April’s Avalanche: How Fears of a Global Trade War Has Sparked a Crypto and Stock Market Meltdown

April, 2025 has already been one of the most stressful months in recent memory for both crypto and stock markets. We haven't seen such a sudden plunge in crypto (or stock) values since the opening months of COVID-19 back in March and April of 2020. It has been no secret that the majority of these retraces are associated with U.S. President Donald Trump, pushing new tariffs that the majority of the world has been against.

These suddenly forced extra taxes on products coming from other countries have wreaked havoc, with many seeing this as nothing more than a power play from the 47th President, and a game of chicken that other countries did not know they were being entered into. What followed was a chain reaction of events that hit markets hard all over the world. Let’s walk through what happened, one big moment at a time.

April 2nd: Trump’s “Liberation Day” Tariff Surprise

Though there had already been rumors of Trump's intention to do so long before he was elected on November 5, 2024, he officially announced a new plan he called “Liberation Day” shortly (and strategically) after stock markets closed last Wednesday. He said the U.S. would put a 10% tax on nearly all products imported from other countries, with even higher taxes for places like China and Europe. For example, all foreign-made cars would now face a 25% tax when brought into the U.S.

Investors obviously didn’t take the news well, now knowing that this wasn't a case of Trump just "blowing smoke" all along. The vast majority of companies around the world, of course, rely on at least one of international infrastructure, revenue, and consumers. So making it objectively less cost effective to do business with the U.S. was undoubtedly going to have cascading negative impacts immediately.

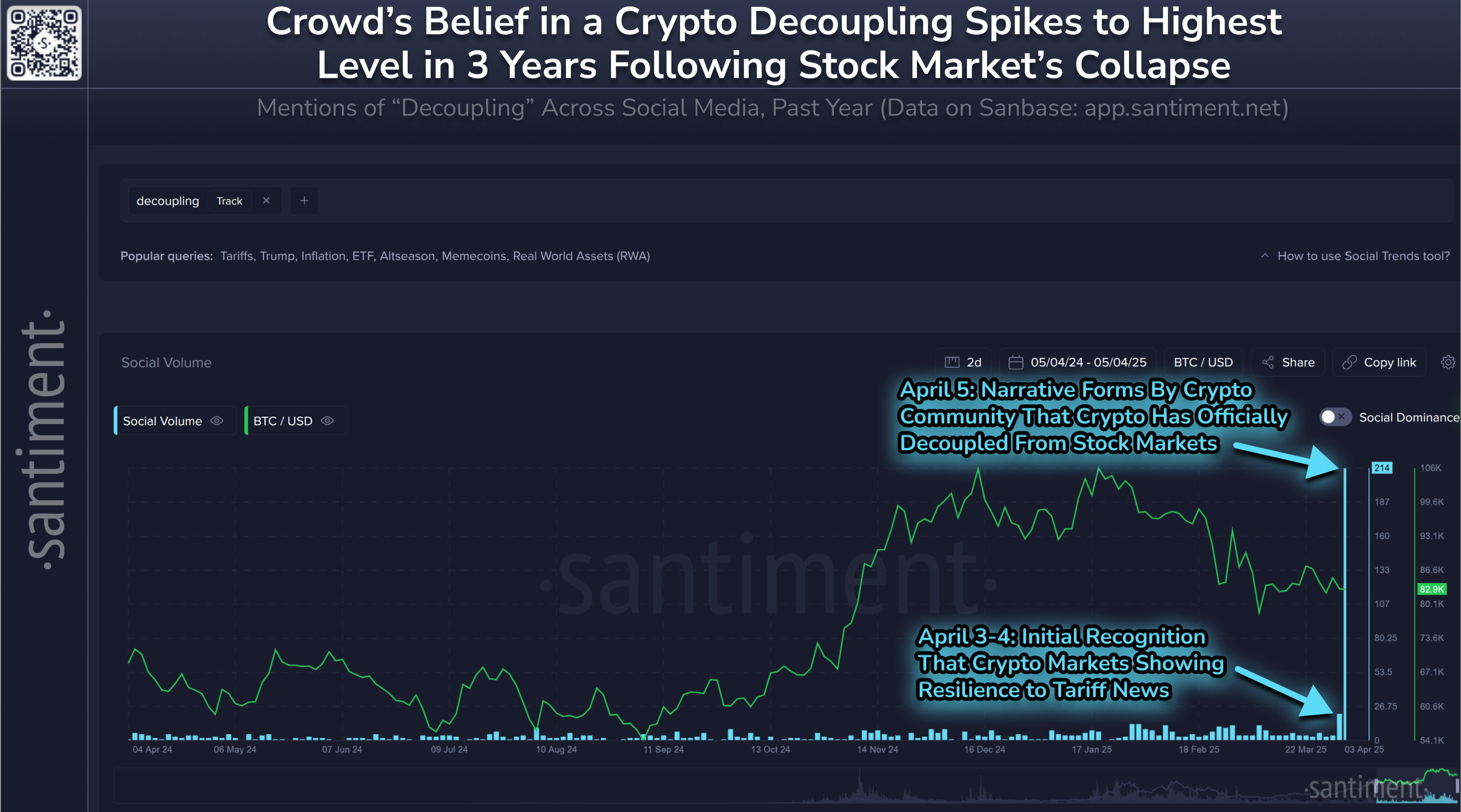

The U.S. stock market dropped right away, and crypto fell even faster. Bitcoin dropped more than 8% in just a few hours, though it did hold up better than many expected in comparison to stock markets. In fact, for a while, cryptocurrencies seemed like the ideal investing play while real-world companies were getting crushed by these new policies. Santiment saw that "decoupling" was a major trending topic shortly after the initial stock market collapse on April 2nd and 3rd.

April 4th: China Hits Back With Its Own Tariffs

Only two days later, China fired back. It announced a 34% tax on U.S. products coming into their country. This move was meant to get back at Trump’s new trade rules.

In response, Trump warned he would raise taxes on Chinese goods even more—up to a crazy 104% total. That really scared businesses, because such high costs could stop trade completely between the two largest economies in the world. Both stock and crypto prices kept falling as the fight grew worse.

April 7th: Chaos Ensues

Monday, April 7th, 2025, will likely go down as one of the most chaotic trading days in years. Both stock and crypto markets went on a wild ride—first shooting up, then crashing—thanks to a series of confusing reports, miscommunications, and media missteps about a potential tariff pause from the White House.

Here's a clean and chronological breakdown of what actually happened on the rollercoaster day, minute by minute (with thanks to @KobeissiLetter's below screenshotted post, who documented it so well):

10:10 AM ET – A Rumor Begins to Spread Online

The day started with tension already in the air after last week's rough trading week, caused by tariff announcements. Around 10:10 AM ET, several popular accounts on X (formerly Twitter) began posting that President Trump might pause tariffs for 90 days—except for China. The rumor didn't link to any official source but caught fire anyway. Many believed the story was based on a morning TV interview with Kevin Hassett, a senior economic advisor to Trump, who had made vague comments about the President "considering options" on Fox News.

10:15 AM ET – CNBC Reports the Rumor as Breaking News

Just five minutes after the online chatter began, CNBC aired a breaking news segment saying Trump was weighing a 90-day tariff pause for all countries except China. While the statement was attributed to Hassett, it was based on a misreading of his earlier interview. Nevertheless, the report was treated as credible and widely shared by other news outlets, including Reuters and Bloomberg.

10:18 AM ET – Markets Go Vertical

Within three minutes of the CNBC report airing, the S&P 500 soared. Investors, desperate for good news, jumped back into the market, pushing prices up across the board. Incredibly, over $3 trillion in market value was added from the day’s earlier lows. Crypto joined the surge too—Bitcoin jumped nearly 4%, and altcoins like Ethereum and Solana saw similar spikes.

10:25 AM ET – Conflicting Reports Begin to Surface

Less than 10 minutes later, new headlines hit the wire: the White House reportedly had no knowledge of any 90-day tariff pause being discussed. Financial analysts and journalists began walking back earlier excitement, suggesting the original CNBC report may have been wrong or at least incomplete.

10:26 AM ET – CNBC Backs Off the Story

Almost immediately after those contradictory updates, CNBC revised its earlier reporting. Anchors noted live on air that the original story may have misrepresented Hassett’s comments. The once-hopeful outlook suddenly looked shaky, and markets started to stall.

10:34 AM ET – White House Denounces the Story as False

At 10:34 AM ET, a White House spokesperson issued an official statement denying that any tariff pause was under consideration. They labeled the original media headlines as "fake news," confirming that no pause had been discussed with the President or his top team.

This announcement erased any hope that a truce in the trade fight was near.

10:40 AM ET – The Market Free-Falls

By 10:40 AM—just 30 minutes after the original rumor broke—the entire S&P 500 rally was gone. $2.5 trillion in market value had vanished in less than half an hour. Bitcoin and other cryptocurrencies also gave up nearly all their earlier gains. Ethereum dropped back below $3,000, and several altcoins posted double-digit pullbacks.

11:00 AM ET – Media Reactions and Market Confusion

CNBC issued a live correction, clarifying that their earlier statements were based on inaccurate interpretations. Reuters and other outlets quickly retracted similar headlines. Traders and commentators took to social media, calling out the speed at which false information had moved markets—and how vulnerable both stocks and crypto have become to headlines with no confirmation.

There were also several developments occurred after this neat chronology of events that were summarized by @KobeissiLetter. Here were further notables during the second half of the trading day, with approximate timelines:

Midday – Financial Markets Experience Sharp Uptick

Following these reports, financial markets responded with notable enthusiasm. The S&P 500, which had been experiencing declines, reversed course and surged. This abrupt rally was mirrored in the cryptocurrency markets, with Bitcoin's price climbing back to $80.8K.

Early Afternoon – White House Officially Denies Tariff Pause Claims

In the early afternoon, White House Press Secretary Karoline Leavitt issued an official statement categorically denying the reports of a contemplated tariff pause. She labeled the circulating claims as "fake news," emphasizing that no such policy discussions were underway within the administration. This put a quick end to the mild rally that was happening while traders were hopeful of truth coming out to the 90-day pause.

Mid-Afternoon – Media Outlets Retract Earlier Reports

Following the White House's denial, media organizations moved swiftly to correct their earlier narratives. CNBC issued an on-air correction, acknowledging that their initial report was based on unconfirmed information and may have misrepresented Hassett's comments. Reuters also retracted its story, expressing regret for disseminating the inaccurate claim. These retractions highlighted the challenges and responsibilities of real-time reporting in the fast-paced news environment.

Late Afternoon – Markets Reverse Gains Amid Clarifications

As the clarifications and retractions permeated, the initial optimism that had driven market gains began to wane. The S&P 500 and other major indices relinquished their earlier advances, returning to negative territory and finishing the day dropping -0.23%. Bitcoin's price also corrected back down to $78.0K, retreating from its intraday highs. This reversal underscored the markets' sensitivity to news reports and the critical importance of accurate information.

The Bigger Picture: Media, Crowd's Emotions, and Markets are All Deeply Intertwined

April 7th wasn’t just about one rumor—it was a clear sign that both the stock and crypto markets are increasingly reactive to news headlines, especially during uncertain times. One vague interview and a misinterpreted quote was all it took to swing trillions of dollars in and out of markets within 30 minutes.

For crypto traders—especially newcomers—this day was a reminder that Bitcoin, Ethereum, and other coins don’t exist in a vacuum. They're heavily affected by traditional finance, politics, and even rumor-driven media cycles. This is ESPECIALLY true if the retail crowd begins pushing forward a belief that crypto has "decoupled" from global stock markets.

As we move further into April, it’s clear that markets will continue to be heavily influenced not just by tariff decisions, but also by how quickly (and accurately) the media reports them. Remember that crypto markets will particularly continue to move the opposite direction of the crowd's expectations while prices are being so driven by speculation of tariff policies that none of us have any control over.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.