BTC - New ATHs but warning signs are growing with each push.

Assets covered: Bitcoin BTC

Metrics used: MVRV, Adjusted Price DAA Divergence, Supply on exchanges, Funding Rate, Mean Dollar Invested Age, Holders Distribution.

Summary: BTC continues upwards, making new ATHs for the year while market participants are left with disbelief. Shorters are paying the price and helping to push BTC upwards but on-chain warning signs are getting stronger each day.

Funding Rate

According to Bitmex, BTC funding rate is mostly in the negative (shorts are paying for longs) for the past week, indicating that there's more short pressure than long. Today's funding rate is in the somewhat neutral side.

Almost looks like disbelief at the moment as every time BTC inches higher, more shorts pile up, get rekt and end up pushing price up further.

Looking at past history, we can observe that usually when there's spikes in the funding rate (especially when price is down), BTC's price does the opposite and rekts all shorters.

Likewise, huge spikes in positive funding rates (with a rising price) warns of a possible Long liquidation coming. As usual, the crowd comes late and gets punished.

There's probably some further room for BTC to grow, but it's worthwhile to keep an eye on the sudden spike in positive funding rate (if it happens), as a warning sign for possible top.

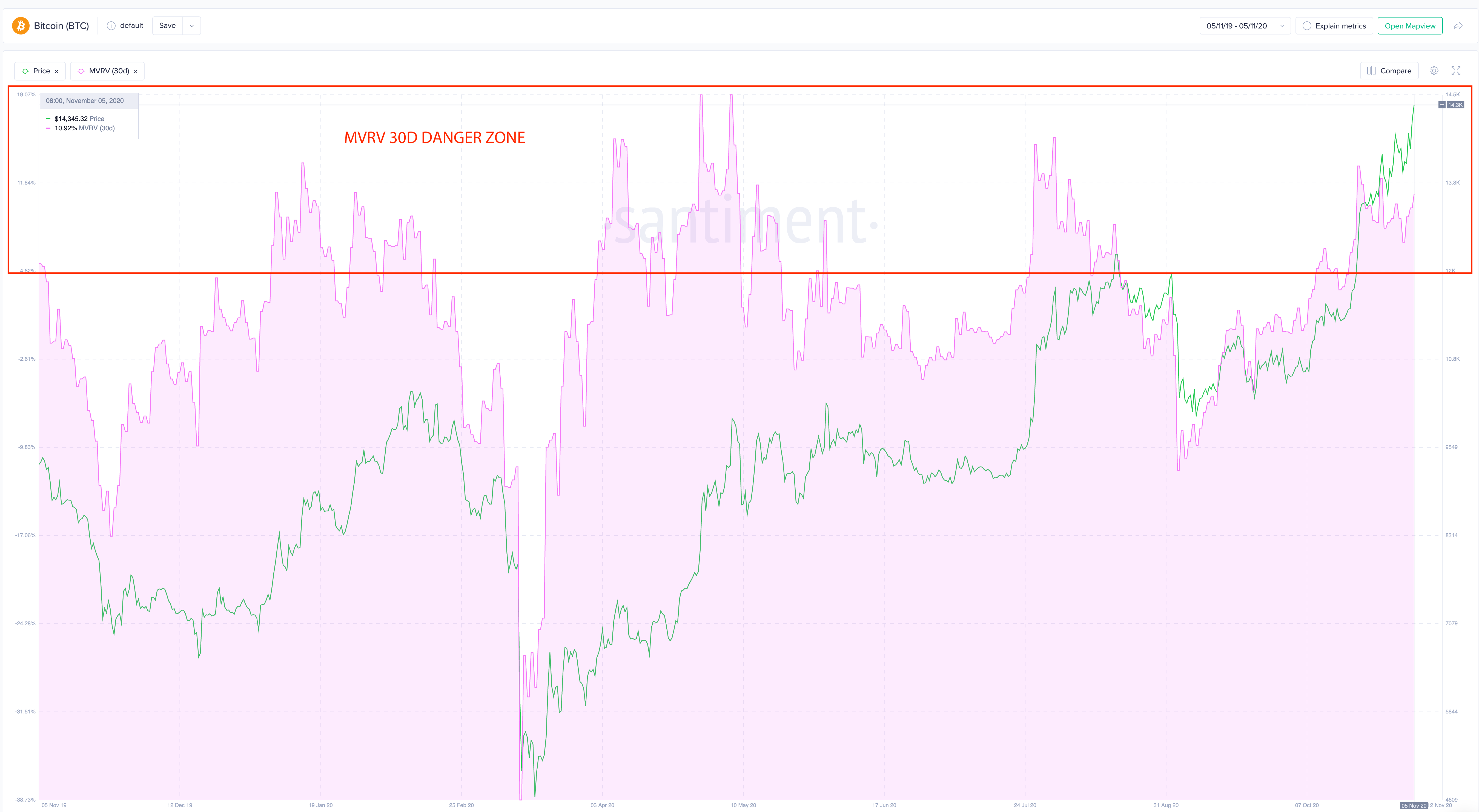

MVRV 30D

MVRV 30D has entered is currently in the danger zone, anything above 10% would be a warning sign, a spike to 20% would likely see more profit taking from short term traders.

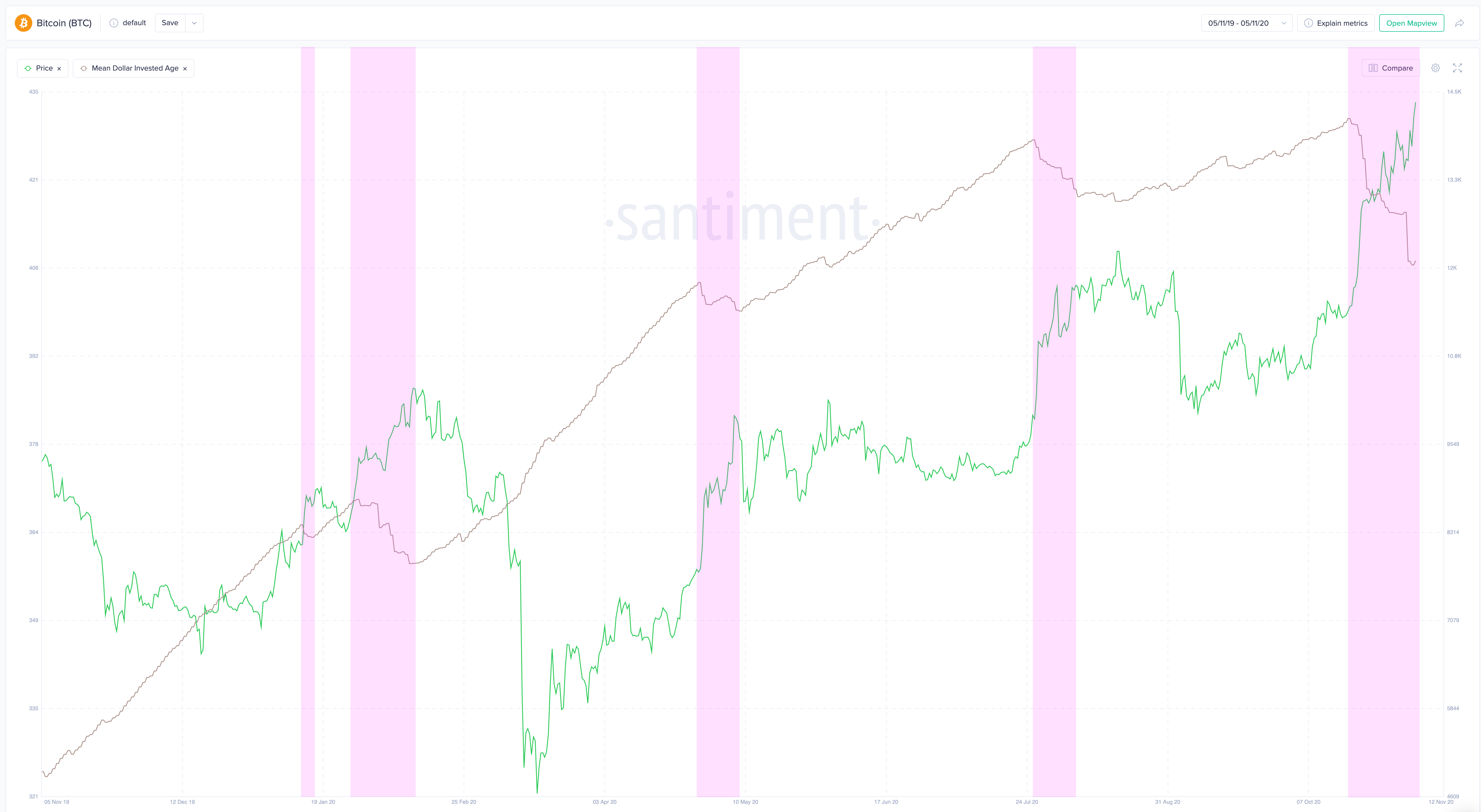

Mean Dollar Invested Age (MDIA)

Mean dollar invested age recently saw huge drop, with the recent one likely due to a Silk Road linked address - 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx transferring 69,369 BTC ($1B USD) to an unknown wallet.

It's still unclear as to what the nature of the transfer could be, but that's not spooking out the market it seems. However, it's important to note that a drop in MDIA tends to signal a local top is coming soon.

Coin Supply on Exchanges

BTC's coin supply on exchanges saw a spike recently with the rally but that didn't stop the price. Overall coin supply on exchanges trend is still down as we see a significant outflow of BTC this year since Black Thursday in March.

Indicating that the behaviour is changing, going from distribution to accumulation. On a HTF, this is very healthy looking and reduces sell pressure.

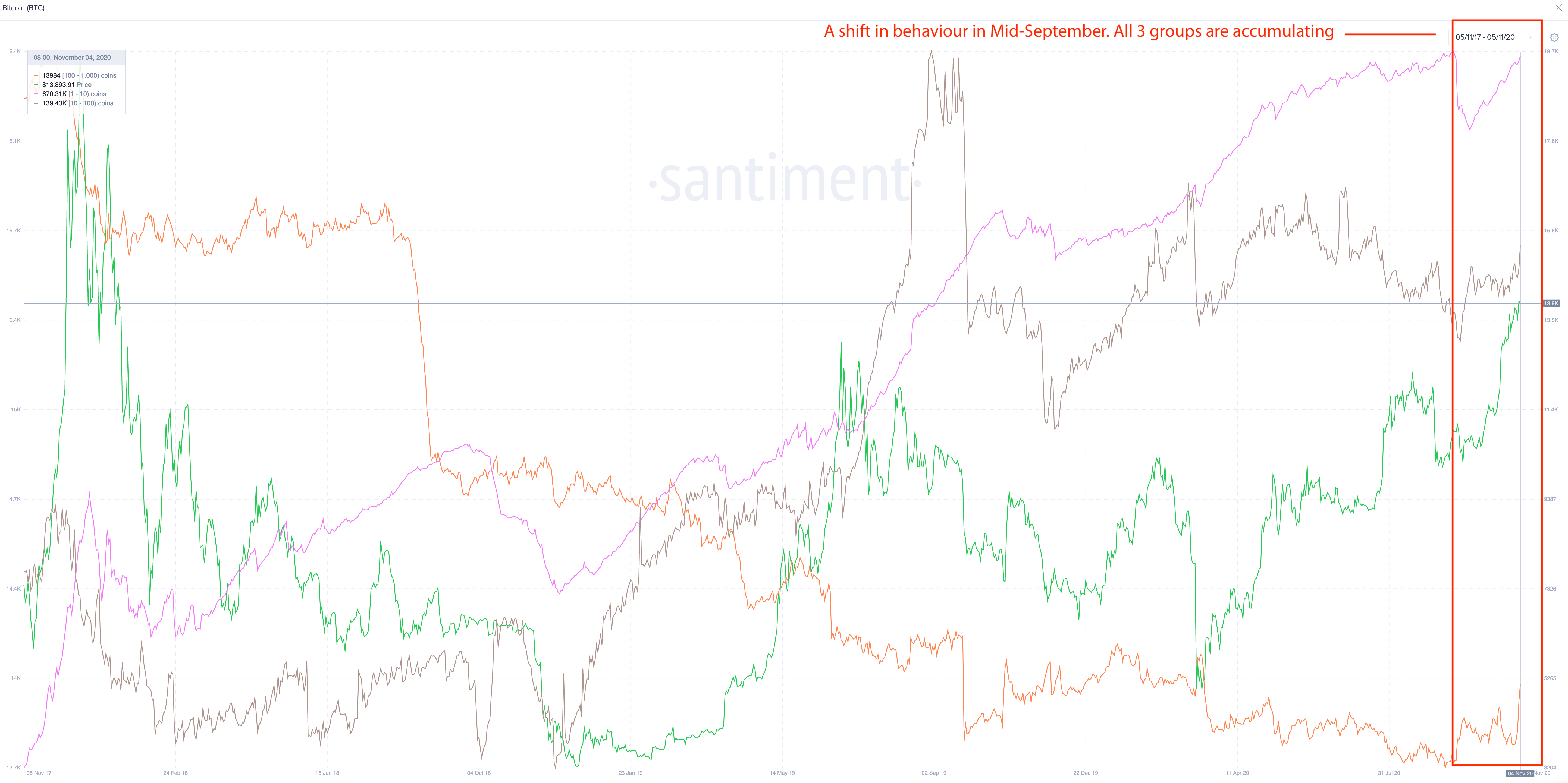

Holders distribution

1 - 10 BTC - We are seeing continued growth in Retail holders over the past 3 year as it makes a new ATH every year. There are currently 670,310 holders having between 1 - 10 BTC.

10 - 100 BTC - Holders in this group saw huge growth in 2019 where BTC bottomed out in the start of the year. However, since late Aug 2019, this group been shrinking as participants reduce their risk. There are currently 139,430 holders in this group.

100 - 1000 BTC - Whales have been generally distributing over the past 3 years, seeing a drop in Whales by 14.77% from the 2017 highs. There are currently 13,984 holders in this group.

Regardless of their individual groups, one thing in common is that from Mid-September onwards, there has been a spike in new holders. This renewed interest in BTC indicates new participants are starting to enter the market (significant ones too).

Adjusted Price DAA Divergence

Summing up

There's no denying that BTC is showing signs of a strong uptrend, making new ATHs for the year with each push.

Market participants seem to be in disbelief as most people are still shorting BTC as the price continues up. But that only serves to fuel the move upwards and this behaviour will allow BTC to growth further.

But can BTC really continue without cooling down?

On-chain metrics are showing signs that an impending top might be coming soon. This coupled with a sudden flip of the crowd to Longs and spike in Social volume will likely be the top as the crowd gets excited.

Also, short-term traders are very likely to take profits as MVRV 30D continues to grow.

Tick Tock.

Get ready for a crazy ride!

Conversations (0)