Jun 12

📈 These are the projects with the highest rises in whale transactions this week compared to last week. Among non-stablecoins, expect high likelihoods of price reversals and volatility among this group:

🐳 Ethereum Name Service $ENS

🐳 Compound $COMP

🐳 Virtuals #VIRTUAL

🐳 Dai $DAI

🐳 USD Coin $USDC (On Arbitrum)

🐳 Mantle $MNT

🐳 OKB $OKB

🐳 USD Coin $USDC (On Optimism)

🐳 Wrapped Ethereum (On Polygon) $WETH

🐳 SPX6900 $SPX

Explore more top indicators to help make more informed cryptocurrency trading decisions. Enjoy 2 free weeks of Sanbase PRO here, and see what others in crypto can't.

Jun 11

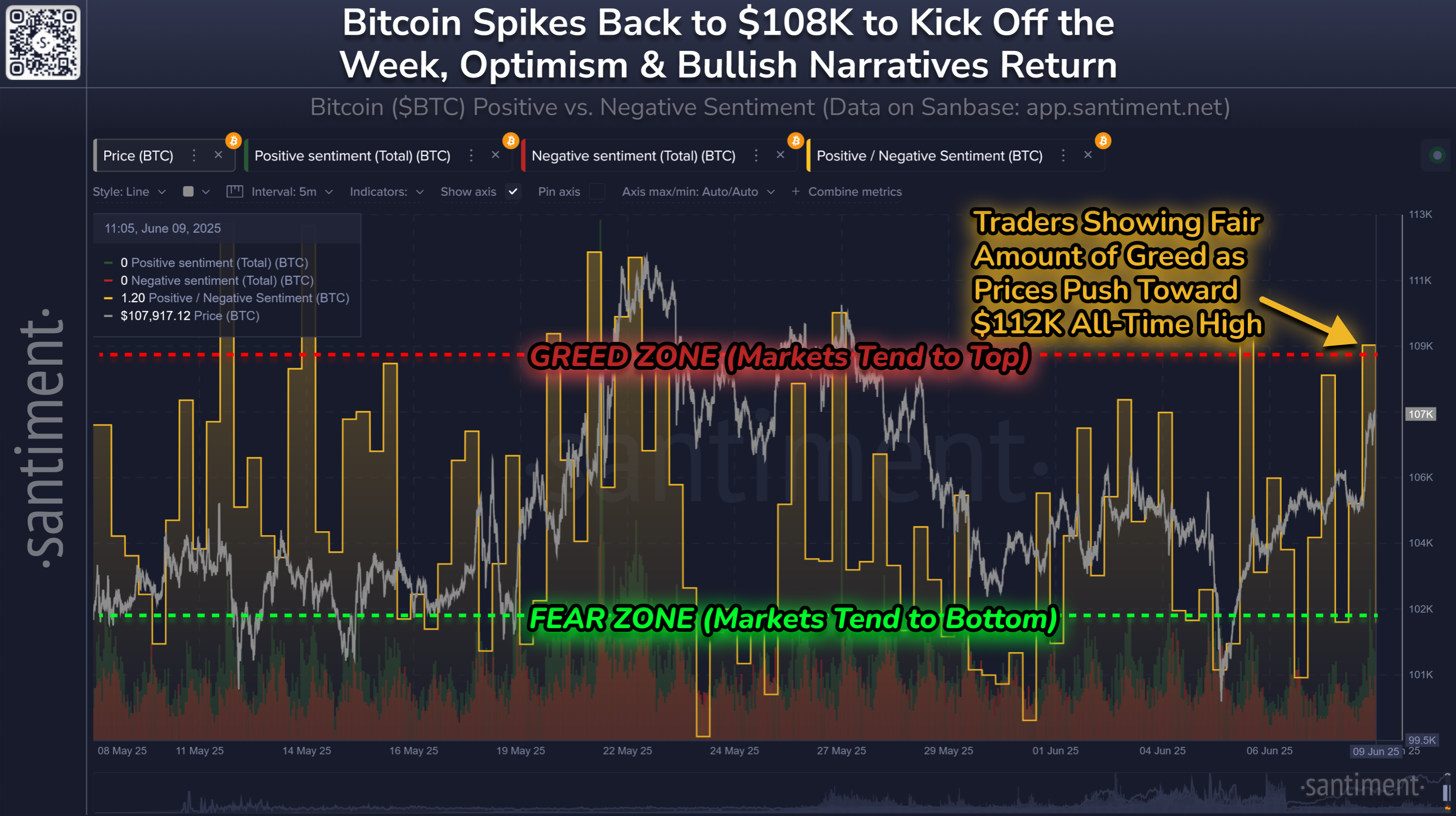

😍 With Bitcoin teasing its $112K all-time high the past couple days, retail has gotten bullish. There are more than double the amount of positive $BTC comments vs. negative across social media, the highest ratio since Trump was elected over 7 months ago.

Track how Bitcoin's sentiment is shifting across X, Reddit, Telegram, 4Chan, Farcaster, and BitcoinTalk with this handy Santiment chart. You can also change to other coins' sentiment using the coin selector at the top left. Enjoy!

Jun 10

🤞 Bitcoin remains within close proximity to its $112K all-time high, currently trading at ~$109.9K. Since markets move the opposite direction of retail's expectations, spikes in discussion related to $BTC's ATH are solid top signals, indicating greed.

Monitor how social volume fluctuates around Bitcoin's all-time high with this highly useful Social Trends chart!

🧑💻 While most of crypto stays flat Tuesday, Chainlink (+7.7%) and Ethereum (+6.3%) have continued to break out. These two projects are known for their top ranked developing teams. Over the past 30 days, $LINK has had the 2nd most notable github events and $ETH is in 8th.

🧑💻 Here are crypto's top Real World Assets (RWA's) by development. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Chainlink $LINK 🥇

➡️ 2) Avalanche $AVAX 🥈

➡️ 3) Stellar $XLM 🥉

➡️ 4) IOTA $IOTA

➡️ 5) Injective $INJ

➡️ 6) Axelar $AXL

➡️ 7) Chia $XCH

➡️ 8) Hedera $HBAR

➡️ 9) VeChain $VET

📈 10) Maker $MKR

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto trading.

Jun 9

🗣️ Crypto discussions have shown rising interest in AI job replacement as of late. Additionally, accumulation from whales like James Wynn and Microstrategy has been a particular focus that has driven markets. From a token perspective, Solana, Loud Token, and various meme coins have seen significant social volume spikes.

This free-to-use Alpha Narratives dashboard is completely free to use, and contains plenty of valuable information to help guide you in how you do your research, and making the most informed decisions for your portfolio.

🥳 Monday has kicked off with a bang for crypto traders, as Bitcoin has quickly returned to $108K. After threatening to fall below $100K just 4 days ago, retail traders panic sold. Now, they are showing signs of flooding back in with the 2nd largest spike in FOMO in the past 2 weeks. Historically, markets will move the opposite direction of the retail crowd's expectations.

This chart is an excellent gauge to see how traders across social media are perceiving markets. In a sentiment-driven industry, using social media as a counter indicator has proven to be effective.

Link to $BTC chart of ratio of positive vs. negative comments across social media.