How to spot opportunities using different screeners

Tons of tokens, bunch of metrics. How to remove noise and focus on most important? Today we'd like to present a few different ways of using Santiment screener.

Spotting large token movements (like WhaleAlert)

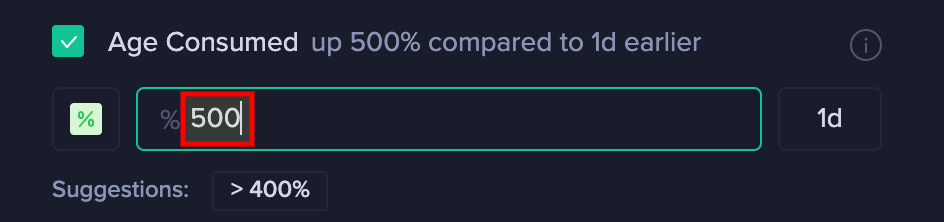

We will use the Age Consumed metric for that.

Criteria:

- Transaction Volume: above $10M USD a day

- Age Consumed: increasing over 500% a day

General steps for creating a screener:

Close a filter and here we go, the list of tokens meeting our criteria:

Each of tokens above is liquid enough and has a solid chunk of tokens moved within last 24 hours. For example CREAM, this is why we are having it in list, an Age Consumed recent spike:

It happened on December 10. What exactly happened? Summoning the "Top Transactions Table", selecting 'December 10' as a single date. We can see this:

WhaleAlert would post a tweet on it like "630,000 CREAM were moved from a Whale to a CEX Trader wallet". We'd leave further investigation outside of this post.

Pre-made Age Consumed screener page

Age Consumed use cases:

- Bitcoin needs a correction half way to next top

- Observing a dip in DEGO

- Time to cool off for Celsius (CEL)?

Spotting possible trend reversals

Criteria:

- Trading Volume: above $5M USD a day

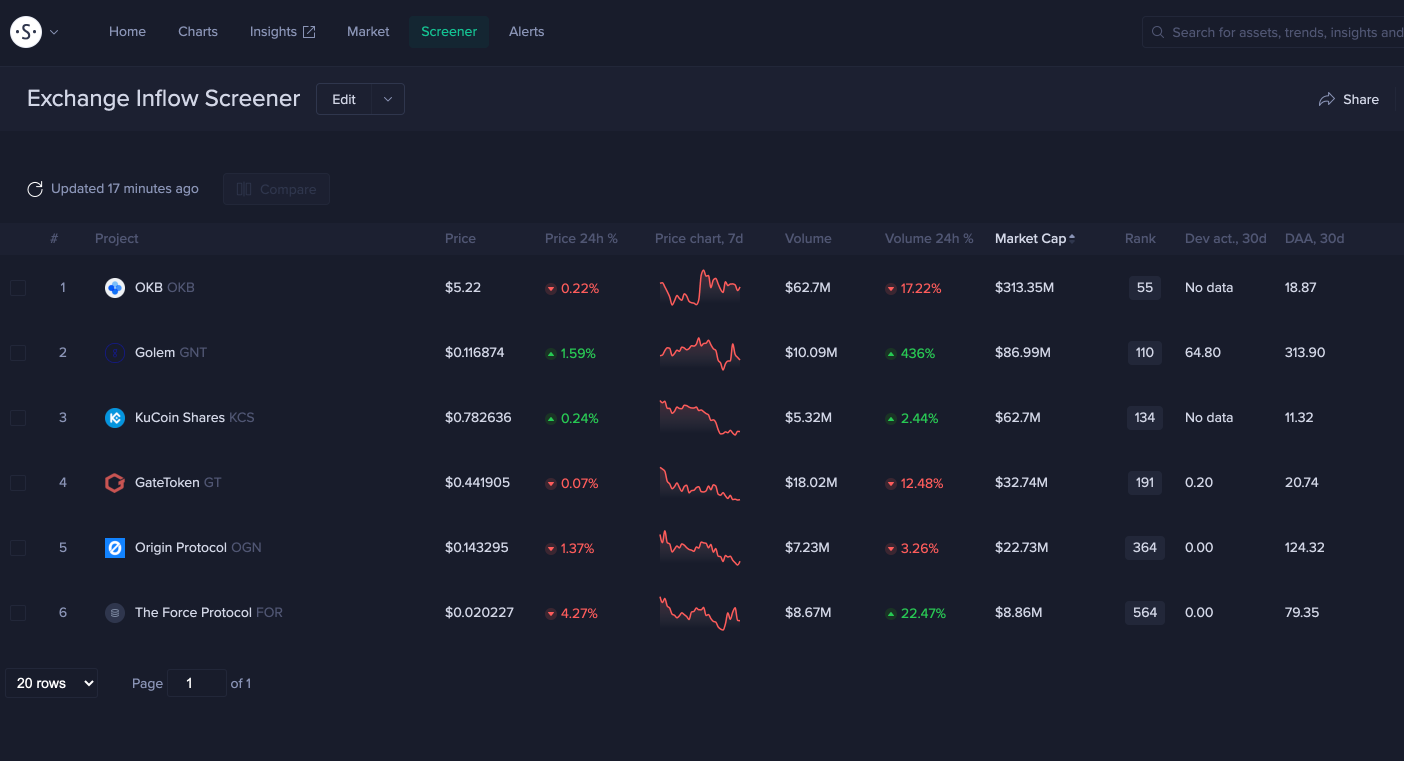

- Exchange Inflow: increasing over 300% a day

Screener filter looking like this:

It gave us a following list of tokens:

GNT for example. Looks like latest Exchange Inflow spikes dropped Golem from a cliff:

Pre-made Exchange Inflow screener page

Exchange Inflow use cases:

- Stablecoin exchange inflow SURGE - what gives?

- Is Ripple anywhere near a finish of it's rally?

- Timing altcoin tops with Aragon (ANT)

Fundamentally solid projects in oversold area

Criteria:

- Transaction Volume USD: above 100,000

- Marketcap: above $1M

- Daily Active Addresses: above 500

- MVRV: below 0.9

A couple of first lines removes lowcap altcoins. DAA threshold removes inactive tokens. MVRV leaves only oversold tokens, below 0.9 is similar to below -10% MVRV.

Filter looking like this:

Results:

Let's take REN for example. It has no doubts strong fundamentals, let's look at MVRV:

We can see it's in 'bottomish' area. Price tends to recover from similar MVRV levels. But it still can go lower before bounce.

Pre-made solid projects in oversold area screener

MVRV use cases:

- UNI holders losing patience

- Bancor: a powerful MVRV tension might push it higher

- Quarkchain Seems to be Accelerating

Summing up

We hope these three screeners would help you to spot opportunities in the market:

- Spotting large token movements with Age Consumed

- Spotting possible trend reversals with Exchange Inflow

- Spotting solid undervalued projects with MVRV and DAA

See you in Santiment Discord to be blown away by your finds!

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Conversations (0)