Signs of 'buying the dip' in stablecoin data?

Around 5 months back, I wrote an article titled “Why’s Bitcoin up 10%? Stablecoins.”, which documented a growing fixation I have on the relationship between the exchange-related activity of top stablecoins and Bitcoin’s short-term market action.

Consider this an unofficial sequel to that post, as various on-chain metrics now suggest a concerted effort by some stablecoin stablecoin cohorts to ‘buy the dip’ after the September 2nd crash, which could help support a market-wide bounceback moving forward.

Let’s cover a few of them here:

USDT

On September 4th, as Bitcoin fell below $10500 for the first time in 40 days, Sanbase recorded a string of major spikes in the flow of ERC-20 Tether to known centralized exchange wallets, with 1.087 billion USDT moving to exchanges in a 24-hour span:

As I suggested in that writeup from 5 months ago, these types of on-chain moves - especially when put into broader market context - could suggest a growing desire by certain whales to begin exchanging their stablecoin bags for more volatile cryptocurrencies.

While Bitcoin might be the most obvious answer here, the USDT/ETH pair has been a close second in terms of daily volumes on Binance and OKEx over the past few days, with USDT/LINK also claiming a non-negligible share.

Assuming the main reason for this massive spike in USDT’s exchange inflow is opportune traders looking to ‘buy the dip’, it’s unclear from the move alone whether an influx of buy orders has been put forward immediately afterwards, or if there’s still some level of buy pressure to work through.

Regardless, the above swelling of USDT on exchanges in the past 4 days coincides with a simultaneous decrease in the collective balances of addresses holding between 10k-100k (shrinking by 84.8 million USDT) and 100k-1m USDT (shrinking by 67.6 million USDT), respectively:

The above lends more credence to the idea that certain ‘stablecoin whales’ may be moving their bags to exchanges in the short term, as they look for discounted entry into major cryptocurrencies in anticipation of a quick bounceback.

Adding on to the above, there’s also been a notable decline in the amount of addresses holding more than 10,000 ERC-20 USDT, which has shrunk by 3,893 since September 3rd:

USDC

The second largest stablecoin by market cap, USDC has recorded a string of ever-larger inflows of USDC to exchanges following the market crash, with 1,037 billion USDC moving to exchange wallets over the past 3 days:

Along with the above, there’s been a considerable uptick in the amount of active USDC deposit addresses (used to funnel USDC to exchanges), growing to a 40-day high 1608 on September 4th and suggesting a dispersed effort to ‘buy the dip’ among USDC investors:

Similar to what we’ve seen with Tether’s whales above, the collective balance of addresses holding between 100k-1m has declined by 10.3 million since Friday, marking an end to a month-long uptrend and suggesting a possible paradigm shift (and perhaps a buying frenzy) among some USDC investors. Unsurprisingly, USDC/ETH and USDC/BTC have been the two most actively traded pairs over the past 24 hours:

DAI

While multi-collateral DAI has been a DEX favorite for a while now, the third largest stablecoin has also seen growing activity on centralized exchanges since the crash. In fact, the amount of DAI moved to known exchange wallets has hit an all-time high 315 million on September 5th, right as ETH ‘bottomed out’ around $322 late on Saturday:

Unlike USDT and USDC, the most active DAI pair (excluding other stablecoins) continues to be Ethereum, which is why I compared it to Ethereum’s price action instead. The amount of active MC-DAI deposit addresses has also seen a steady incline following the market drop, with a total of 434 deposits recorded on September 4th - the second highest single-day deposit activity in the history of the network:

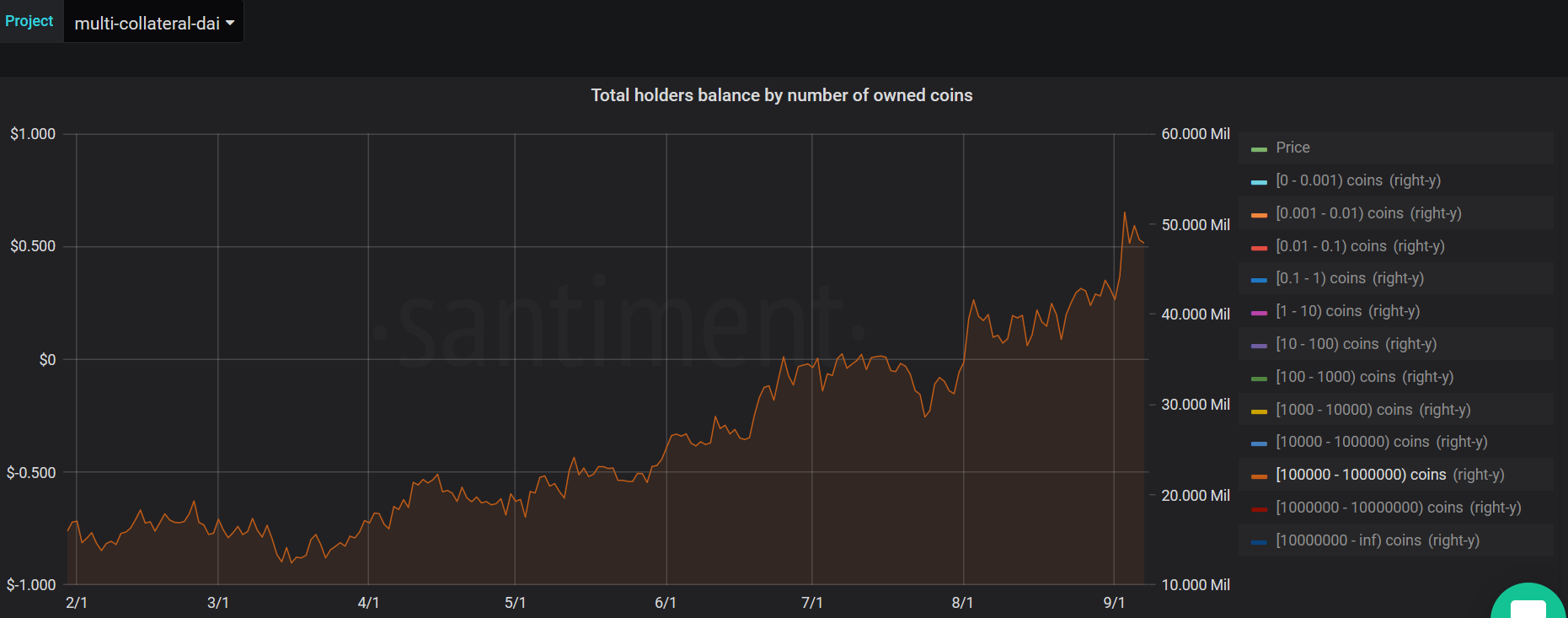

Further in line with the behavior of other stablecoin whales, there’s also been a subtle drop-off in the collective balance of addresses holding 100k-1m DAI, which has shrunk by 3.7 million since September 3rd:

BUSD and Gemini

While commanding a significantly lower market share, Binance USD and Gemini have also recorded a noteworthy uptick in their respective exchange-bound activity. September 4th saw the second highest single-day inflow of BUSD to exchanges since the coin launched, with 46.1 million BUSD moving to Binance as Bitcoin retreated to the $10500 mark:

And although it pales in comparison, a similar uptick in GUSD’s exchange activity also occured on September 4th, with 337,000 GUSD moving to known exchange wallets:

In conclusion, we’ve seen many of the largest stablecoins by market cap record a major spike in their exchange-related activity since last week’s market-wide crash, with a corresponding (and in some cases significant) drop-off in their respective ‘whale’ balances.

I mentioned this very confluence of factors shortly after the Black Thursday crash - as it looked like everyone was FUDing into stablecoins. As the market still reeled from the effects of the March 12th dump, I wrote:

“For now, I’d keep an eye on the behavior of USDT and USDC holders in days to come. If we see whales and/or retail owners start offloading their stablecoin bags - and especially if there’s a corresponding spike in the inflow of stablecoins to exchanges - it might suggest a paradigm shift and a growing confidence among investors in a market-wide recovery.“

That shift finally came about a month later - at the end of April - and coincided with a 10% gain in Bitcoin’s price shortly afterwards. As I mentioned at the start, I documented this event in another article where I attributed Bitcoin’s 10% gains to this major paradigm shift in stablecoin holders, and stablecoin whales in particular.

We may now be witnessing a similar scenario unfold, albeit on a smaller scale compared to the April move: following a market-wide crash, the stablecoin holders begin to funnel millions of dollars to exchanges and whales start to offload their stablecoin bags after months of accumulation.

Assuming this indicates a strong desire to ‘buy the dip’ among speculators, such concerted spike in potential buy pressure - especially if it gets supported by strong market fundamentals - could help prop a similar bounceback to what we’ve seen back in April.

At the moment, however, Bitcoin and Ethereum's fundamentals still look a bit shaky, with major sell pressure and flaky on-chain activity marking the first several days after the dump. If these continue to normalize while stablecoin-related activity remains as above, a more comfortable path upward could be charted.