Are we rich yet? - Yield farming 1 month later...

It's been almost a month since Compound kicked off the DeFi craze with liquidity farming.

Let's take a quick look at how things are looking now for two of the most popular liquidity mining protocols out there - Compound and Balancer.

COMP distribution breakdown

- 2,396,307 COMP have been distributed to shareholders of Compound Labs, Inc., which created the protocol

- 2,226,037 COMP are allocated to our founders & team, and subject to 4-year vesting

- 372,707 COMP are allocated to future team members

- 4,229,949 COMP are reserved for users of the protocol (Over a period of 4 years based on emission rate of 2,890 per day)

- 775,000 COMP are reserved for the community to advance governance through other means — which will be announced at a future date

- 0 COMP will be sold or retained by Compound Labs, Inc

So far the amount of COMP distributed to users:

Daily Distribution

2,890

Total Distributed

88,458

Remaining

4,141,490

But that's just the User portion. What about the Top non-exchange holders?

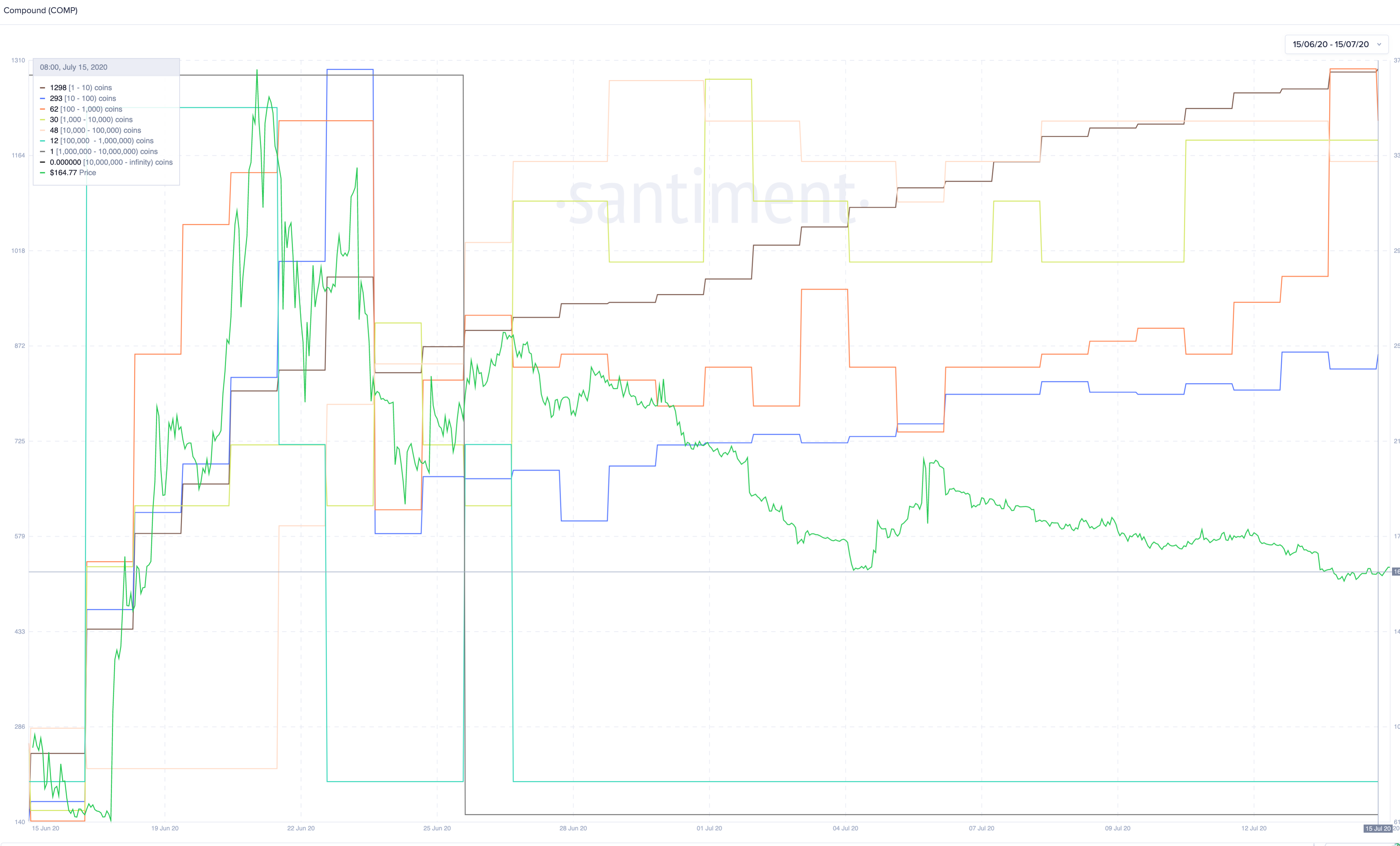

The top 10 non-exchange addresses have been reducing their holdings since launch and it appears that with each reduction, a dip in price follows not long after. They have offloaded a total of 870,000 COMP since launch. Currently, they are not doing much, and have been inactive since 8th July.

Current Holder distribution

0.01 -0.1 COMP: 5166

0.1 - 1 COMP: 2482

1 - 10 COMP: 1298

10 - 100 COMP: 293

100 - 1000 COMP: 62

1,000 - 10,000 COMP: 30

10,000 - 100,000 COMP: 12

1,000,000 - 10,000,000 COMP : 1

Majority of COMP still lies in whales/Compound wallets. But it's good to see that increasing amount of COMP holders in the lower bracket with distribution via liquidity mining.

Some of the large COMP holders are key participants in Compound's governance,

Do note that the amount of COMP they hold may also contain COMP that's delegated to them by other COMP holders. It also requires 100,000 to create a governance proposal, so at the moment, only the top 9 on the leader board can make such proposals.

Yield

Yield is generally decaying over time at Compound following multiple changes to the protocol and price of COMP not holding up.

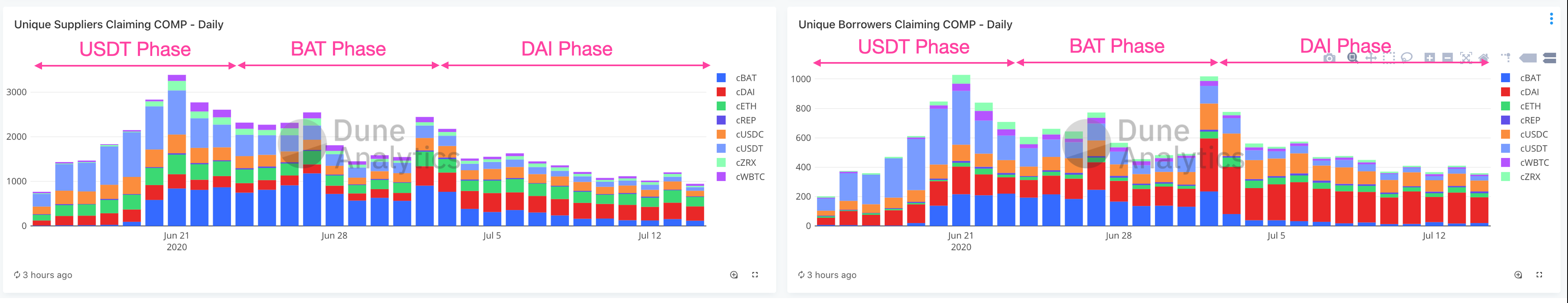

We are currently in the DAI phase, where DAI is still the best coin to use for farming COMP. Previously it was USDT, followed by BAT.

10,000 DAI will give an APY of 10.02%. Considering how the APY was just 14.13% about a week ago, the latest APY is likely to drop further if COMP continues to not hold its price if everything else remains constant. To keep up to date on what's the latest APY, refer to this.

Below is a chart of % of COMP claimed by Supply/Borrow market that illustrates how behavior have changed over time in each phase.

Since 3rd July, we are observing a downtrend in unique Suppliers/Borrowers claiming COMP, this behavior is reflective of the governance changes over time. Users having assets other than DAI will probably find better yield elsewhere and migrate accordingly.

For detailed COMP analytics, refer to here.

BAL distribution breakdown

Maximum supply of BAL is 100M. However it's not exactly a hardcap as BAL holders can change it through governance if deemed necessary.

According to the team, 35,435,000 BAL have been minted, of which:

25M for the founding team, stock options, advisors and investors (read below for more details on the vesting schedule of these tokens). Out of these 25M, 10% is reserved as options to be vested by key employees that join Balancer Labs

5M for the Balancer Ecosystem Fund. This fund will be deployed to attract and incentivize strategic partners that will help the Balancer ecosystem grow and thrive. BAL holders will ultimately decide how this fund is used over the coming years.

5M for the Fundraising Fund. Balancer Labs raised a pre-seed and seed round. This fund will be used for future fundraising rounds to support Balancer Labs' operations and growth. BAL tokens will never be sold to retail investors.

0.435M was minted for liquidity providers of the first 3 weeks of liquidity mining as described above. Every week another 145,000 BAL will be minted and distributed to liquidity providers.

The remaining BAL will be distributed with the current schedule:

- 145,000 BAL per week, or approximately 7.5M BAL per year

- BALs could keep being distributed to liquidity providers for about 8.6 years before reaching the cap of 100M BAL.

- Do note that BAL token holders can alter the distribution schedule via governance if they deem fit but for now, the above stands.

So far the amount of COMP distributed to users:

Weekly Distribution

145,000

Total Distributed

870,000

Remaining

64,565,000

Current Holder distribution

0.1 - 1 BAL: 780

1 - 10 BAL: 1149

10 - 100 BAL: 1141

100 - 1,000 BAL: 378

1,000 - 10,000 BAL: 124

10,000 - 100,000 BAL: 47

100,000 - 1,000,000 BAL: 61

1,000,000 - 10,000,000 BAL: 5

Majority of BAL still lies in whales/Balancer wallets. Holders in the lower bracket (non-whales) are increasing... but it's a struggle for Balancer's decentralization as these most of these holders don't stay long. You'll notice on the chart above that with each BAL distribution, holders from these brackets just dropped off. Indicating that they were there merely for a mine and dump.

Which is somewhat understandable given that there's no proper governance system in place like Compound where BAL holders can propose, vote or delegate to action importance changes to the protocol. Currently, the team serves as the governance system (which isn't ideal), hearing out the community and having discussions on a daily basis to better the protocol.

Yield

Like Compound, yield continues to drop over time. This is largely due to the lack of a governance system that encourages "skin in the game" and the same rewards going to stablecoin/soft peg that doesn't carry the same risks as other altcoin pools.

Currently BAL holders have little to no reason to hold BAL so each every weekly distribution adds to the sell pressure and thus driving BAL's price lower and in turn, the Return on Liquidity (RoL).

For comparision, a LP providing $10,000 USD liquidity for a 50% MKR 50% WETH pool had a RoL of 45.12% just last week. The same LP would only get a RoL of 32.3%.

To keep up to date on what's the latest APY, refer to this.

The lack of a strong usecase for BAL at the moment will likely see its value continue to decline. While LPs are only only seeing yields drop, the ones that got rekt badly are the speculators that FOMO'd into BAL during the DeFi craze, probably benchmarking it to the marketcap of Compound.

That said, the team is heard the community loud and clear.

They will be moving forward with a carbon voting page to allow voting on proposals relating to soft peg, balFactor and change in feeFactor, all of which will influence the behavior of liquidity mining participants and the price of BAL.

This is a good initial step forward as Balancer goes through its teething pains, hopefully in the long run, both the team and community comes out better.