Top Social Gainers for Friday, March 29th, 2019

Here are today's biggest developing stories in crypto based on Santiment's data:

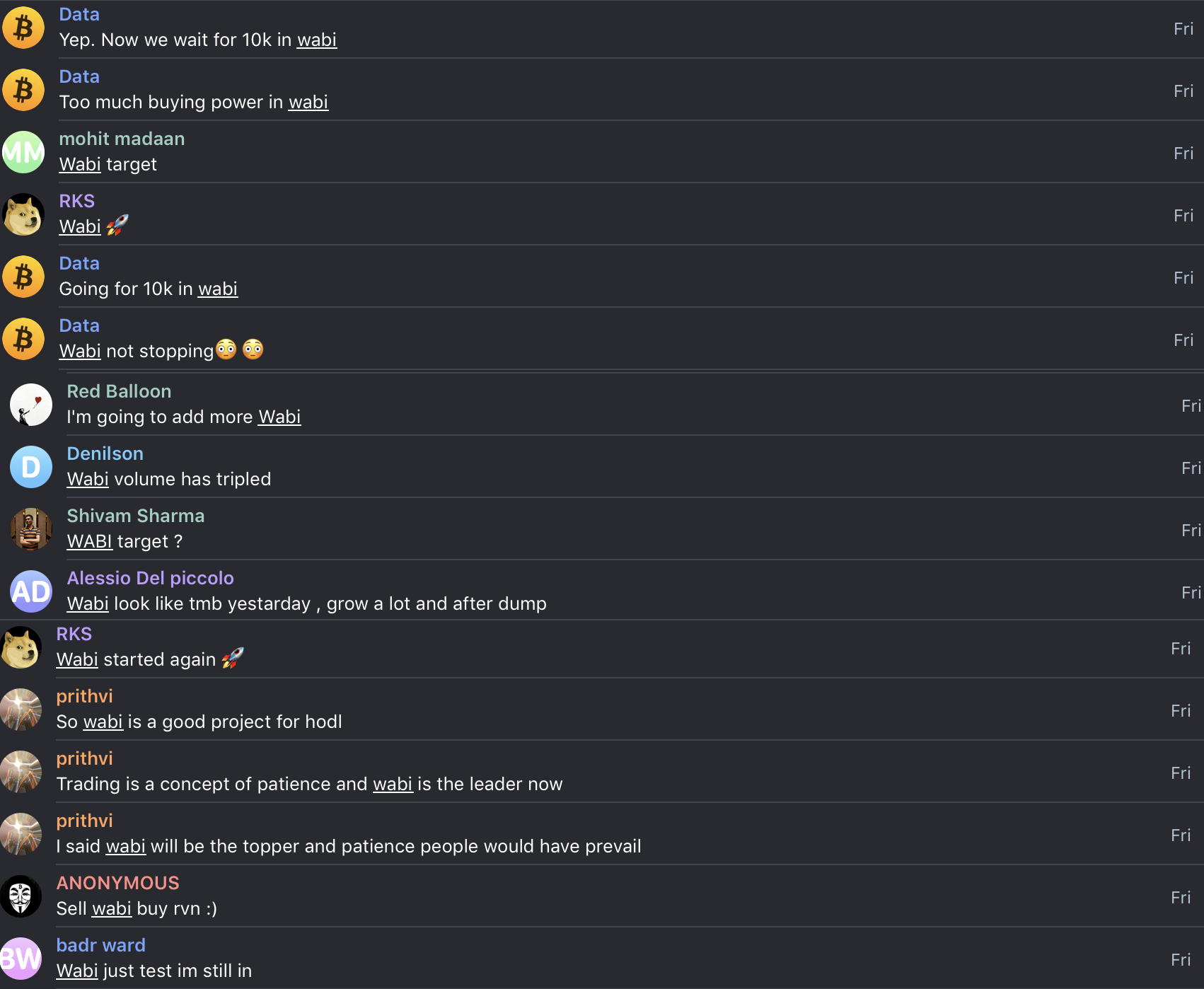

Another day, another altcoin gets selected in March's great "Altcoin roulette", this time it's WABI turn and it sure got the crowd excited.

Onchain wise, we saw a nice spike in Daily Active Addresses (DAA) to 211.

33.65% of DAAs were Exchange deposit addresses which may suggest either arbitrage or past hodlers using this price rise as an opportunity to exit.

QLC's mainnet will be live on 31st March with users being able to run Master nodes and staking from day one. Holders can stake their NEP-5 QLC and Q-Gas will be airdropped to their Go-QLC wallet on a daily basis according to their latest post.

As the mainnet launch draws closer, the price continues to increase and so did the crowd's excitement:

It seems that most of them are looking forward to getting the Q-gas airdrop and hoping that Binance supports it. In crypto, mainnet launches or airdrops have been exciting events for the crowd. By combining both of them together in one, QLC sure got the crowd even more excited.

Will be interesting to see how QLC's price will be after the launch. As with most post mainnet launch/airdrop, token prices tend to freefall.

Reddit user u/wolfwolfz recently shared an alternative to Coinmarketcap (CMC) called Openmarketcap (OMC) on r/Cryptocurrency. It is pretty much CMC but with market data only from "trusted exchanges", starting with a list of 10 exchanges based on Bitwise's recent slides to the SEC.

While not perfectly accurate, it is indicative of just how fluffy the cryptomarkets can be.

But not all users agree with Openmarketcap's approach. Calling them out for not finding a middle ground and having to vote in new exchanges with their own DIRT token.

On the other end, users are also putting pressure on Coinmarketcap to address fake trading volume on their website.

to which CMC responded:

The topic of actual exchange trading volumes has popped up more than once this year and it's great to see that now more effort is made. Hopefully it will continue to encourage exchanges and market data providers to step up their transparency game and usher in a more efficient crypto market.

As always, visit SANbase to explore these and other trends in more detail!