BTC - We have finally arrived

Assets covered: BTC

Metrics used: Price, Social Volume, Social Sentiment, MVRV, Coin supply on exchanges

Summary:

What a monumental day it was for BTC on Wednesday.

3 years in the making, we have finally breached the 20k mark and went well above it. At the time of writing, BTC is trading at $23,436.71 USD.

Let's take a quick look at how things are now that we broke the 20k level.

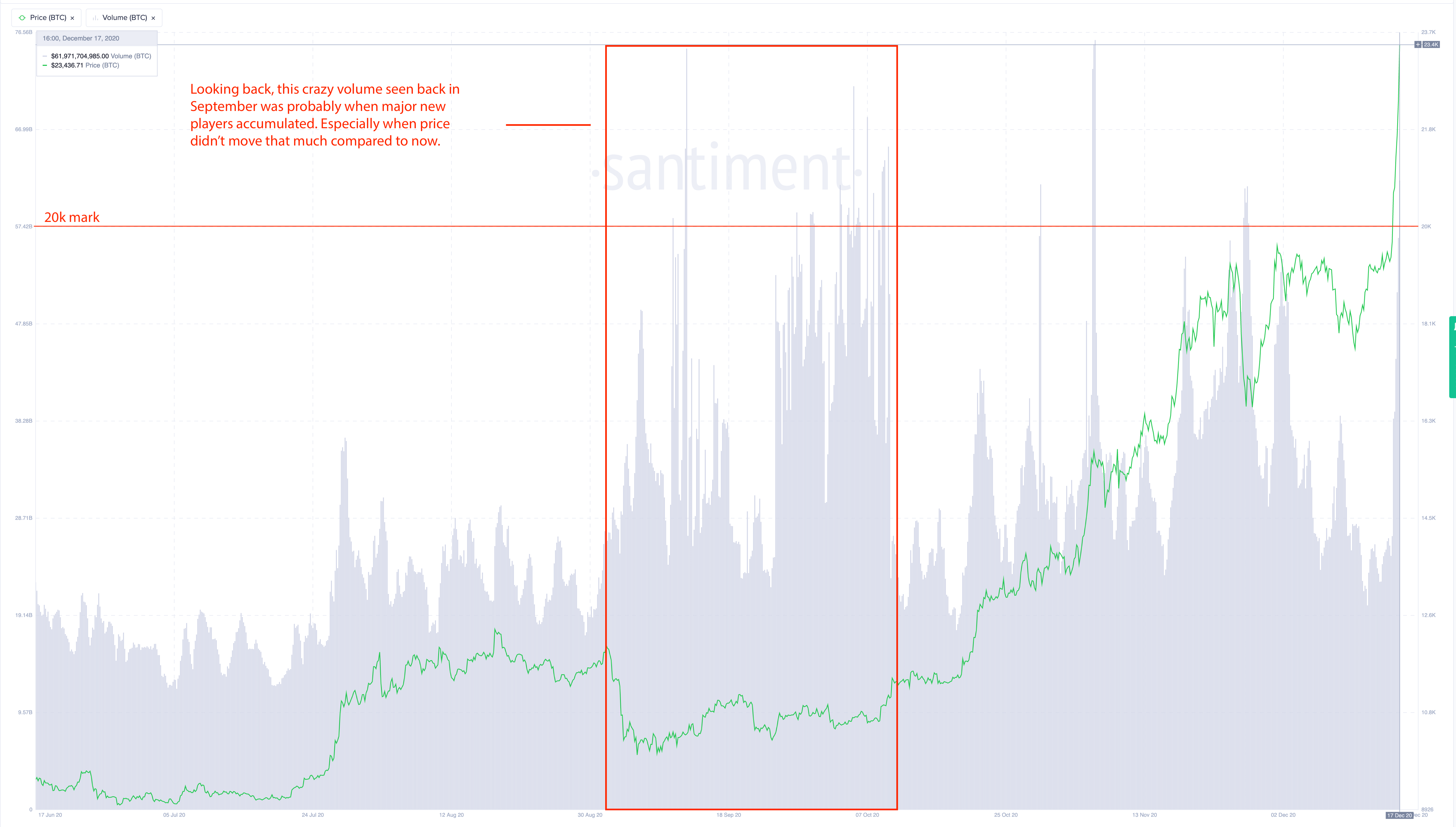

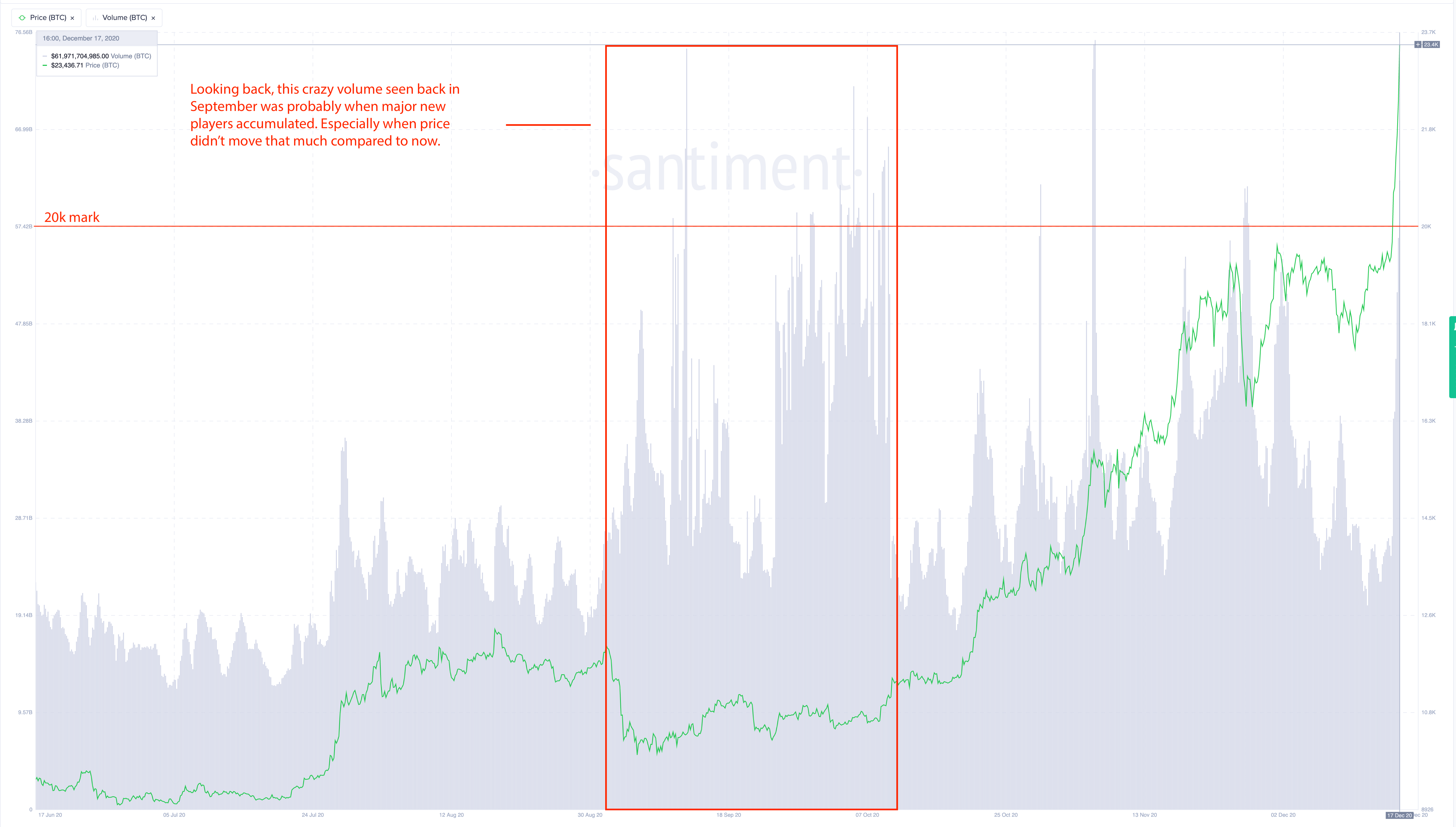

Price

BTC successfully held its lower highs and the next thing it needed to do was to make a higher high and it sure did fulfil that.

With this breakout, it's in price discovery mode and going to be hard to guess where BTC will end up. One thing for sure though, there's going to be high volatility in uncharted territory where we'll see +$1,000 and -$1,000 candles at play.

Interesting thing to note is that, looking at the charts again, one could observe strong accumulation back in September (where price didn't move much but high volume occurred).

The new big boys are here to stay. Period.

So what's driving the price?

BTC's current price action is likely to be driven by eager shorters being liquidated as a total of $535.59M shorts were liquidated on Wednesday when we first broke 20k and they are still getting liquidated today, resulting in BTC's price pushing up further (The sudden long candles are usually a result of liquidation).

This will eventually settle down as market in turn rekts the late longers so we can find equilibrium, whatever the price is.

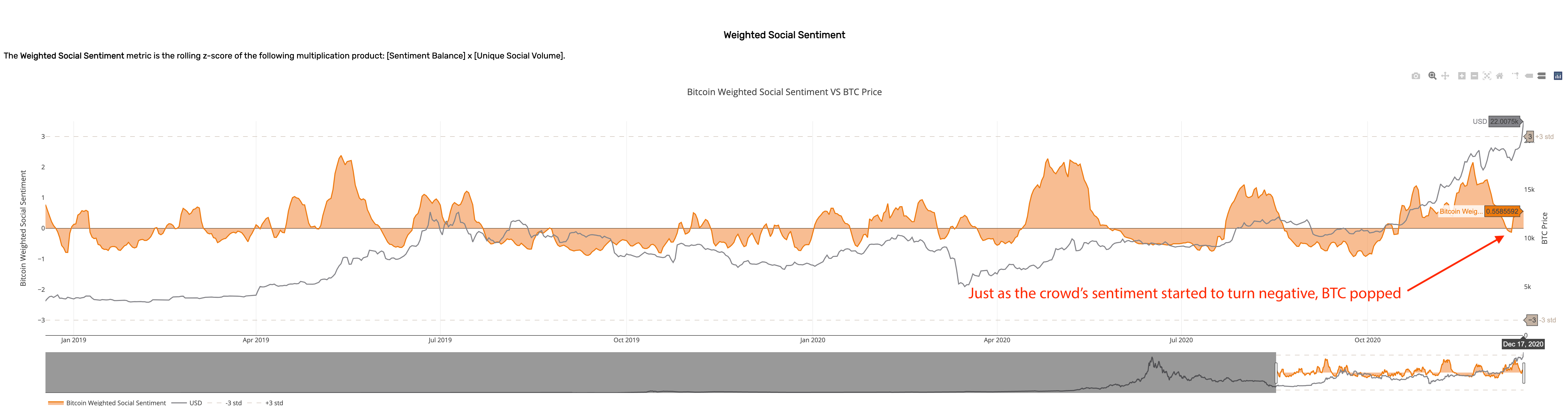

Social volume and Sentiment

Social volume is showing a large spike but pales in comparison to what we've seen in the past, one would expect way more when breaking 20k is a significant event.

Perhaps they are just slowly coming in or maybe people are still in disbelief? The crowd is showing less excitement than before. The highest social volume spike was when BTC finally broke 10k level in Consider the amount of social volume

Also interesting to note, the accumulation period mentioned before was a period where BTC social volume was the lowest in the year.

After what felt like forever at attempting to break the 20k mark, market sentiment dropped sharply since late November (as mentioned in previous post, cheers for 20k were no where to be seen as the crowd got exhausted and ventured into the negative sentiment territory right at the last dip before BTC went on a rampage.

Now with the 20k break, things are picking up but doesn't appear euphoric yet on the crowd's end. Nothing like in late November, but it's worthwhile to check the mood as the days goes by (we are only 1 day after BTC broke 20k).

There are people are getting excited and naturally so, it's a monumental event, the positive sentiment is healthy at the moment.

Coin supply on exchanges

The past 4 months have been rather consistent when it comes to Coin supply on exchanges. Each time there's a significant decline in BTC on exchanges, it kicked off a new rally.

The recent dip (before BTC went all bonkers) was no different. However, we are seeing more BTC entering into exchanges, indicating sell side pressure is present but currently, it's not as high as what we have observed in the past few months.

MVRV 30D

BTC has now entered deep into the Dangerzone of the MVRV 30D, which usually signals a local top is coming soon as short-term holders are well in profit at the moment.

Going forward

All in all, it's an exciting time for BTC, there'll be high volatility as price discovery plays out. There'll be a cooloff soon enough as MVRV 30D climbs even higher (short-term folks way in profit) and more BTC entering exchanges. Late margin traders will get rekt as usual and volatility should calm down as the market decides where to go next.

People are excited but the real FOMO has yet to start. Sit back, relax and just enjoy the ride for now.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.