MCO - Looking surprisingly decent

Continuing on with our Teeka's Game Revealed series, today we will be taking a look at MCO - which is part of Teeka's 2020 Phenomenon Play list

that includes:

- CRPT (Click to read our report from May 14th)

- TNT (Click to read our report from May 13th)

- ZRX (Click to read our report from May 16th)

- MCO

- SNT (Click to read our report from May 19th)

- SOLVE

Speaking of lists, here's a Sanbase watchlist of Teeka's 2020 phenomenon play if you wish to track how it performs.

For the uninitiated, Teeka and the Palm Beach Confidential's recommendations tend to have a huge rise in a coin's price following the announcement. At times, even more than an exchange listing.

However, amongst the recommendations, MCO only saw a 7.2% gain as it went from $5.52 USD to a local top $5.90 USD. Currently, the price is pretty much back to pre-announcement levels.

Trading volume

That said, MCO trading volume is seeing huge increase since Black Thursday's crypto meltdown, with trading volume not seen for a long time since 2017.

On average, we are looking at a trading volume of $50M USD recently. If this was 2017, price on such volume would have easily doubled. But currently, price gains are around 7%-10%.

Which is rather interesting, could it be a result of fake volume or market making activities? Whichever it is, it surely does not look organic at all.

New retail holders growing

Looking at the holders distribution, the retail group (holders with less than 10,001 MCO) been growing since Black Thursday:

March 13th

1 - 10 : 5089.50

10 - 100 : 3449.50

100 - 1,000 : 1708

1,000 - 10,000 : 253

Today

1 - 10 : 6410

10 - 100 : 8191

100 - 1,000 : 4018

1,000 - 10,000 : 291

This likely due to likely from their continuous effort in rolling out their MCO Visa card to different regions around the world during this period

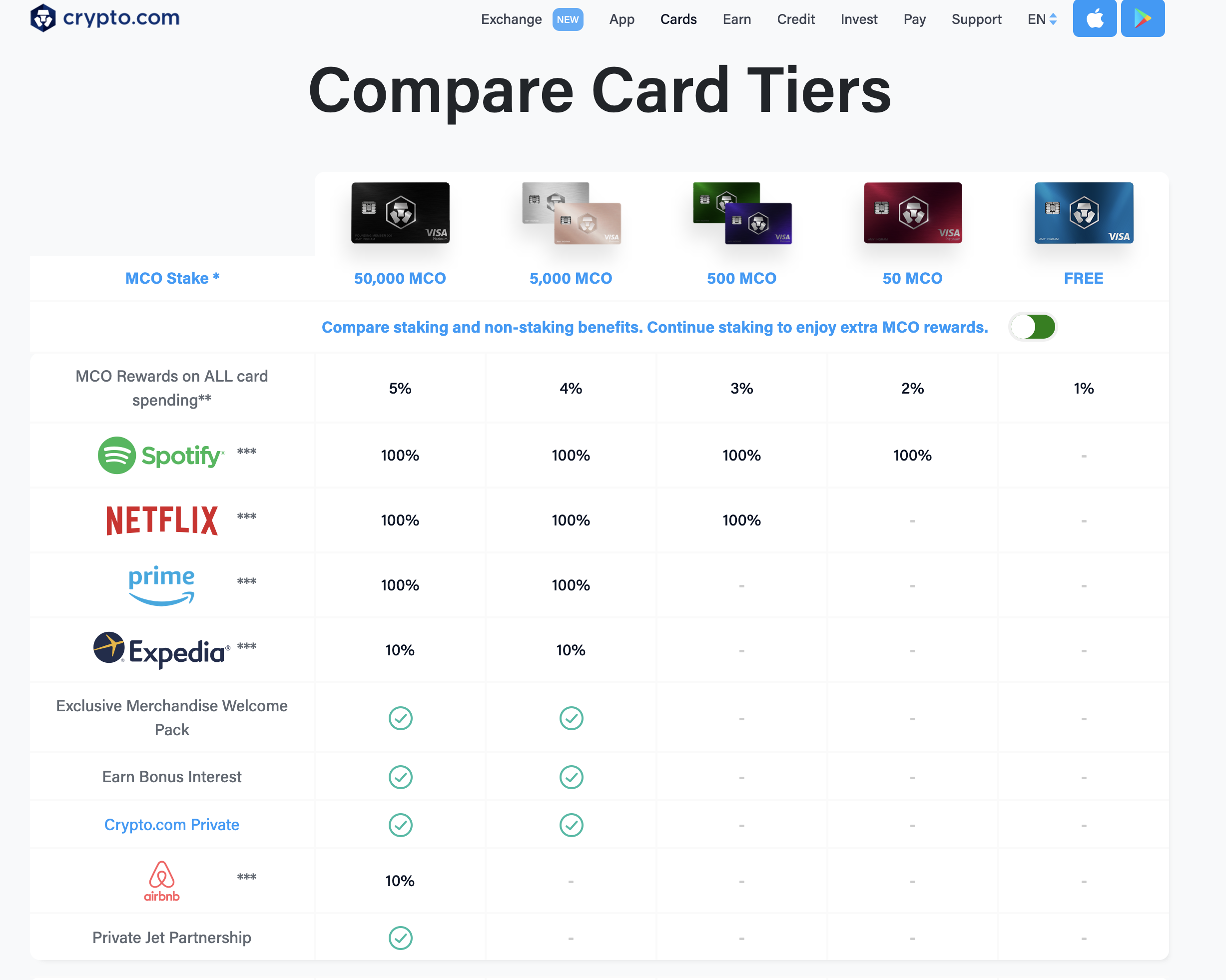

and card holders grabbing some MCO to stake for their respective benefits:

However, even with the decent retail growth, it's doesn't tally with the large trading volume seen recently.

DAA saw a huge spike following Teeka's announcement. Generally, when there's a Price and DAA spike followed by drop in DAA for the next few days, price tends to slide (just like the case circled in Feb).

And... it did for a short while.

However, MCO's price saw a nice bounce and DAA increase with price normalizing over the few days and DAA stablizing. It actually looks rather healthy lately as it continues to make a higher DAA and comparing to the DAA activity for the past 6 months, it's looking much better now.

What's the playing field looking like?

MVRV shows that short (7d) to long-term holders (365d) are generally still not in high profit, so it's unlikely we'll see any strong profit taking soon from these participants.

However, we are seeing % of token supply on exchanges increase by 4.4% since early April this year to 14.44%, which may indicate a higher sell pressure.

This increase is likely from long term holders moving into exchanges as Token age consumed spiked on the same day Exchange flow balance spiked. To clarify, Token age consumed shows that large amount of old coins that did not move for a long time have started moving.

Given that the price remains relatively stable even after the recent net inflow, it may signal a move in preparation for a price movement to the upside.

With everything above considered, in this case, Teeka might just be right. MCO might just see a uptrend if things remain status quo.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)