YFI - Attack of the clones

As YFI's initial distribution (30,000 YFI) came to a conclusion 27th July, opportunists were quick to fork it and create their own version of YFI. In less than a week, we saw multiple clones, some legit but most were scams prying on eager yield farmers.

If you need a recap on what's YFI, head over here.

Else, let's take a look at what played out over that week.

The Legit clone: YFII 🤗

What is it?

YFII is a Chinese fork of YFI with YIP-8 implemented - where supply schedule is similar to Bitcoin's, with the halvening happening every week.

It was initially considered as a scam/quick money grab when the the YFII minting admin key was still available and little information around it was available. This was largely due to the conversations happening in WeChat than the regular telegrams/discord western crypto folks were used to.

In fact, Metamask, Etherscan and Balancer blacklisted YFII initially:

But YFII was soon legitimised when the admin key was burned and a multisig with 11 co-signers made up of core team and prominent community members was created.

Out of the 11 co-signers, one will probably recognise Boxmining (popular crypto influencer) and Dovey Wan (Founding partner @ PrimitiveCrypto and also provides great insights into the Chinese crypto community).

With crazy yields of over 300% and growing confidence in YFII, the TVL quickly rose quickly to $200M just within 2 days since launch.

Was it a concern for YFI? No, not really. It was actually good thing since YFII provided yet another avenue to yield farm for the YFI community. How so? Thanks to yvaults.

Check below:

Instead, it seems to be a concern for the YFII community as the price fell sharply after news of it spread. Even though the amount of YFII that was dumped by the yvault wasn't that significant (around 150 YFI per day apparently), fear and panic over that dump thought was greater.

It didn't help as well when BTC decided to march towards $12,000 which saw a marketwide altcoin slaughter during that weekend.

Price

So YFII went from around the range of $600 USD at the start to a high of $1,129 USD before crashing down to a low of $105 USD (-90.69%) and is now hovering at around $140 USD with decent enough trading volume.

But this crash caught definitely caught a quite a number of speculators and farmers by surprise.

Around this time, another YFI clone called YFFI surfaced offering even higher yields than YFII but...it also crashed much harder than YFII did. This probably probably contributed to the panic selloff as well.

You can read more about the YFFI clone later in this article.

Liquidity crisis & Impermanent Loss

We often hear about the term "Impermanent loss" risk for being a liquidity provider in AMM platforms like Balancer, Bancor, Uniswap but i don't think we have a great example of how bad it can get until the recent YFFI crash.

Those that provided liquidity in the DAI/YFII pool from the start and didn't exit before it crashed to $105 USD would have incurred an impermanent loss of around 2% to 15% once the price drops over 70%. Whatever 1% yield they might have gotten for a day would have been eroded by the selloff.

The drop in YFII's price also saw TVL drop drastically as Liquidity providers head for the exit to avoid Impermanent loss on a single day.

The YFII yearn pool wasn't that badly affected as it's a stablecoin pool and didn't involve YFII as a trading pair.

Even Boxmining mentioned that he was done with 98/2 pools to avoid Impermanent loss.

Following the Impermanent loss scare, the TVL is sitting at $118M (-41%) currently.

How it all imploded

The thing about the yearn ecosystem is that it creates a tight feedback loop. It works well when incentives are there and therefore will be positive. But once negative feedback loop sets it, it implodes rather quickly (if incentives are based on thin air). Cloning it at face level will inherit the same properties.

Below is a summary of factors that contributed to the fall:

- Farmers started to chase other high yield clones and got scammed, leaving a portion of liquidity evaporated.

- Speculators got burnt buying YFII off the market resulting in less speculators, less liquidity

- Impermanent loss kicks in, LPs exit resulting in further drop in liquidity

- No new farmers on DAI/YFII pool = Less YFII liquidity

- YFI farms YFII with yvaults.

- Lack of new innovation - One can clone the existing tech but you can't clone Andre Cronje and the YFI community that consists of really solid folks committed to the success of YFI. YFII community will still need to prove itself amidst the dumps.

Much of the above was forewarned by Andrew Kang prior to the meltdown but the pursue of 800% yields sure is hard for anyone to turn down and eventually becomes a game of hot potato.

As the dust settles.....

That said, the YFII community is serious about furthering the development of YFII in their own way. There are actual governance proposals happening and devs looking into it. If anything, the meltdown helped to clear out alot of the temporary speculators, leaving only those that are serious about YFII and in it for the tech.

How it will eventually play out is entirely up to the Chinese community efforts now. Will be interesting to see whether it captures a good part of the Chinese crypto community on the sidelines that were not able to partake in DeFi due to language barriers.

The dodgy looking clone: YFFI 👀

What is it?

Not much information is known about the project. It just seems to have popped up conveniently to capture whatever marketshare they could in the midst of YFI mania. There's not even a community forum available for gov proposal discussions or anyone reputable enough to back it up as far as I can see.

Unlike the YFII community, the YFFI community appears to be just made up of just pure speculators playing a game of hot potato using the yearn ecosystem feedback loop.

As with new YFI clones, the yields are very attractive (think 500% and above) at the start and tend to attract farmers everywhere. As long as farmers get a sense of safety, they will flock to it as usual.

In this case, they just had to ensure that no further YFFI minting was possible and an issuance model was established.

And then came the liquidity:

It quickly grew from a TVL of $5M to $100M within 2 days. A good part of liquidity probably flowed from YFII to YFFI.

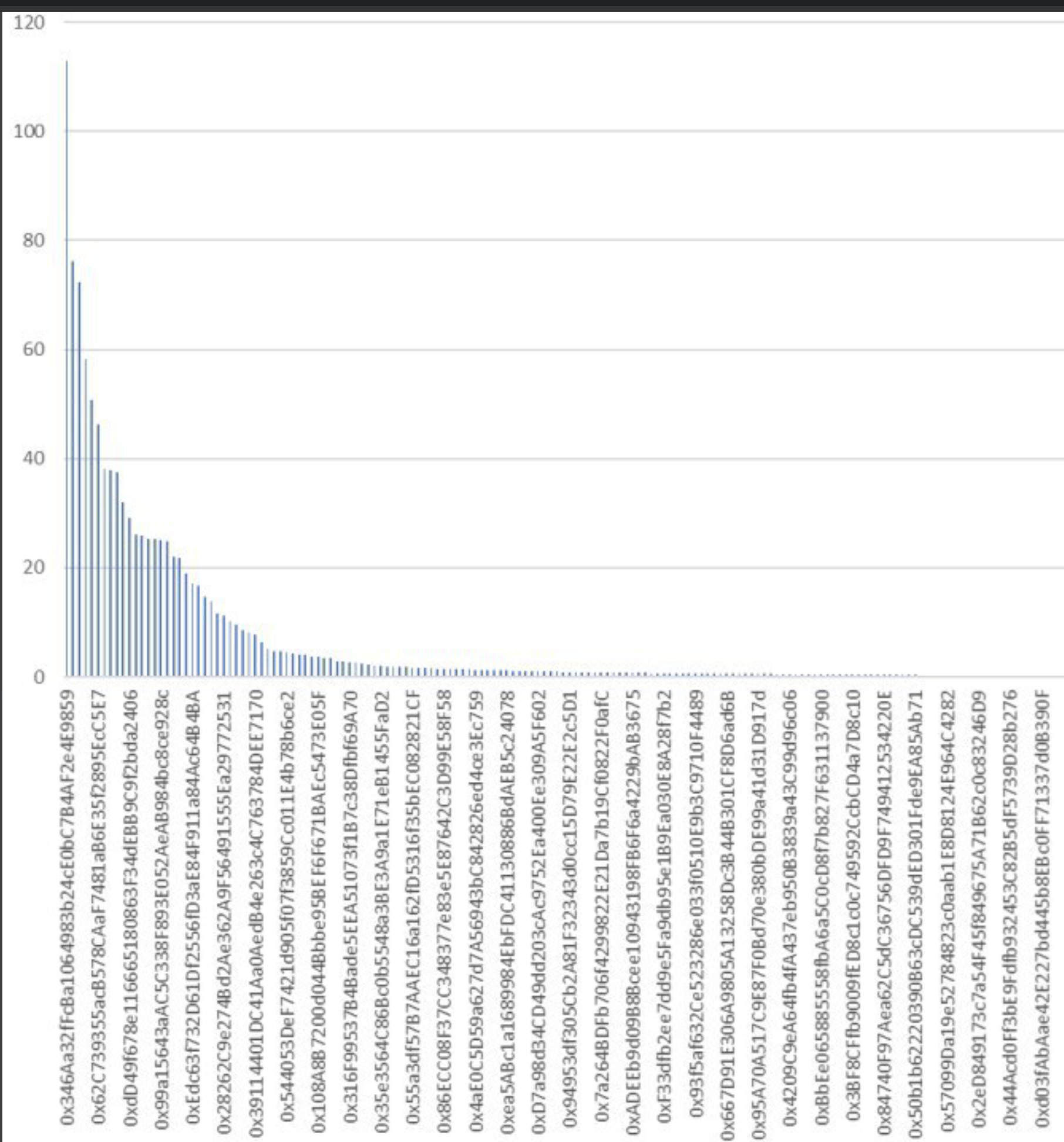

If one looked into the Top holders at the "official launch", one will notice that a portion of the Top holders had a good head start and mined a decent amount of YFFI even before the "official launch" as reported by Toos!

7 founders farmed the pool 5 hours before it was announced. Well, the cat was out of the bag and YFFI had some explaining to do.

The best they came up with was to burn those premined tokens in an effort to regain the trust of the yield farmers.

But it was too late. The bubble popped.

Price

YFFI started trading at around $619 USD before crashing all the way to $1.22 USD (-99.8%) and is now hovering at $2.40 USD with little to no trading volume.

As mentioned before, the price action of BTC during this time didn't help either.

Liquidity crisis and Impermanent loss (Ultimate edition)

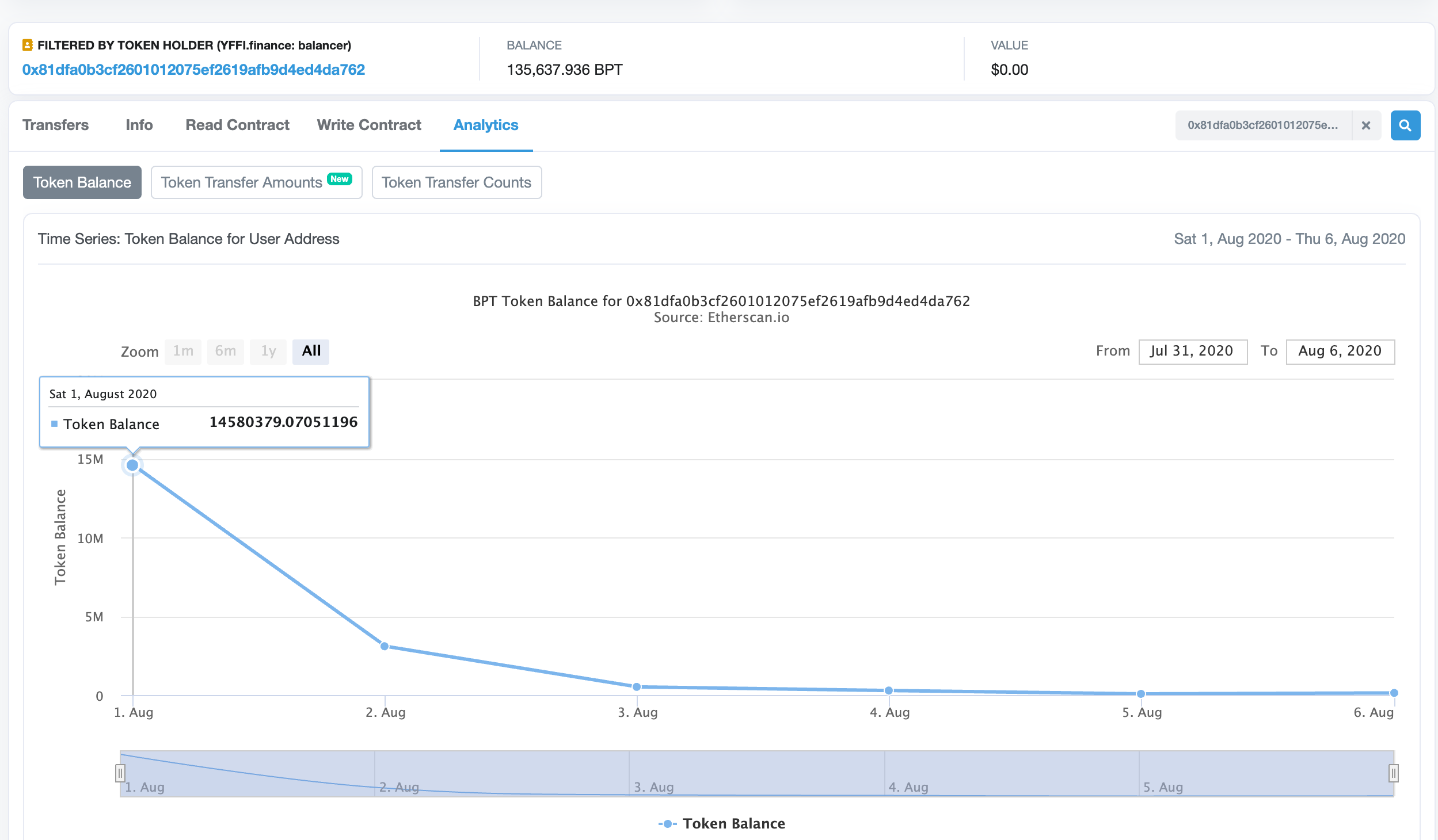

The situation here is very different from that of YFII. TVL dropped from $100M USD to..... around $3M USD (-96.9%) currently.

As the price dropped by 99.8% ($618 USD), the early DAI/YFFI - Balancer pool farmers that didn't exit in time would have experienced at least 63% Impermanent loss and probably are stuck now holding YFFI as there's no liquidity to exit fully without incurring further slippage.

Not the best situation to be stuck in......at all.

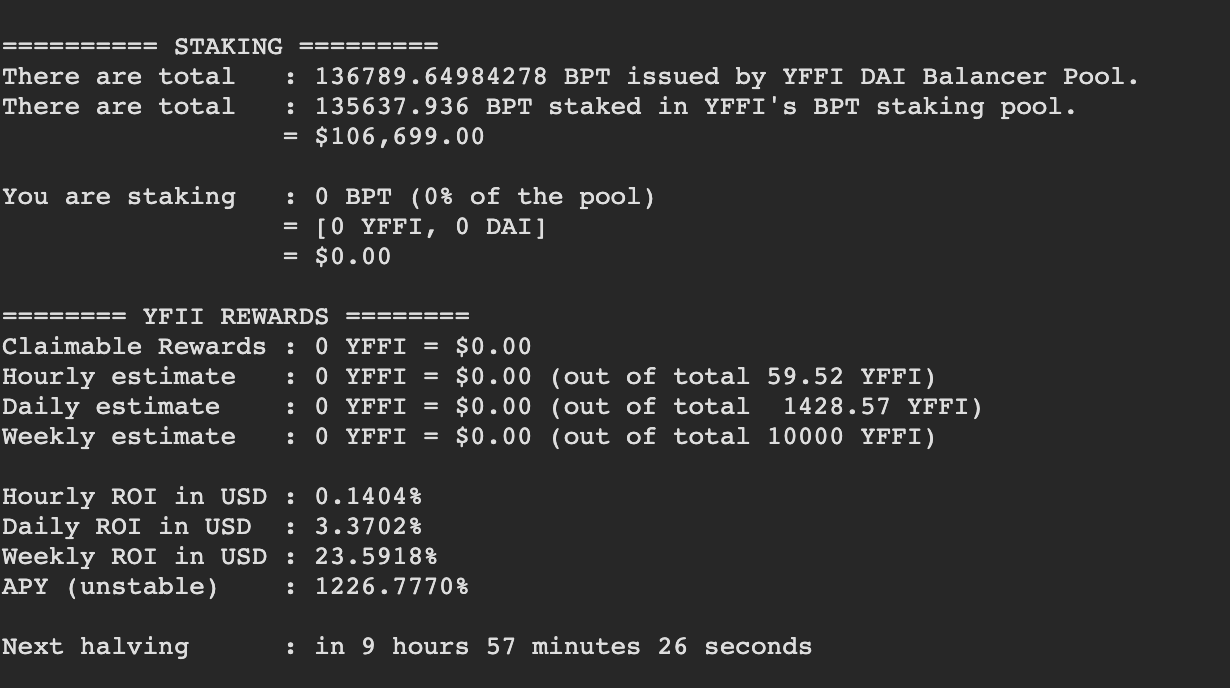

Even though the DAI/YFFI - Balancer pool is currently having a 1226% yield, no one is really coming in. Whatever is left in that pool might be those that folks that are stuck.

No decent yield farmer is touching this 🤮.

Because he knows, if there's no crowd coming in after him, he'll be left holding the hot potato.

It's a brutal cycle as mentioned before, no liquidity and it's gameover. What makes it worst for YFFI is that, the team behind it is...questionable.

Good luck to the YFFI community.

The exit scams 😱

And then.... there are the exit scams. What's crypto mania without them right?

Asuka

A YFI clone from a korean developer known as Jongchan who's also involved with ETC. He had a pre-mine of 1,000, but burned 850 to gain trust of the community. Eventually he dumps his ASUKA stash a total of 28,000 DAI according to Twitter user Mewn's nice detective work.

His last words to the community before he exited, "쪽팔려서 튑니다", which translates to "I feel ashamed so I will runaway now".

It also had a bug that was inherited from the YFII fork.

YYFI

A YFI clone but without the minting admin key being burned. This is the perfect example of how one can use infinite minting to drain the balancer pools.

Once there was enough liquidity in the YYFI/DAI balancer pool, the owner minted 1,000,000 YYFI and started draining it. Apparently they also removed their twitter and frontend for their balancer staking, leaving anyone without smart contract knowledge unable to withdraw before the scammer.

There are probably more clones that exit scammed but we probably get the gist of things. While yield farming is great, always keep oneself in check and not forget the fundamentals.

Stay safe out there everyone and remember, there's only one YFI!

Conversations (0)