The good and the bad news of ZRX's +24% pump

It’s a good day to be a 0x ($ZRX) holder, with the popular DeFi coin logging in +23.6% in the past 24 hours and rushing to a 3-year high of $2.03 at the time of writing.

The reason for the (surprise) pump? Nobody seems to be sure. The most recent price-moving announcement - 0x on Binance Chain - is already two weeks old, so most twitter pundits already ‘blamed’ the rally on fortuitous TA:

Whatever the reason, the 0x pump is here - but is it here to stay? Or are we now just waiting on the other shoe to drop?

Let’s take a closer look at the latest on-chain and social data from the ZRX coin, and what it suggests about today’s monster rally.

Let’s start with some good news first. The amount of ZRX-related mentions on crypto social media remain surprisingly low at the time that this is published, suggesting that the mainstream crypto crowd is still not entirely aware of today’s rally.

Why is this ‘good’? As a rule of thumb, elevated social volumes - especially when they occur during price pumps - tend to signal moments of ‘peak hype’, as the crowd becomes both euphoric and irrationally confident about the coin’s future price potential.

This is why, according to several of our backtests as well as ZRX’s own historical data (see above), high social volume frequently coincides with local price tops and interim price correction or consolidation.

Like I said, ZRX’s social mentions aren’t flashing any warning signs as of yet, allowing for future price appreciation before the ‘FOMO’ crowd ruins it for everyone. That said, keep a close eye on this chart if ZRX does continue to pump. A sudden surge in social volume - like we’ve seen several times in February - may indicate that a short-term top could be ‘in’.

Also in the ‘good news’ department is the recent behavior of large ZRX addresses, namely the 100k-1m ZRX holders and 1m-10m ZRX holders, respectively.

The 100k-1m group looks particularly interesting, as they’ve previously offloaded a significant part of their holdings around both the February high and the most recent price top (March 24th), demonstrating a non-insignificant impact on the coin’s market value.

More recently though, it seems like this cohort of ZRX holders has pivoted back to accumulation. The combined balance of all addresses holding 100k-1m ZRX has grown by 4.61m ZRX (~$8.8m at the time of writing) in the past 48 hours, signaling a decent amount of ‘whale’ confidence about the coin’s future performance:

On the other hand, the combined holdings of the 1m-10m ZRX groups has been rising sharply since the start of the year, though it’s safe to assume that this one (and the group above) is already populated with a fair few exchange wallets, so take this uptrend with a grain of salt:

Alright, time for some ‘not so good’ news. First off, ZRX’s exchange activity is (as expected) rising fast into this rally, suggesting a growing sell-side pressure that may derail the uptrend.

For starters, the amount of ZRX deposits (addresses used to move ZRX to exchanges) in the past 24 hours is already mirroring the levels around its previous price top, recorded on March 18th:

In the past, we’ve seen multiple instances of deposit spikes coinciding with short-term consolidation - not just in ZRX but most tokens - as they tend to suggest a network-wide pivot to taking profits and reducing exposure into the rally.

Similarly concerning is ZRX’s exchange inflow, or the amount of ZRX entering exchange wallets over time. In the past 12 hours, more than 5m ZRX (~$10m at the moment) has been funneled into exchanges, the largest amount since - again - the coin’s March 18th top:

Personally, I’d suggest checking in on these two metrics in the next 24-48 hours. If they keep inflating, it will become increasingly likely that the sell-side pressure will prove too much for the ZRX bulls to absorb, potentially resulting in a short-term correction.

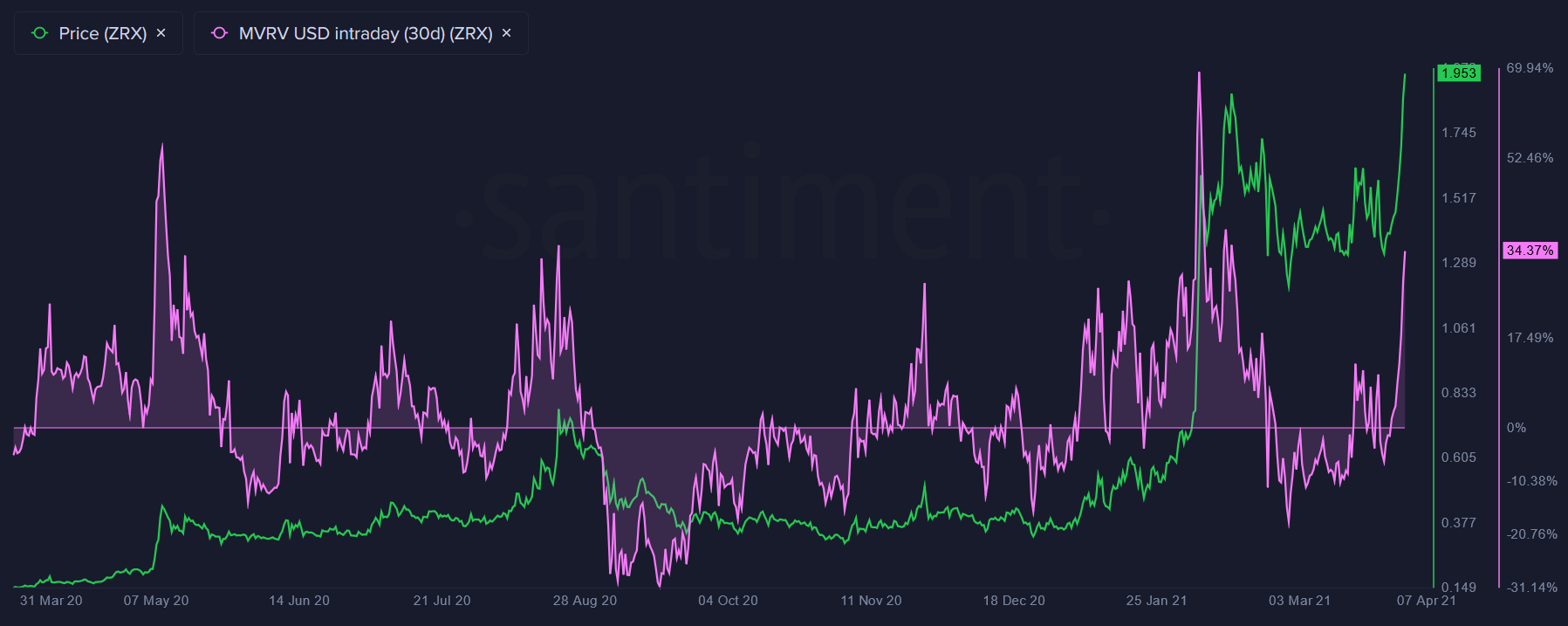

Also helpful in gauging potential sell-side pressure is ZRX’s MVRV ratio, which aims to calculate the average profit (or loss) of all addresses that have acquired ZRX within a certain time frame. For instance, ZRX’s 30-day MVRV tracks the average P or L of all addresses that acquired ZRX in the previous 30 days.

At the time of writing, ZRX’s 30-day MVRV is sitting at +34.3%, suggesting that the coin’s short-term holders are - on average - roughly up a third on their initial investment:

So what does this mean? Well, as a rule of thumb, the higher the MVRV ratio, the greater the profits and the more likely it is that BTC holders will begin to sell and exit their positions - and vice versa.

This is also why some on-chain analysts believe that high MVRV ratios suggest ‘overvalued’ conditions while extremely low MVRVs might present an opportune time to accumulate.

As you can see above, ZRX’s current 30d MVRV ratio is almost as high as it was during its February price top, which may suggest a short-term correction is needed for the metric to normalize. Furthermore, over the past year, the current MVRV levels have rarely been sustainable for more than a few days, suggesting an elevated risk that swing traders will begin to claim some of these profits and exit the coin for the time being.

On the other hand, ZRX’s 365-day MVRV currently hovers at +76% which - while relatively high - is still some ways from the February peaks or the coin’s summer 2020 rally:

Still, both ZRX’s 30-day and 365-day MVRV ratios are quickly moving into the proverbial ‘danger zone’, which often begets a short-term correction before another, sustainable leg up is possible.

These are some of the metrics I’d keep an eye out in the coming days for ZRX. While the lack of crowd awareness and apparent whale accumulation seem positive, the rising sell-side pressure and elevated MVRV ratios seem to suggest that a short-term top might be near for the coin. Stay safe out there!

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Conversations (0)