Apr 8

📊 Based on mid-term timeframes, average trading returns are now unsurprisingly showing 'Opportunity Zones' for the majority of altcoins. As tariffs have wreaked havoc on the crypto sector, the Santiment MVRV Divergence model shows that assets have racked up heavy enough realized losses to justify dip buys...

HOWEVER, cryptocurrency is an unprecedented and unique situation with global economic uncertainty looming. Just as we saw during the initial weeks of COVID-19, on-chain metrics can and will be defied as historic circumstances play out.

If and when a global tariff solution is reached, it would undoubtedly trigger a very rapid cryptocurrency recovery. However, this is currently a very big "if" based on the latest media coverage on what is quickly being referred to as a full-fledged "trade war" between the US and the majority of the world.

With your Sanbase PRO membership, you can make a copy of our MVRV Opportunity & Divergence model, plug in your API code we provide you, and instantly identify which assets appear to be bullish vs. bearish according to one of our most coveted metrics.

Make a free copy of our MVRV Mid-Term Sansheets model here: https://docs.google.com/spreadsheets/d/1i8VplmifLIqNv_Ns2IQ-g0J7pU0qfWj8qNQPI4CNtUE/view

For easy instructions to check on this top indicator at any time for your favorite #cryptocurrency assets, simply:

1) Download Sansheets: https://academy.santiment.net/sansheets/setting-up/

2) Plug in your API: https://academy.santiment.net/sansheets/adding-an-api-key/

3) If you're having trouble getting the data to load on a model, head to the 'Data' tab on the far right of the spreadsheet, and go to the yellow cell. Then delete the cell formula, then hit Undo. This should manually refresh the data.

4) If data still won't load, copy the URL of your model, close the tab, and then paste the URL in a new tab and hit enter

🇺🇸🇨🇳 The tariff situation showed a brief period of brightness today, as Bitcoin reached $80.2K again and the S&P 500 started up on the day by ~+4%. However, no notable positive progress has been announced on tariff negotiations. Developments of note:

📌 Bitcoin is back down to $76.4K, down more than -9% since Trump's Liberation Day announcement

📌 Yesterday, China sold $50B in treasuries in retaliation to Trump's initial tariff announcements

📌 Today, USA retaliated back with an announced tariff hike on China to a staggering 104%, effective approximately 8 hours from now

All markets will continue to see unprecedented volatility and minimal strategy until tariff clarity comes forward, or retail traders begin opening extensive shorts or significantly sell off. Neither have occurred as of yet.

Stay tuned, and monitor the above pictured chart here.

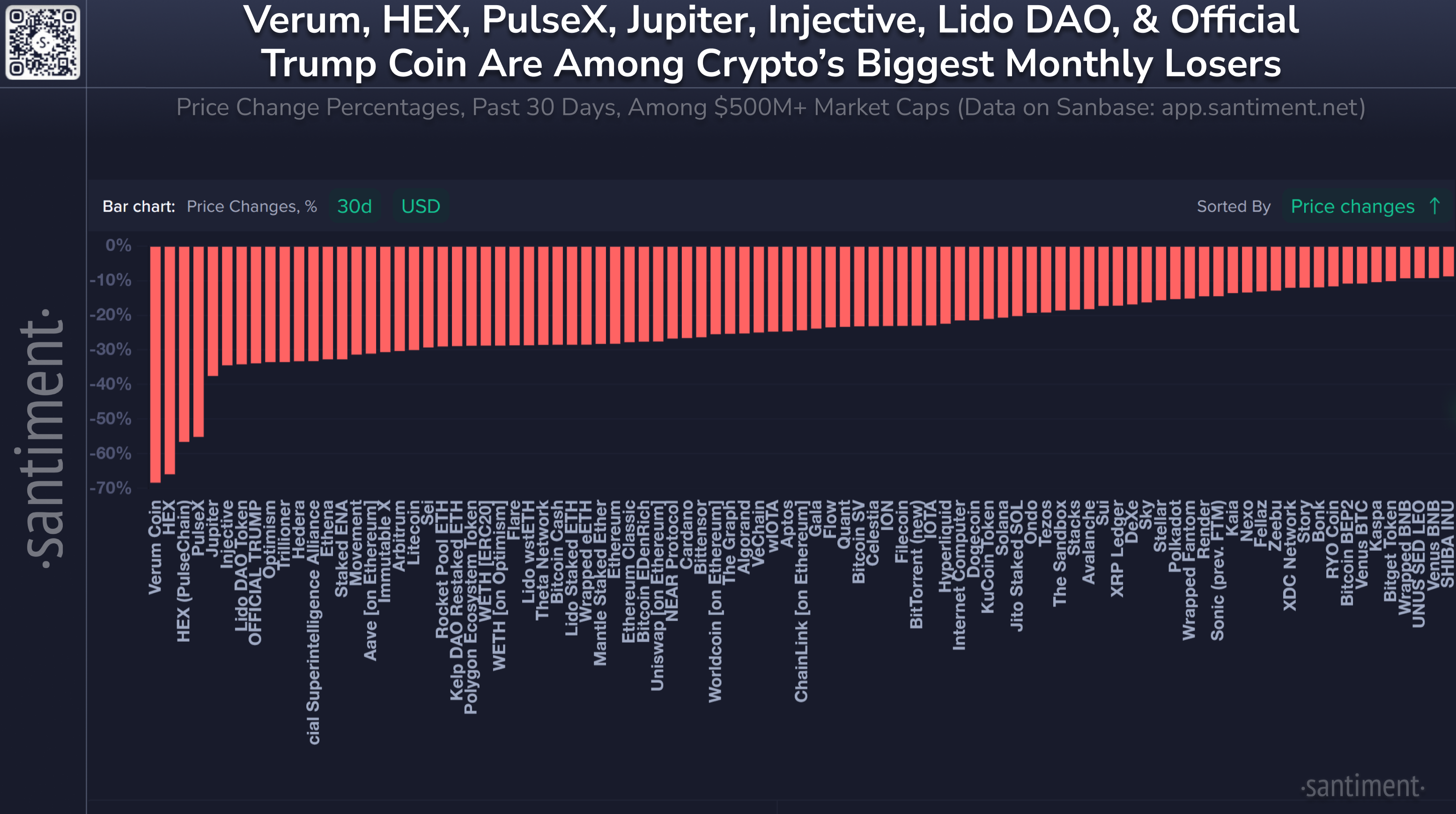

📉 As cryptocurrencies continue to feel the pain in a tumultuous 2025, here are the projects that have shed the most value by percentage (among $500M+ market caps) in the past 30 days:

🪙 Verum $VERUM: -68%

🪙 HEX $HEX: -56%

🪙 PulseX $PLSX: -55%

🪙 Jupiter $JUP: -38%

🪙 Injective $INJ: -34%

🪙 Lido DAO $LDO: -34%

🪙 Official Trump $TRUMP: -34%

🪙 Optimism $OP: -34%

🪙 Trillioner $TLC: -34%

🪙 Hedera $HBAR: -33%

Apr 7

🤑 Crypto finally saw a temporary jump in market caps following the weekend bloodbath. Trade war fears are being slightly alleviated by Asian and European countries showing willingness to negotiate with the US on tariff policies.

This has resulted in Bitcoin's crowd sentiment turning slightly positive again, and Ethereum's sentiment returning to neutral territory (after being at some of its most negative sentiment levels in years these past few days).

💸 Bitcoin sits at $78.6K at the time of this writing, with Ethereum down to $1.54K. After crypto plummeted this weekend, there have been some positive signs of other countries coming to potential terms that would ease the tariff-driven downswings.

Taiwan is the latest country that has agreed to drop U.S. tariffs, joining a handful of other Asian-based countries. The European Union is also stating their intention for mutual 0% tariffs.

Should the tariff landscape suddenly change, resulting in reduced or eliminated tariffs between countries, expect an immediate bullish explosion in crypto market caps, alongside stock market prices.

Apr 5

🗣️ Social media has been buzzing with mentions of crypto's "decoupling" from stock markets, according to data from X, Reddit, Telegram, 4Chan, Farcaster, and BitcoinTalk. Following the S&P 500's -10.5% combined losses on Thursday and Friday alone, traders are optimistic that Bitcoin and other cryptocurrencies are fairly insulated from the U.S. & China tariffs that have rocked global economies.

🐂 If the crypto markets are indeed becoming less and less reliant on stock markets, this would be an encouraging sign. Historically, most of cryptocurrency's biggest bull cycles have come when there is zero (neither a negative or positive) correlation between the two sectors.

Apr 4

🇨🇳 China has imposed 34% reciprocal tariffs on US goods, and stock markets have now dropped to 11-month lows. However, Bitcoin and altcoins have actually stayed relatively unharmed. The crowd has shown a slight bearish bias ever since Trump's tariffs were announced, but the resilience being shown by cryptocurrencies toward this news remains a positive sign for if & when global resolutions are met. 👍