Is everyone FUDing into Stablecoins?

Takeaways:

- The biggest non-exchange addresses of top stablecoins - especially USDT and USDC - have been acummulating in a hurry since the market crash

- The total balance of USDT and USDC among retail holders has grown rapidly in the past 2 weeks

- Despite this, the supply of all top stablecoins on exchanges has actually increased since ‘Black Thursday’

- On-chain activity (transaction volume and exchange inflow) for top stablecoins is beginning to normalize back to pre-dump levels

If we’re going strictly by market cap, stablecoins emerge as the clear ‘winners’ of the now-infamous Black Thursday (March 12th) and the ensuing market-wide collapse.

In the past 12 days, the four biggest stablecoins - Tether, USDC, Paxos and TUSD - have all experienced double digit gains to both their market cap and its trading volumes.

Most traders and media pundits attribute the growth to cryptocurrency speculators exiting the market in bulk over the past 2 weeks and retreating into low-volatility assets until the madness stops (and - on a smaller scale - converting their fiat to digital dollars).

Looking at their on-chain data and the recent behavior of their holders, there’s a number of indicators pointing to growing uncertainty amid whales and retail investors alike.

However, the story is far from black and white. Below, we examine the fundamentals of the world’s biggest stablecoins since the market crash, and what they can tell us about the recent state of the market.

Tether

Since the March 12th drop, Tether’s total market cap ballooned from 5.25 to just over 6 billion - a 14.7% increase recorded during one of the worst weeks for crypto in recent memory.

Besides the rising supply, ‘Black Thursday’ left a clear mark on Tether’s on-chain behavior just the same. As BTC plunged below $4500 on March 13th, a combined total of 2.49 billion ERC-20 USDT was exchanged between network addresses - the most in coin’s history:

That’s ~2.5 billion dollars moving on-chain in a single day, as speculators flocked to stablecoins amidst BTC’s 42% drop. Some of this USDT moved after being dormant for a while, as evident by the single biggest spike in Token Age Consumed recorded on the same day:

Although ERC-20 Tether’s on-chain volume has been slowly reverting back to pre-dump levels, we’ve also seen several days with unusually high amounts of coins (1.7B+) moved on-chain since the March 12th dip. So where’s all this magic money going?

- Whales

Sandata tracks the cumulative balance of the top 100 addresses holding Ethereum or any ERC-20 coin.

According to the platform, the biggest non-exchange ERC-20 USDT addresses (aka whales) within the top 100 went from holding 755.25 million on March 12th to 1.049 billion today:

That’s 294 million USDT added to Tether whales’ bags since Black Thursday, or a 38.8% increase.

The ongoing accumulation among Tether whales supports the widely-held belief that big players are retreating into stablecoins for the time being. Should we see this trend continue in days to come, it could prove a worrying sign for Bitcoin’s short-term recovery.

- Retail

It’s not just whales that have been piling into the world’s biggest stablecoin since the drop.

According to Sandata, addresses holding between 1000 and 10000 ERC-20 USDT have increased their collective Tether bags from 162.6 million on March 12th to 271.58 million today:

That’s a 66.9% increase in ERC-20 Tether holdings since Black Thursday, as the retail sector appears equally uneasy about current market conditions, and happy to wait it out on the sidelines.

- On Exchanges

On March 13th, 687 million ERC-20 Tether left known (centralized) exchange wallets - the second biggest exchange outflow in the coin’s history:

While this further validates the idea that speculators have been mass-exiting into stablecoins, it’s worth noting that the same day saw an even greater amount of Tether entering exchanges - a total of 819 million ERC-20 USDT, to be precise.

In other words, more Tether actually moved to exchange wallets amidst the drop than away from them, and has continued to do since. In fact, the total amount of ERC-20 USDT on centralized exchanges is now hovering around an all-time-high of 1.238 billion:

Overall, we’re seeing an interesting narrative develop on Tether’s charts. Both the top USDT whales and some in the retail sector have been converting their bags to ERC-20 Tether since Black Thursday, which ought to be reason for caution among swing traders and perennial bulls alike.

On the other hand, we’re also seeing the amount of Tether on exchanges continue to rise, which could be down to a number of factors including pre-buy positioning among bounceback hopefuls.

USD Coin

A similar story to the above repeats itself on USDC’s charts. The second-largest stablecoin’s market cap has grown by 43.4% to $665 million since the crash, allowing the asset to climb to spot #18 among the world’s biggest cryptocurrencies.

On-chain, March 13th proved to be the ‘busiest’ day in USDC’s history, with 664.45 million USDC moving between network addresses.

Unlike with Tether, however, it would appear that the above volume was mostly driven by short-term traders, as USDC’s Token Age Consumed remained fairly normal throughout the crash, indicating that dormant coins haven’t been moving in bulk:

Let’s break down USDC holder behavior since the market crash:

- Whales

Much like with Tether, the top non-exchange USDC addresses (within the top 100) increased their cumulative holdings by 80.46 million since March 12th, enough for a 25.8% increase:

Once again, the biggest whales have added millions to their respective stablecoin bags, signaling a growing uncertainty in the market’s short-term potential.

The pattern repeats itself with smaller whales just the same. In particular, addresses holding between 100,000 and 1 million USDC have added another 101.4 million to their collective balances since Black Thursday:

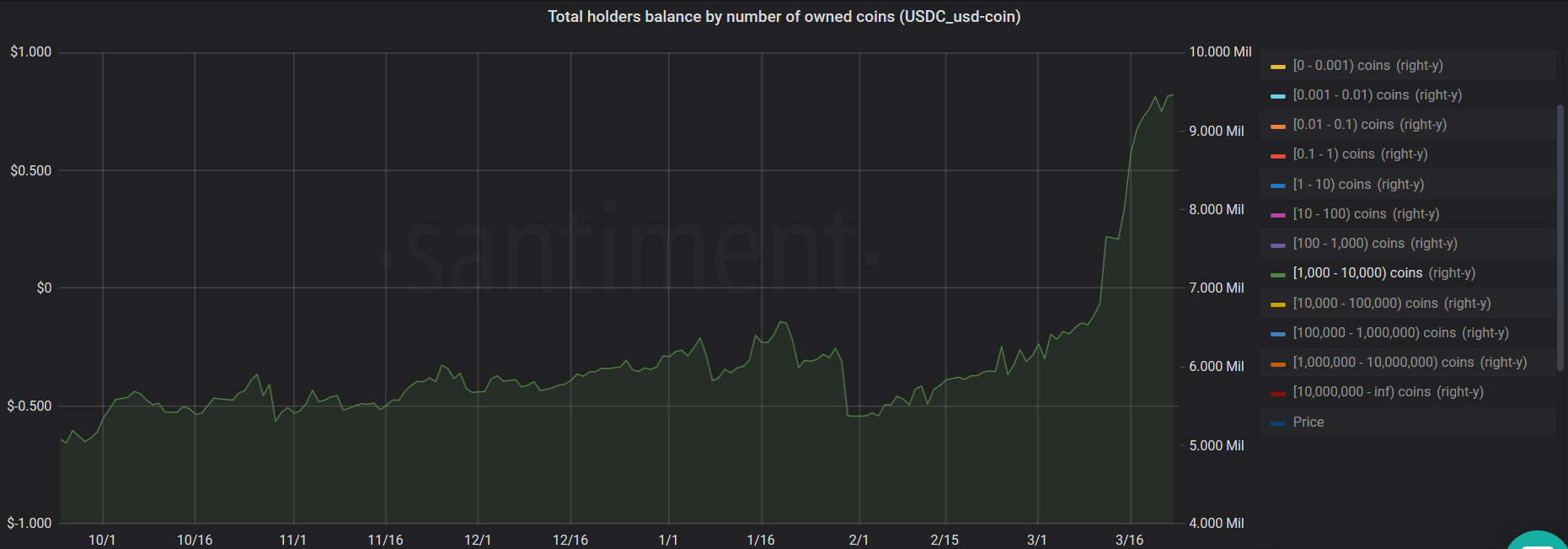

- Retail

The retail sector has also rapidly grown its USDC holdings since the crash, with addresses holding between 1000 and 10000 USDC improving their bags by a total of 1.95 million in the past 12 days:

If we’re to assume these increases in whale and retail holders’ balances to mainly be prompted by panic sell-offs, the prevailing sentiment about market recovery appears to veer negatively at the moment.

- On Exchanges

An important caveat to the above is the fact that, like with Tether, we’ve actually seen a significant increase in the amount of USDC flowing to centralized exchanges in the past 2 weeks.

In fact, an additional 44 million USDC has moved to exchange wallets since the drop, effectively doubling USDC’s supply on exchanges:

At this point, it’s important to note that Coinbase does have a USDC rewards program since October 2019, letting users earn interest on every USD Coin they hold on the platform.

This could, at least in part, explain the massive rise in exchange-based USDC since the crash: sell crypto bags for USDC and start earning interest on it while the market calms down.

Paxos and TrueUSD

While Tether and USDC had the most visceral response to the market correction, it’s worth taking a quick look at the recent dealings of other top stablecoins.

A total of 150 million PAX moved between wallets on March 13th, marking the third busiest day in the coin’s history:

Meanwhile, about 48.5 million TUSD exchanged addresses on the same day, which is relatively normal for the coin’s high-activity days.

Both PAX and TUSD’s whales have increased their stablecoin bags since the drop, albeit on a smaller scale. Paxos’ top non-exchange wallets grew by 53.3 million PAX in the past 12 days, while TUSD’s top non-exchange wallets added 3.56 million TUSD.

Meanwhile, the sentiment among PAX and TUSD retail holders isn’t as obvious as with the two top stablecoins.

The collective balance of addresses holding between 1000 and 10000 PAX has actually peaked around the time of the drop - at 5.4 million - and has since shrunk by 770k PAX

As for TrustToken owners, addresses holding between 1000 and 10000 TUSD have been zig-zagging their collective balance over the past two weeks, which is currently down by 120k TUSD compared to Black Thursday.

The recent volatility is hardly out of the norm for either asset, further indicating that the most acute response to the drop was concentrated among the two biggest stablecoins by market cap - Tether and USDC.

Conclusion

Based on the above, a few patterns emerge:

- Top non-exchange holders of the biggest stablecoins - especially USDT and USDC - have been accumulating in a hurry since the market crash

- Retail holders of ERC-20 USDT and USDC have quickly grown their collective stablecoin balances since the market crash

- The supply of all top stablecoins on exchanges has actually increased since ‘Black Thursday’

- On-chain activity (transaction volume and exchange inflow) for top stablecoins is beginning to normalize after a wild two weeks

While the first two points could be a sign for concern if you’re hoping for a quick bounceback, the spike in a supply of the 4 biggest stablecoins on exchanges does suggest there’s a growing speculative cohort looking to buy the dip.

For now, I’d keep an eye on the behavior of USDT and USDC holders in days to come. If we see whales and/or retail owners start offloading their stablecoin bags - and especially if there’s a corresponding spike in the inflow of stablecoins to exchanges - it might suggest a paradigm shift and a growing confidence among investors in a market-wide recovery.

Conversations (0)