22nd of April was a busy day for CRV

One of the most prominent characteristics of On-chain analysis is the fact that it gives you the ability to monitor Whale activities. in this insight I try to use this feature in order to find a proper opportunity and a relatively low risk price zone based on the following metrics and indicators.

On the 22nd of April we can see a clear spike in the indicator. there were 23 whales involved in this spike. the spike happed at $2.57 , so we can consider this price as an interesting price zone for the so called whales to do some trading. yet we don't have any idea about the fact that whether they were buying or selling and thats when we need to expand our analysis to other indicators and metrics.

at the same day we can spot an outflow from the exchanges. By now it is more probable that the whales transactions were on the demand side of the game.

this metric is in a gradual descension which is an indication of taking less and less profit taking happening on the network. potentially this is a good sign, because the investors are more eager to hold their assets. they can be a hodler of CRV or some under water investors that don't find the proper opportunity to sell. in the following metric I'm going to check the mid-term investors condition by using the MVRV ratio(60 days). you can monitor the other tiers of investors by using Sanbase platform.

According to this metric, historically there is a relatively high possibility for mid-term investors to take some profit out of CRV market, so it is a bit risky to think about opening a position. let's consider some other metrics and indicators in order to measure the risk a bit further.

The funding rate in the following exchanges are negative. when there are some spikes in the negative areas of this indicator, we can consider this as a good point cause it makes the probability of a potential bounce back.

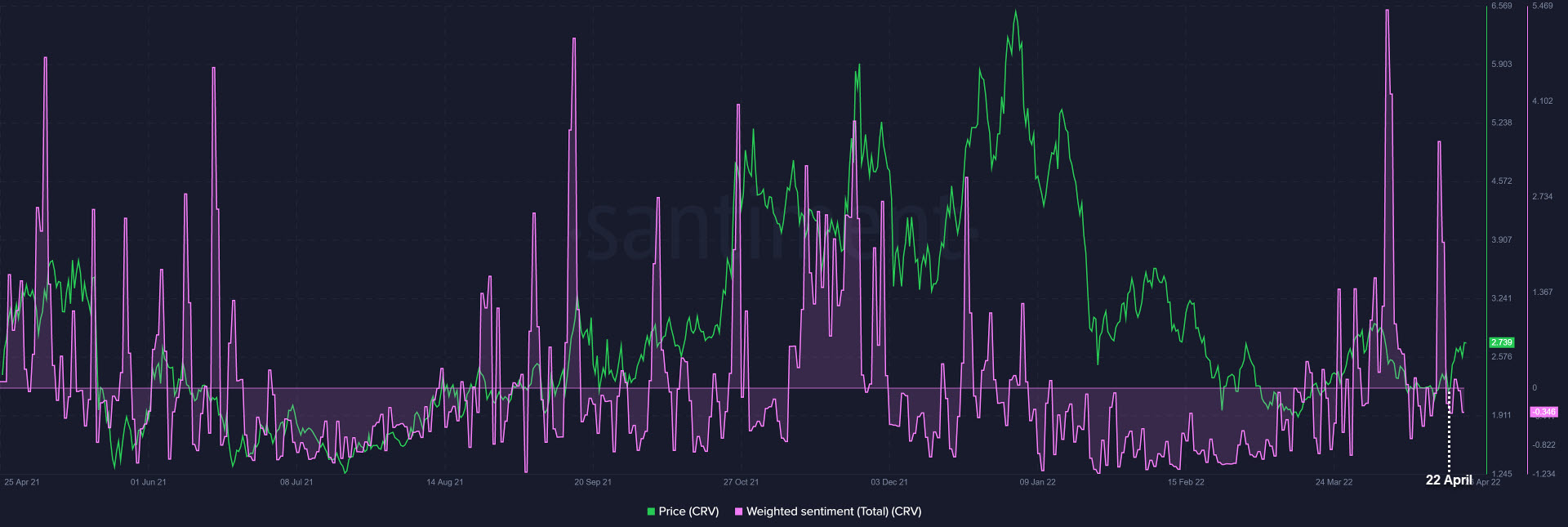

CRV attracted relatively high attention on April 20th and two days later the weighted sentiment experienced a decline to the negative areas and settled within. Surprisingly or not, the following whale transaction that we already talked about, happened on the same day that the weighted sentiment entered to its negative zone when the price was ranging at $2.57. technically or let's say On-chainically due to the reasons that we talked about, the mentioned price is a relatively proper entry price with your own risk management.

#Not_A_Financial_Advise

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from Alerzio!

Get 'early bird' alerts for new insights from this author

Conversations (0)