What the YFI is going on?

Last weekend saw the birth of a DeFi Kraken with a TVL of $300M+.

While most were focused on mStable's auction sale on Gnosis....

a little known project called yearn.finance (previously iearn) by Andre Cronje resurfaced and launched its governance token ($YFI) in the most Satoshi way possible - Build a gem with no premine, no VCs, remove oneself from it, and let the community figure things out by themselves.

Some of you might be familiar with yEarn if you have used the stablecoin liquidity Y pool on Curve.fi . It's one of if not the best pool there as it automatically finds the best yields from Compound, dYdX, Aave, DDEX and rotates accordingly. Here's how the Y pool work under the hood.

The pool has grown from $8M to now $307M in less than week since YFI's launch.

Now, the Y pool is just one part of the suite of systems that Andre have created (he is shipping at lightning pace) and hopes to decentralize the control of them over to the community:

Each of these systems have control mechanisms, configurable fees, maintenance controls, and rules that can be modified. Thus far, these have been managed by us.

In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.

YFI token

The YFI token launched with total supply of 30,000 that's spread across 3 pools of 10,000 each to be mined within 7 days of each pool's release.

Tokenomics*

Total Supply on launch

30,000

yearn Staking (0x0001)

- 2,871 / 10,000

Balancer Staking (0x033E)

- 3,726 / 10,000

Governance Staking (0x3a22)

- 6,443 / 10,000

Est. Circulating Supply

16,958 / 30,000

*above figures from Coingecko.

The 30,000 YFI should be completely mined soon enough but do note that'll be increased supply following a community proposal (Refer to proposal section)

Now, even though Andre insisted that the token was of no value at all....the market felt otherwise...as it traded from $35 to a peak of $1765.

Currently the price of YFI is $1,185.13, giving it a marketcap of $20,172,553 and $35,550,000 (fully diluted).

It also has a TVL of $307.9M according to Debank and looking at the ranking list, it's either some of the projects with higher TVL are overvalued by a huge mile... or... YFI is really really undervalued.

Here's a nice quick fundamental analysis on valuating YFI.

Crisis averted

While everyone was so focused on throwing money into YFI pools to get that sweet yield, the question of attack vectors/security took a backseat until... Twitter user @trentelme brought it up.

Andre still had the admin key to an EOA address that would allow for infinite YFI printing. This meant that YFI farmers in Balancer pools run into the risk of having their funds drained by using the infinite YFI DAI/YFI pool ( worth $102M now ) and yCRV/YFI (worth $125M now).

As news of this possible attack vector continue to spread, the price took a tumble.

But this was swiftly mitigated as Andre gave control of the admin key over to a Gnosis 6-of-9 multisig that consists of key community members and he is not one of the signers.

To learn more about the temp crisis in detail, click here.

Meanwhile.....YFI Fam: "We dodged a bullet there, let the farming continue!"

It's up to the community now...

The launch of YFI came with two proposals Andre created to allow the community to decide for themselves how they want to shape the course of YFI.

Proposal 0

This proposal will decide whether to cap the total supply of 30,000 YFI (which will also be completely mined by end of one week).

Voting signal

For: Allows future YFI to be minted.

Against: To cap total YFI supply to 30,000

It had just concluded and below are the results:

Quorum: 68%

Total for votes : 7734007.468950574 (61.02%)

Total against votes : 4939315.734708158 (38.97%)

Start block : 10490942

End block : 10508222

Now the next step is for the community to propose a new supply and emission schedule. A request for comment regarding it is ongoing at the moment here.

Proposal 1

This proposal is to decide whether to have the current fee claim mechanism (To collect yEarn fees, users have to burn YFI) to remain or to change it to a staking based one.

Voting Signal:

For: Continue burning YFI to claim trading fees.

Against: Stake YFI to collect trading fees staking, instead of burning.

It just concluded and below is the result:

Quorum: 22%

Total for votes : 502445.8576 (11.27%)

Total against votes : 3953417.124441156 (88.72%)

Start block : 10490942

End block : 10508222

Even though "against" won, it did not pass the minimum quorum ( > 33%), and as such, burning for rewards will be re-implemented.

Keeping track of Proposals

To check out other live proposals and how voting is going, click here.

To follow all proposal discussions, visit their governance forum.

How to farm YFI?

Now before we go further.... as always, please note:

Risks involved

It's important to note that DeFi is pretty nascent there are very real inherent risks involved:

- Smart contract exploits/bugs/hack

- Collateral getting liquidated

- Stablecoin de-pegging

Now on to the farm:

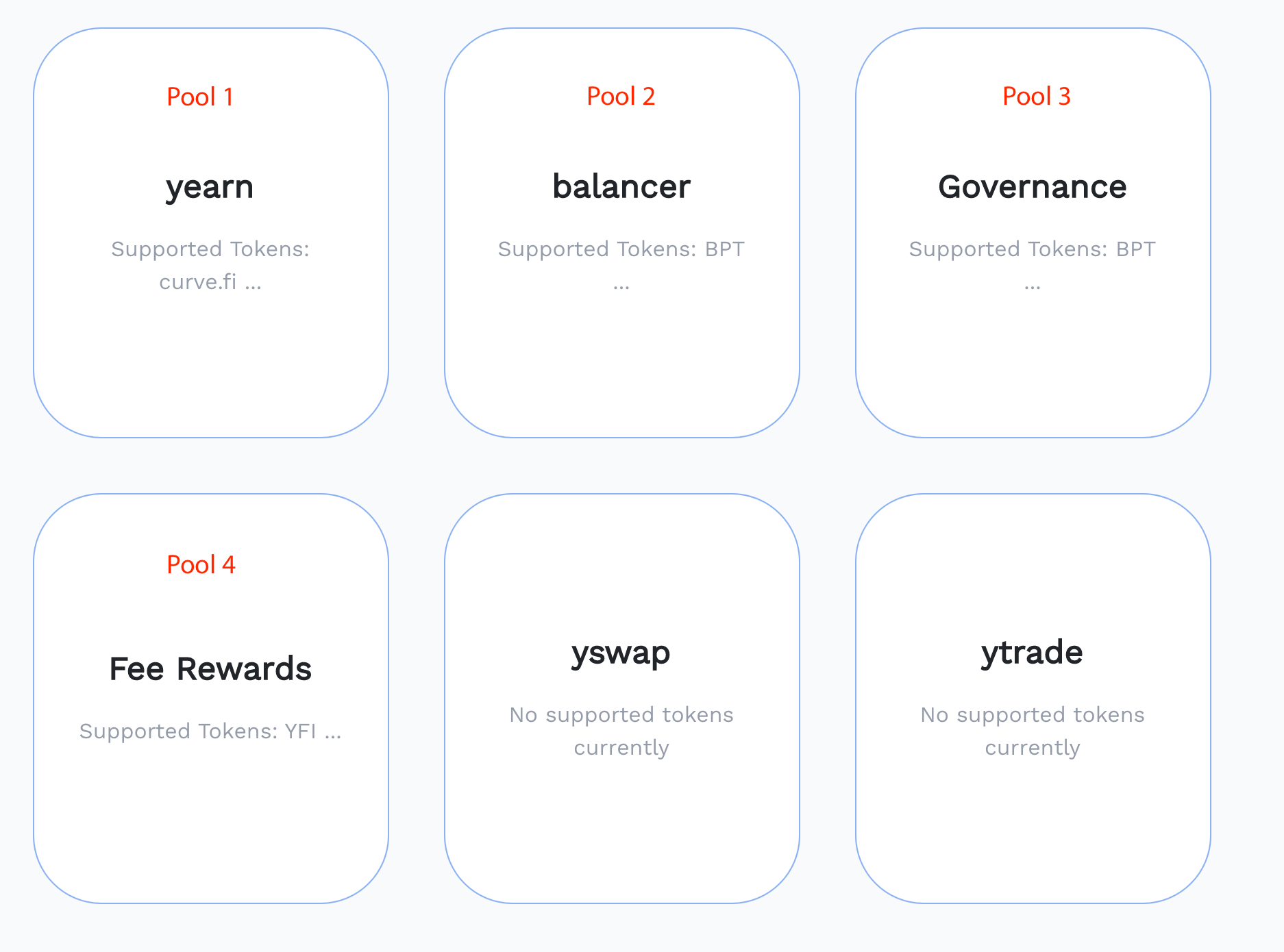

There are currently 3 pools where YFI can be mined and 1 bonus pool where rewards from the yearn.finance ecosystem can be claimed.

Pool 1 (yearn)

Farms: CRV (unreleased), YFI

Current APY: 337.2995%

How: Providing liquidity to https://www.curve.fi/y and stake yCRV.

To track yield, use this.

Pool 2 (Balancer)

Farms: BAL, YFI

Current APY: 569.4857%

How: Providing liquidity to DAI/YFI pool on Balancer and stake BPT in Pool 2 (balancer) on ygov.finance.

To track yield, use this.

Pool 3 (Governance)

Farms: CRV (unreleased), BAL, YFI

Current APY: 482.1226%

How: Providing liquidity to yCRV/YFI pool on Balancer and stake BPT in Pool 3 (Governance) on ygov.finance. This will then allow you to vote on Governance proposals and is the only way to participate in Governance atm.

To track yield, use this.

Pool 4 (Fee rewards)

Farms: Fee Rewards from yearn.finance ecosystem

Current APY: 42.4018%

How: Stake YFI on ygov.finance but prerequisites apply (Voted on governance proposals and have at least 1,000 BPT from Pool 3).

To track yield, use this.

Here's a visual summary of how things work:

For a nice overview, do check out the post written by Weeb.

Also, one can choose to action each step manually or choose to use Zapper.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Sanfam!

Get 'early bird' alerts for new insights from this author

Conversations (0)