Supercharging a crypto portfolio with DeFi

With the DeFi craze going on, it's getting harder each day to ignore the yields and strategies one can integrate to a crypto portfolio.

Take a sample portfolio allocation of

40% BTC

30% ETH

20% Altcoins

10% Stablecoins (For buying dips!)

Most of the time, people just buy and hodl for the long run, leaving the cryptoassets in the cold storage and do nothing with them. Some might have an occasional rebalance but that's about it.

With DeFi though... now it's possible to make the cryptoassets in a portfolio work harder...much much harder and with pretty decent yields!

In this insight, we'll be exploring the various DeFi protocols available and how they can be utilized.

As always,

Disclaimer: Information shared here is for educational purposes only and not financial advice.

Risks involved

It's important to note that DeFi is pretty nascent there are very real inherent risks involved:

- Smart contract exploits/bugs/hack

- Collateral getting liquidated

- Stablecoin de-pegging

Let's begin!

COMPOUND

Compound is a money market protocol that enables the lending and borrowing of cryptoassets. So instead of just hodl'ing ETH in your cold wallet, you can now earn yield by lending it to the protocol and still maintain a long position. Meanwhile, shorters can now look for an alternative source of liquidity for their asset of choice by borrowing from Compound.

Total value locked: $672.6M

The yield

Each day 2890 COMP tokens ($567,360 USD at current COMP price) are distributed to suppliers/borrowers on its platform. However, not all assets on Compound yield the same.

Currently, DAI yields the most COMP returns due to a recent governance proposal and the Maker community have expressed their concerns.

For comparison, supplying

10,000 DAI gives a 14.13% net APY

10,000 USDT gives a 6.37% net APY

100 ETH gives a 1.47% net APY

The above APY is inclusive of net interest earned by supplying and mining the COMP token. It is important to note that APY is not constant and fluctuates depending on asset demand & supply, price of COMP and any governance changes to the protocol.

To calculate yields on Compound, use this.

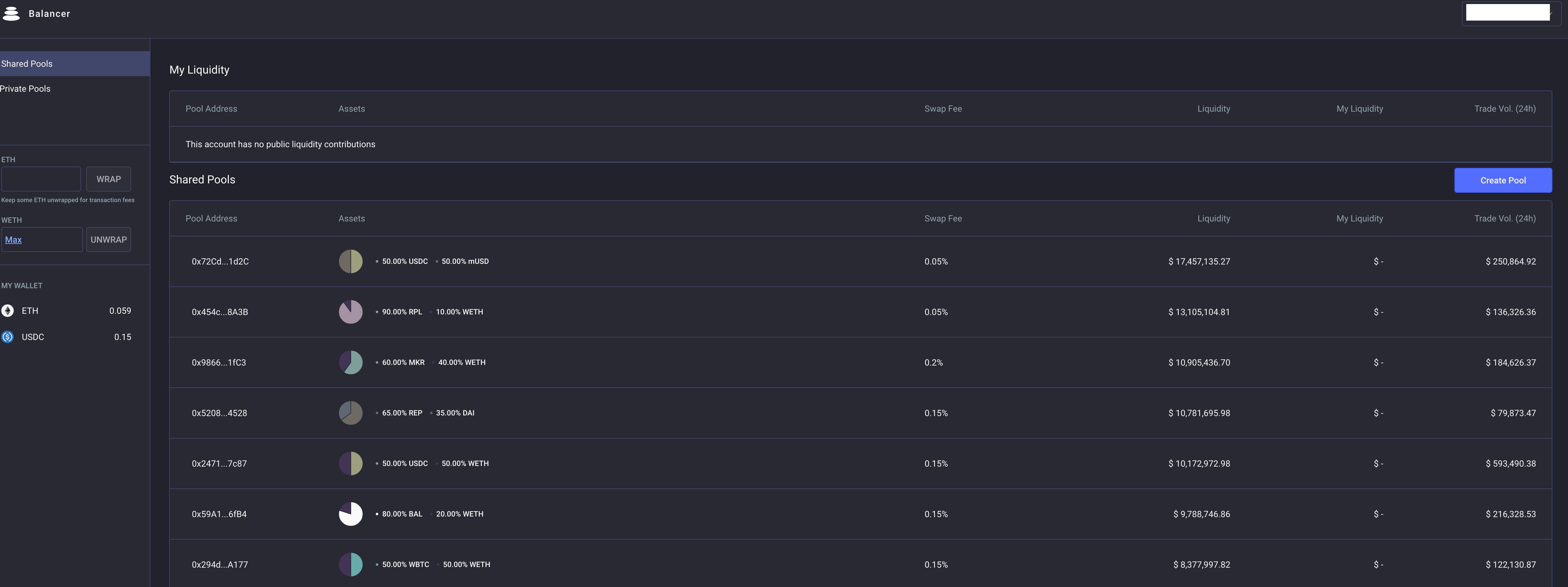

BALANCER

Balancer is an automated portfolio manager, liquidity provider (LP), and price sensor.

While it's similar to Uniswap, its ability to allow liquidity pools to customize weighted assets outside the usual 50/50 allocation. This combined with liquidity mining for the BAL token makes it more attractive to use over Uniswap (No token).

Total value locked: $158.8M

The yield

Each week, 145,000 BAL tokens ($1,493,500 at current BAL price) are distributed to LPs. Currently in its 5th week, a total of 725,000 BAL have been distributed since BAL was made available for mining.

On top of liquidity mining, LPs get a share of the trading fees in the liquidity pool as well.

Following a recent exploit and other whales' attempt to game the platform, the Balancer team have introduced a token whitelist and a $10M cap eligible liquidity per token for BAL distribution.

Each liquidity pool is different and yield varies dependent on several factors.

Ideally LPs looking to supply to a pool should have the corresponding assets ready. E.g In a MKR 60% WETH 40%pool , LP should have MKR and ETH. While it's possible to supply a single asset, Balancer will still split the single asset accordingly to match what is required for the trading pair in the background. This may result in slippage costs (depending on size)

The Return on Yield for supplying $10,000 USD worth of liquidity to a MKR 50% WETH 40% pool is currently 45.12%.

This makes Balancer one of the best yields out there at the moment. However, it is important to consider impermanent loss where one might be better off hodling or lending it out the asset instead of being a LP.

To work out the yields, use this.

CURVE.FI

Similar to Balancer and Uniswap, Curve.fi is an exchange liquidity pool but it is mainly focused on:

(1) extremely efficient stablecoin trading

(2) low risk, supplemental fee income for liquidity providers, without an opportunity cost.

This makes it the best place to swap stablecoins (lowest slippage) in the DeFi space.

Total value locked: $62.4M

The yield

The CRV token has not been released yet as the team is fine-turning some details and plan to launch the distribution sometime later this month if all goes well.

According to the team, liquidity providers on Curve will be awarded CRV retroactively from day 1 based on how long and how much they have provided liquidity to Curve.fi for. The plan is to have the initial supply around 1b with inflation taking it to a total supply of 3.03b.

So currently, liquidity mining on Curve.fi is purely speculative - betting that it'll be worthwhile once the token is traded on any of the DEXs.

That aside, anyone with spare stablecoins lying around can look forward to the yields for various liquidity pools below:

Conversations (0)