DeFi pumps continue: How high can LEND go?

When it rains, it pours, as yet another DeFi-related token - LEND - surges to +30.35% over the past 24 hours, and is now hovering at a 30-month high $0.128:

LEND joins a string of recent De-Fi related pumps including the likes of KNC, MKR, ZRX and REN (whose monster pump we covered just the other day), to name a few. And while the crowd is still shouting ‘moon’, the coin’s on-chain data has been turning increasingly bearish over the past 24 hours, with several major red flags now flashing for LEND speculators.

But before we get to that, let’s take a step back:

What is LEND?

LEND is the native token of AAVE, a quickly-growing decentralized lending platform that’s not the least shy about gunning for the slice of Compound’s pie. Originally launched as ETHLend back in 2017, the project rebranded as AAVE a year later and launched their protocol on the Ethereum mainnet on January 8th, 2020:

As a lending platform, AAVE boasts a number of unique selling points that make it stand out in an already crowded space. Here’s a very incomplete list:

1. Other than offering lending and borrowing on the top stablecoins (and some up-and-comers like sUSD and bUSD), AAVE also supports dozens of popular ERC20 assets including KNC, SNX, MKR and LINK, which has quickly become the crowd favorite.

2. Unlike most competitors, AAVE has created its own unique interest rate models, and lets you choose and switch between their so-called ‘variable’ and ‘stable’ interest rates. To make this post about a 1000 words lighter, check out the major differences between the two interest rates here.

3. Typically pitched as the most novel aspect of the AAVE protocol is its ability to leverage so-called ‘Flash Loans’, which let users borrow any amount of capital under condition that it’s paid back in the same block. Although just 6 months old, the flash loans had already created some very intriguing use cases, most notably around arbitrage.

So where does the LEND token fit into this picture? Well, LEND was originally envisaged as the cornerstone of the ETHLend protocol - a utility token that offered users reduced fees on the platform, staking perks and improved loan-to-value ratios.

As the project pivoted, so too did LEND’s use cases, and the coin evolved into a governance token whose actual scope is still a work in progress. For now, LEND holders are able to vote on proposals put forward by the AAVE development team and chime in on a variety of operational topics including interest rates, liquidation configurations and new assets added to the platform.

In the future, LEND is hoped to see increased staking utility as well, including the ability to claim AAVE protocol’s fees in exchange for LEND holders acting as the first line of defence in case of malicious protocol activity.

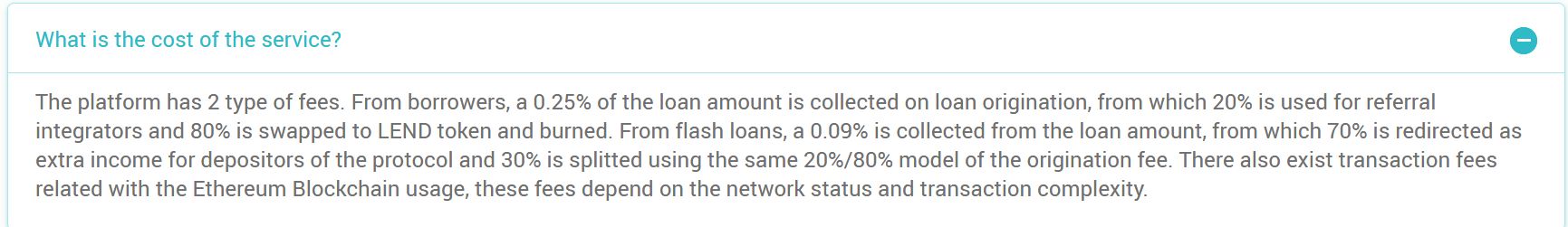

Finally, it’s important to note that the AAVE protocol uses 80% of the platforms fees to burn LEND on the open market, hoping to grow the coin’s value through scarcity. Since the mainnet launch, a total of 1,838,500 LEND (~$235,328 at the time of writing) has been successfully burned:

Now that we know a bit more about the protocol and its tokenomics, the question remains - what’s driving LEND’s ongoing rally? At present, the coin has gained over 30% in the past 24 hours, and more than 105% over the last two weeks!

In terms of recent project news and announcements, there are several likely culprits for LEND’s latest breakout. The first leg of the rally started on June 8th, roughly around the time that Binance research published an in-depth report highlighting the AAVE project:

Then, just two days later, the project announced crossing a major psychological milestone - a market size of over $100,000,000:

To complete the perfect storm of price-moving news, the same day Coinbase announces a list of projects it’s considering adding to the exchange, including, as it happens, AAVE’s own LEND token (first in the screenshot):

Since a number of other DeFi tokens were already rallying, the above proved more than enough fundamental support for LEND’s own upward bid. The coin shortly broke above $0.1 on June 10th before correcting; then, following another failed stint a few days later, the barrier was finally successfully breached earlier this afternoon.

LEND's on-chain and social activity

And while the recent announcements and market-wide trends helped boost LEND’s price in the short term, the coin’s on-chain data suggests the conditions for a sustained rally might have been a long time in the making.

Looking at the behavior of some of the coin’s largest non-exchange holders, LEND’s top whales have been accumulating since early November 2019, adding more than 256,000,000 LEND (~$31,500,000 at the time of writing) in the past 8 months:

At around the same time, LEND’s supply on exchange also started a determined decline, coinciding with the coin’s breakout in late 2019 and extending to the present day. I’ve seen this pattern occur quite often in low and mid-cap coins: assuming unchanged demand, the coin’s available supply to trade diminishes (sometimes intentionally/artificially), driving the trading price up:

All of which brings us to right now, and LEND’s +30.3% Thursday. Looking at LEND’s on-chain charts today, it’s immediately clear that the latest price rally is having a massive impact on the coin’s network activity.

Just today, the amount of addresses interacting with (sending or receiving LEND) spiked to a 30-month high 2100, dwarfing even LEND’s on-chain activity around the AAVE protocol launch:

The coin’s on-chain transaction volume has also positively exploded, with over 204,000,000 LEND (~$25,000,000) moving between addresses in the past 24 hours - around 11x higher than the coin’s transaction volume when the protocol launched:

It’s fair to assume much of LEND’s recent on-chain activity is speculative, as supported by a large spike in the amount of LEND moving to known centralized exchange wallets in the past 24 hours as well:

Elevated exchange inflow can suggest increasing sell pressure, as certain LEND holders look to take advantage of the rally and offload their bags. It will now be on LEND’s bulls to try and absorb the ensuing sell wall - if not, a short-term correction could well be in the books.

Another concerning sign today is a huge spike in LEND’s token age consumed, indicating that a significant amount of previously idle LEND tokens have recently started moving on the blockchain:

Spikes in token age consumed spikes are common ‘trend breakers’, and can indicate a major shift in the behavior of some of the coin’s long-term holders. Paired with the above spike in LEND’s exchange inflow, there’s growing signs that short-term price volatility might be near:

That said, we’re still not seeing clear signs of disarray among LEND’s large holders, which have continued to accumulate into the latest pump:

In terms of profit margins, LEND’s 30-day MVRV ratio currently sits at 1.46, indicating that short-term holders are currently (on average) +46.3% on their initial investment. Historically, LEND’s short-term MVRV ratio’s been pretty choppy, though it’s fair to say that it now sits comfortably in a ‘danger zone’, approaching levels at which ‘new money’ tends to sell their bags and take profit, leading to a short-term correction:

However, that’s nothing compared to LEND’s 365-day MVRV ratio, which indicates that LEND’s long-term holders are currently (on average) +204% on their initial investment! This is nearly identical to LEND’s 365-day MVRV levels at two of its previous tops, bacon June 10th as well as May 8th, giving another cause of concern for the coin’s rally moving forward:

In terms of the coin’s social data, the amount of ‘LEND’ and ‘AAVE’ mentions on crypto social media is quickly growing, suggesting that the ‘mainstream’ crypto community is starting to pay attention to the rally.

These elevated levels of social chatter - especially during a pump, can often indicate ‘peak hype’ and point to rising risk of a price correction. Zooming out, you’ll notice similar spikes on a number of LEND’s local and interim tops over the last year:

And while LEND-related chatter is quickly growing, our sentiment data suggests that the mood of the conversation is not all festive. In fact, over the past 24 hours, LEND mentions on social media have gone from overwhelmingly bullish to ambivalent, according to our Weighted Social Sentiment:

Also, we have yet to see LEND make it on our list of Emerging Trends, indicating that it’s one of the most discussed topics on crypto social media at the moment. This has often been a clear-cut signal of an incoming correction, as we’ve recently proven with a study that we performed on 200 coins.

Conclusion

Overall, LEND’s on-chain and social data are surfacing a number of bearish markers, including a massive spike in LEND’s token age consumed, elevated exchange inflow, dangerous MVRV levels and rising social media mentions.

That said, the coin’s general on-chain activity (daily addresses and transaction volume) is still very strong, which can provide fundamental support for another leg up. Keep an eye on these indicators over the next few days - if we see LEND’s on-chain action retrace back to pre-pump levels despite the price trying to push upward, a short-term correction might be around the corner.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Ibis!

Get 'early bird' alerts for new insights from this author

Conversations (0)