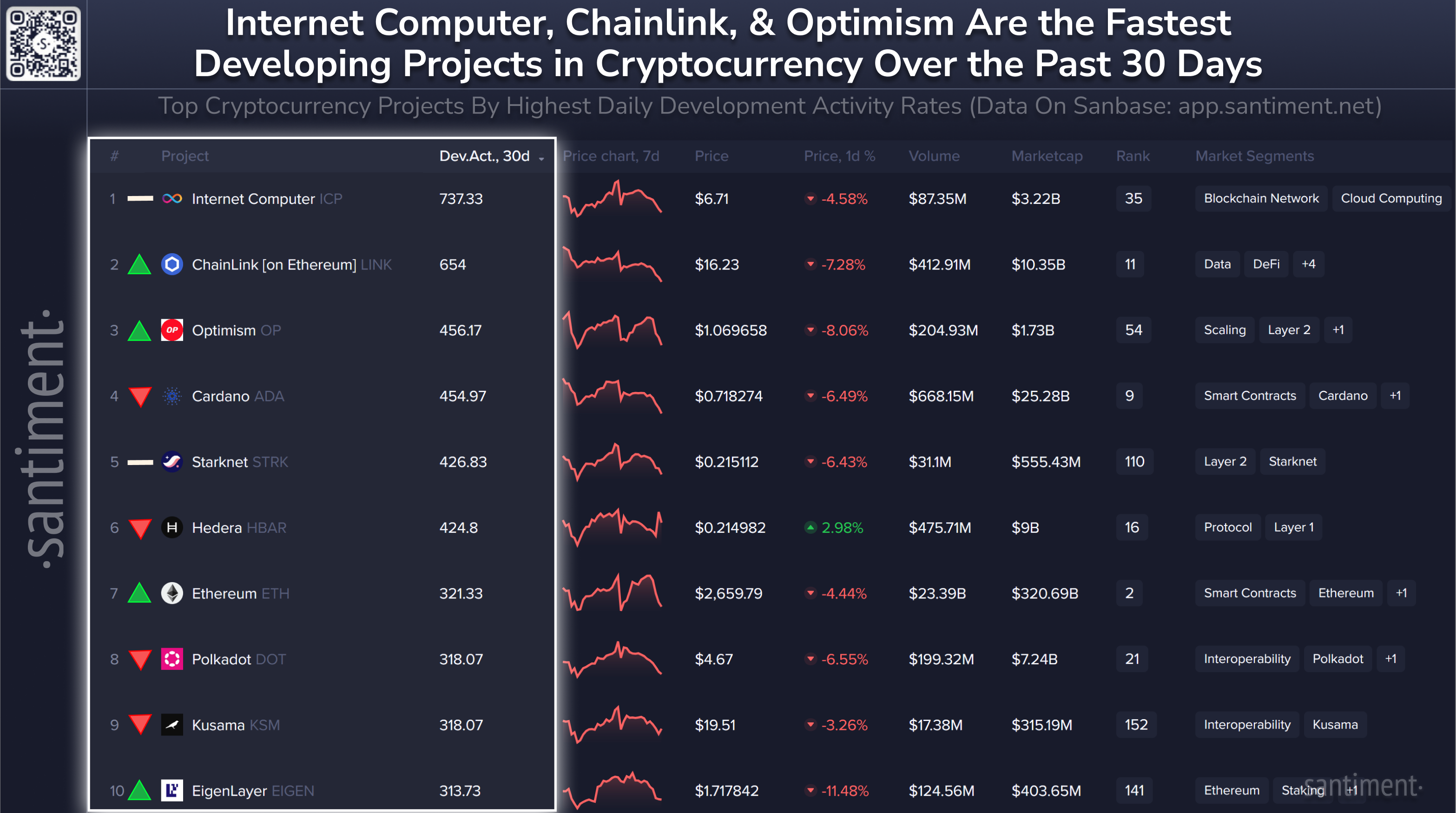

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

📈 2) Chainlink $LINK 🥈

📈 3) Optimism $OP 🥉

📉 4) Cardano $ADA

➡️ 5) Starknet $STRK

📉 6) Hedera $HBAR

📈 7) Ethereum $ETH

📉 T8) Polkadot $DOT

📉 T8) Kusama $KSM

📈 10) Eigenlayer $EIGEN

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading.

Feb 11

📊 In terms of cryptocurrency discussions on X, Reddit, Telegram, 4Chan, Bitcointalk, and Farcaster, Bitcoin (in teal) is leading the way as usual. Cardano (in pink) is seeing a massive rise compared to usual, while Ethereum (red) and Dogecoin (orange) are nearly non-existent.