Jul 14

Celsius, the crypto lender that last month halted withdrawals, has filed for bankruptcy. User withdrawals will remain halted.

What can we see on charts?

- The price has dumped around 11%, which is expected:

2. Network Profit Loss showing almost only loss last months:

3. Now the interesting part. Whales balance:

Big token holders are not panicking, they are pulling down slowly.

Their reaction to filing to bankruptcy is quite calm compared to earlier moves. Either all who wanted has already left, either... there's not enough liquidity?

Let's see.

Uniswap:

Paraswap:

Oh yes, this is the case. Whales simply can not offload Celsius without loss.

Losses here and there.

This is the way.

Jun 22

This is a brief overview of topics trending in crypto social media according to Social Trends:

References:

Jun 20

Celsius has pumped almost 40% on Monday.

It has been considered to be dead but bounced nicely.

We'd like to share an overview of CEL token holders behaviour.

Three groups:

First one (100 to 10K CEL) is the crowd leading the pump.

10k to 100k behaving more or less the same.

100k to 1m been buying early, this is the expected behaviour for whales.

All groups bought a lot directly into the dump, then selling more or less on the way up, then buying again.

Interesting that it's a kind of unusual behaviour for small token holders.

Usually they are the ones not touching token when scared.

May be not scared yet?

May 8

As we've done in previous weeks, we're continuing to keep an eye on which projects are seeing notable movement from their respective whale addresses. Watching which assets are seeing a growing amount of addresses worth $100,000 or more can give a great indication into future price pumps and dumps.

Below, we've listed three projects with notable rises in whale numbers, as well as three with notable drops:

⬆️ Increasing Number of Whale Address

Bancor ($BNT)

Skale ($SKL)

Sushi ($SUSHI)

⬇️ Decreasing Number of Whale Address

Celcius ($CEL)

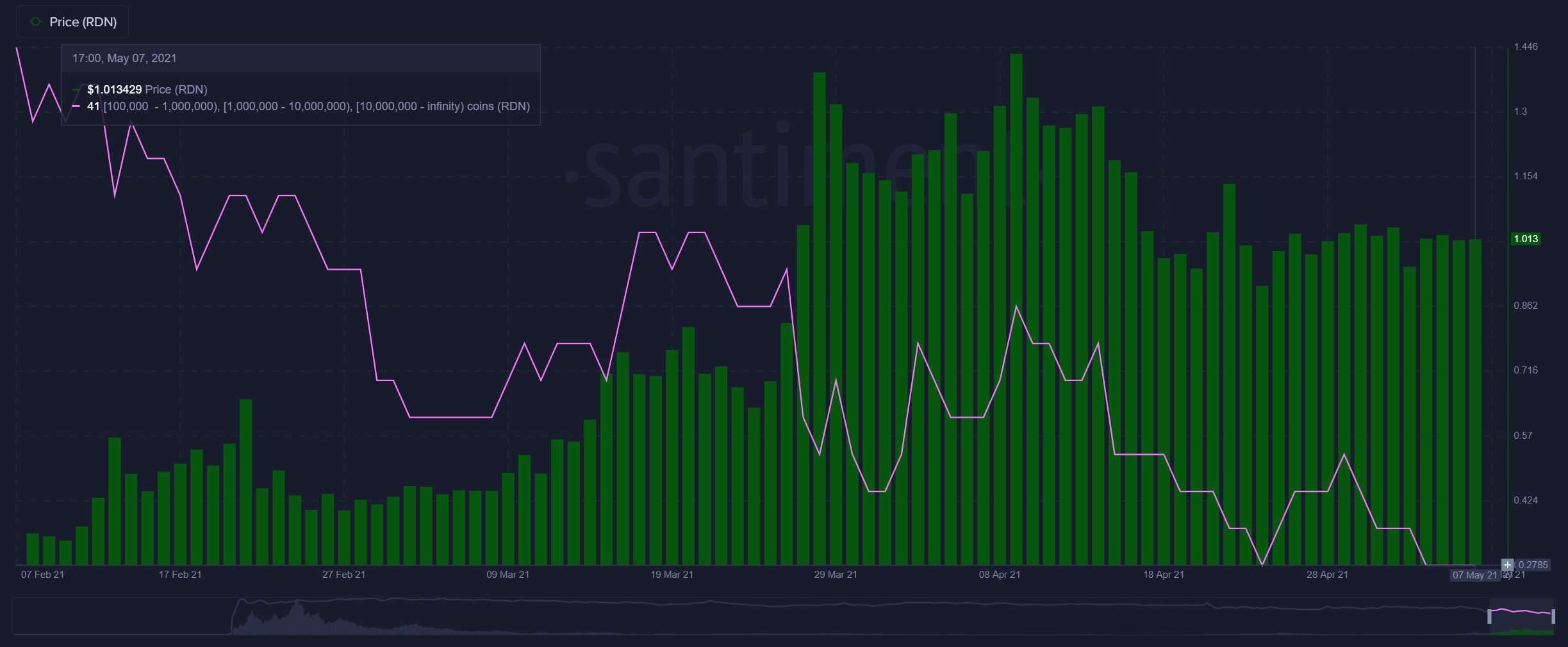

Raiden ($RDN)

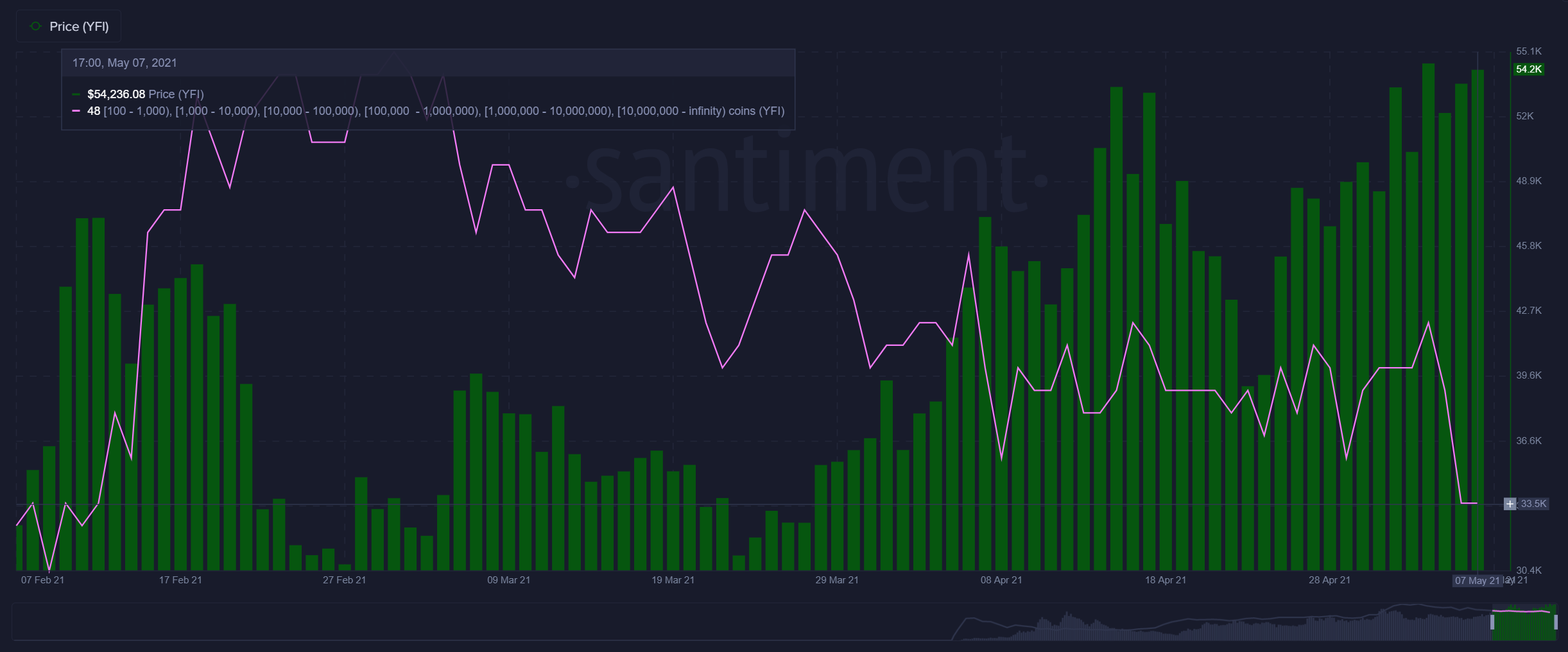

Yearn Finance ($YFI)

Apr 20

When volatility strikes, as it has in the negative direction over the past 3-4 days, many traders tend to display a phenomenon known as "freezing up". This behavior is exactly how it sounds - traders don't want to make a mistake and buy into a downswing or sell into an upswing.

However, whales of many altcoins tend to become much MORE active when prices begin to rollercoaster wildly as they have been as Bitcoin dipped to $53k this weekend.

Here are three assets we see with major whale numbers rising this past week, and conversely, falling:

⬆️ Increasing Number of Whale Address

Ethereum ($ETH)

Ren Protocol ($REN)

Band Protocol ($BAND)

⬇️ Decreasing Number of Whale Address

Celcius ($CEL)

Litecoin ($LTC)

Storj ($STORJ)