Apr 16

🤞 Cryptocurrency markets are enjoying a mild rebound, and Bitcoin has been repeatedly crossing above & below $85K. Traders are showing optimism that $BTC can regain $90K, which will likely be dependent on tariff & global economy news as the week progresses.

Apr 15

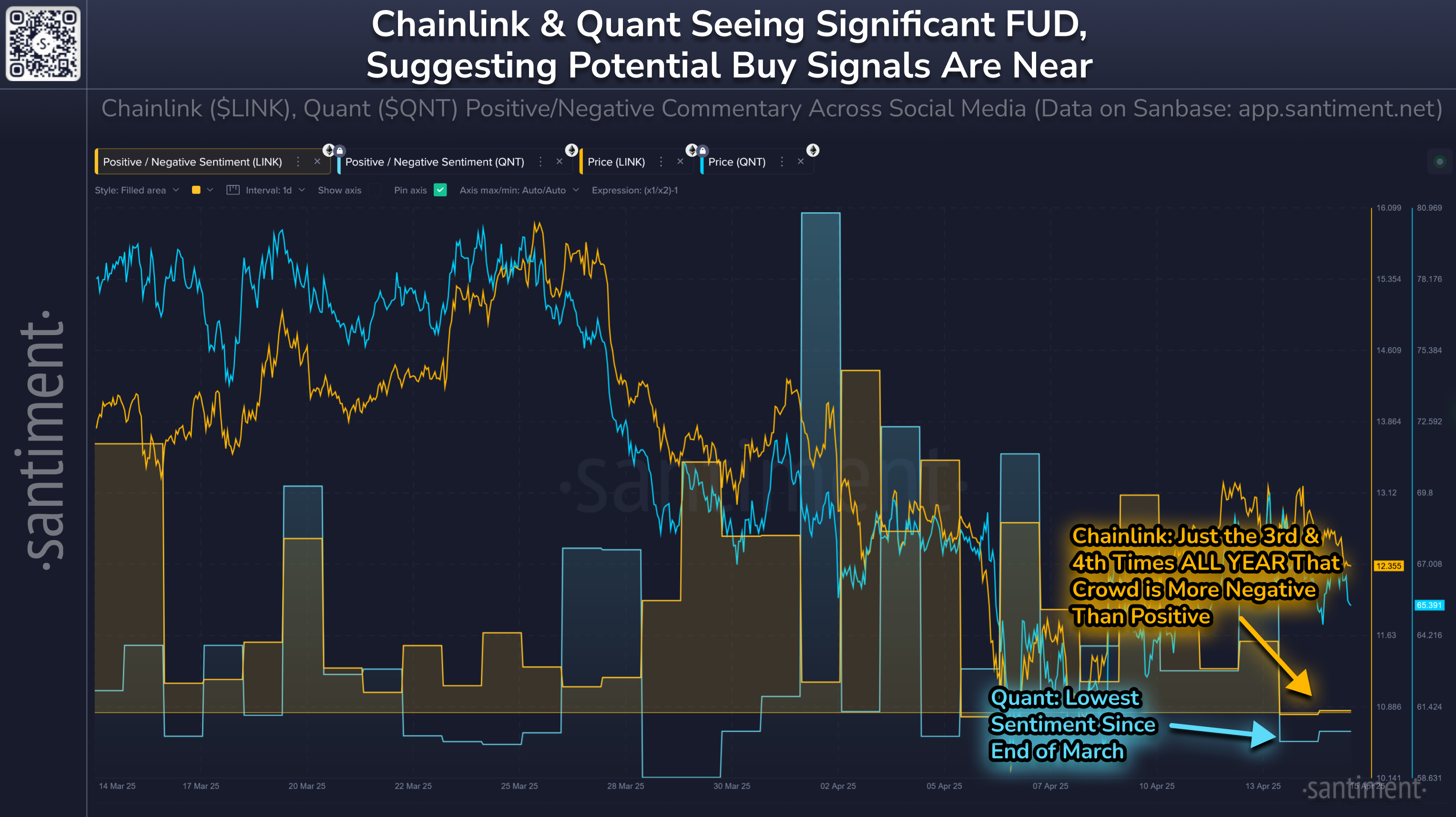

😮 As crypto markets range, keep an eye on the FUD forming around Chainlink and Quant. Their 3-week price dips have made traders grow impatient. Markets typically move the opposite direction of the crowd's expectations, increasing the likelihood of $LINK & $QNT bouncing soon.

Grab your free 2-week trial to Sanbase PRO and enjoy all sorts of professional-grade trading tools & indicators. See what others in crypto can't.

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

📈 1) DeFiChain $DFI 🥇

📈 2) Synthetix $SNX 🥈 (On Ethereum)

📈 3) Lido DAO $LDO 🥉

📈 4) Liquity $LQTY

📈 5) Liquity USD $LUSD

📈 6) Injective $INJ

📈 7) Uniswap $UNI (On Ethereum)

📈 8) Foxcoin $FOX

📈 9) Curve $CRV (On Ethereum)

📈 10) Curve $CRV (On Arbitrum)

Read about Santiment's methodology for covering development activity for over 4,000 projects.

Apr 14

📊 Bitcoin ETF outflows have been prevalent throughout April as a reaction to the tariff chaos and falling prices. But we may see a turning point of money returning this week on Trump's rumored rollbacks. Monitor inflow/outflow data for FREE.

👍 There has been an increased level of bullishness pouring in from the crypto crowd Monday. Ever since the (still not fully clarified) tariff exemptions announced over the weekend, Bitcoin in particular has had a flood of optimistic calls. This is the highest level of positive (vs. negative) commentary since the day before Trump announced tariffs.

Retail traders will always have a slight reactionary bias toward $BTC and altcoins after market caps swing a certain direction, so watch for FOMO & greed to take over if prices approach $90K this week.