Could BTC break 60K?

Assets covered: Bitcoin (BTC)

Metrics used: Funding rate, Network Profit Loss, MVRV, Dormant circulation, Mean Coin Age, Mean Dollar Invested Age, Supply Distribution by Balance of Addresses

This week has enough good news for crypto. Still BTC is testing 60K resistance.

Where we are in terms of onchain data? Let's see.

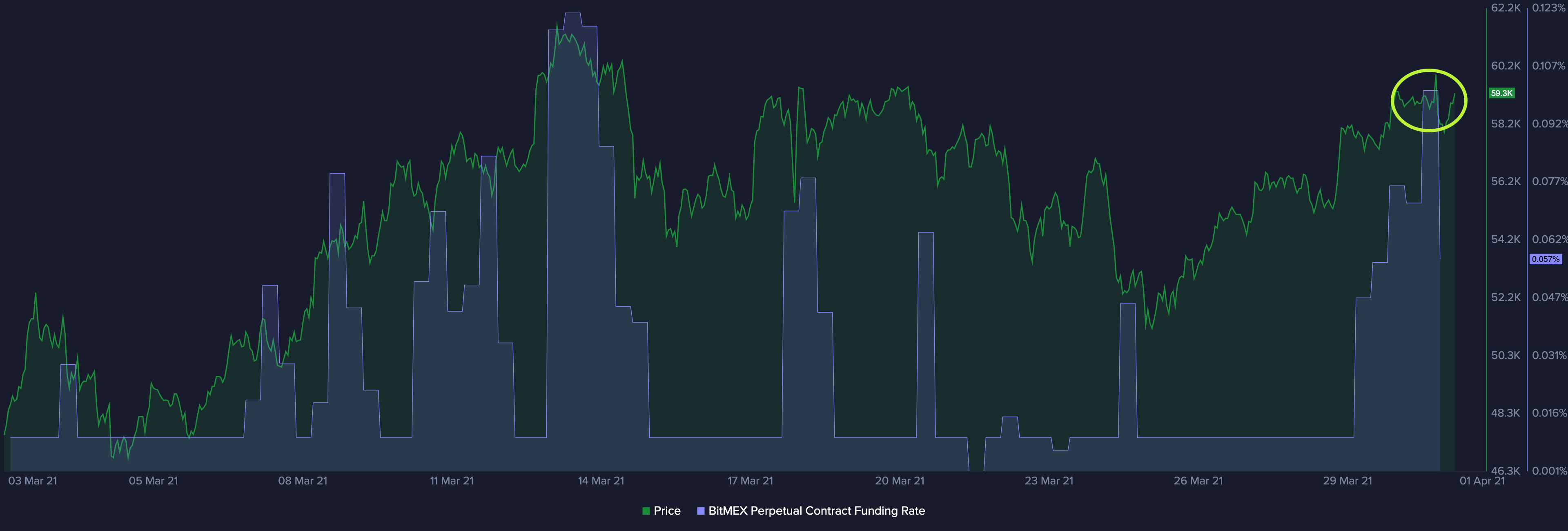

Derivatives market. Funding rate:

There is an impressive spike here. The funding rate is a fee paid by one side of the perpetual contract to the other. When the funding rate is positive, Bitcoin longs pay Bitcoin shorts, and vice versa. Funding rate of +0.10% is very close to +0.12% levels that we’ve seen on Bitmex a few weeks ago, right around Bitcoin’s March price top. The ongoing pump in Bitcoin’s funding rate throughout the last week suggests that the derivatives market is very bullish for the time being.

Higher FR levels have pointed to increased risk of short-term tops for the benchmark coin in the past.

Network Profit Loss

We can see a few signals that people are taking elevated profits. Along side that spike in derivatives. Probably both of them contributing.

Such signs of interim profit-taking, however, aren’t necessarily a bad omen for Bitcoin’s future price action, as they suggest a healthy amount of investor fear about the coin’s price potential and the lack of extreme bullish bias.

Short term MVRV (30d)

We are moving up into the not super overvalued territory but... There is a lot of room to grow according to MVRV. Still ok. Not close to the danger zone. Obviously this is a good sign as long as the bull market continues. Because generally we are way way overvalued compared to historical trends. Especially for 365d MVRV:

We're closer to the top we've seen in 2019 in terms of long term 365d MVRV.

3-yeas and 5-year Dormant Circulation

We use this metric to estimate an age of coins being moved. Generally it shows how many coins that have not been moved for [xx} years were transacted during a day. And these specific 3y and 5y DC seems to be spiking very high. A fair amount of very old Bitcoins have moved here.

Related article -

This is a good sign, distribution keeps taking place. Also should show itself on Mean Coin Age metric. Because coins became younger.

On the other side we're seeing 5y DCC going back to normal levels suggesting that long term holders for the time being are done with redistribution. Which might be slightly concerning.

Mean Coin Age

It shows the average amount of days that all BTC tokens stayed in their current addresses. Rising slope signals a network-wide accumulation trend. Drop-offs indicate increased movement of BTC tokens between addresses.

And as expected, the old coins moves are reflected on the chart. But overall MCA has grown since then. Which makes sense, because there haven't been that many spikes in these old cold coins (dormant circulation).

Mean Dollar Invested Age

Similar as MCA, a rising slope signals a network-wide accumulation trend. Drop-offs indicate increased movement of BTC tokens between addresses. MDIA is falling quite low. And it becomes more and more concerning as it drops deeper. The moment MDIA begins to increase could be the top. We think there still could be a little room to drop (and the price to pump) before things revert.

Whales moves

According to Santiment current data we're not seeing major panic in whales (holders from 100 to 10K BTC). We've seen it a few days ago before a minor correction. People started to offload around 10k BTC. Since then they basically accumulated the same amount back. For now we wouldn't be too scared if we would't see similar strong drop offs in the near future. We're seeing a fairly confident behaviour of Bitcoin whales for the time being.

Summing up

Most Bitcoin metrics remain neutral or slightly positive. Funding rate is a possible red flag. The crowd has bullish expectations on April. We'll see how it goes soon.

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Santrends!

Get 'early bird' alerts for new insights from this author

Conversations (0)