YFI. A new ways of DeFi utilization

Assets covered: YFI

Metrics used: Amount held by top non exchange addresses, Coin Supply on Exchanges, Mean Coin Age, Age Consumed, Network Profit/Loss, Daily Active Addresses, MVRV, Exchange Flow Balance

Summary: Making profits on bleeding markets becomes easier thanks to DeFi protocols

After market has crashed that far now it's good time to earn the other way around, by selling (shorting). Available now in completely decentralized way, with enough liquidity.

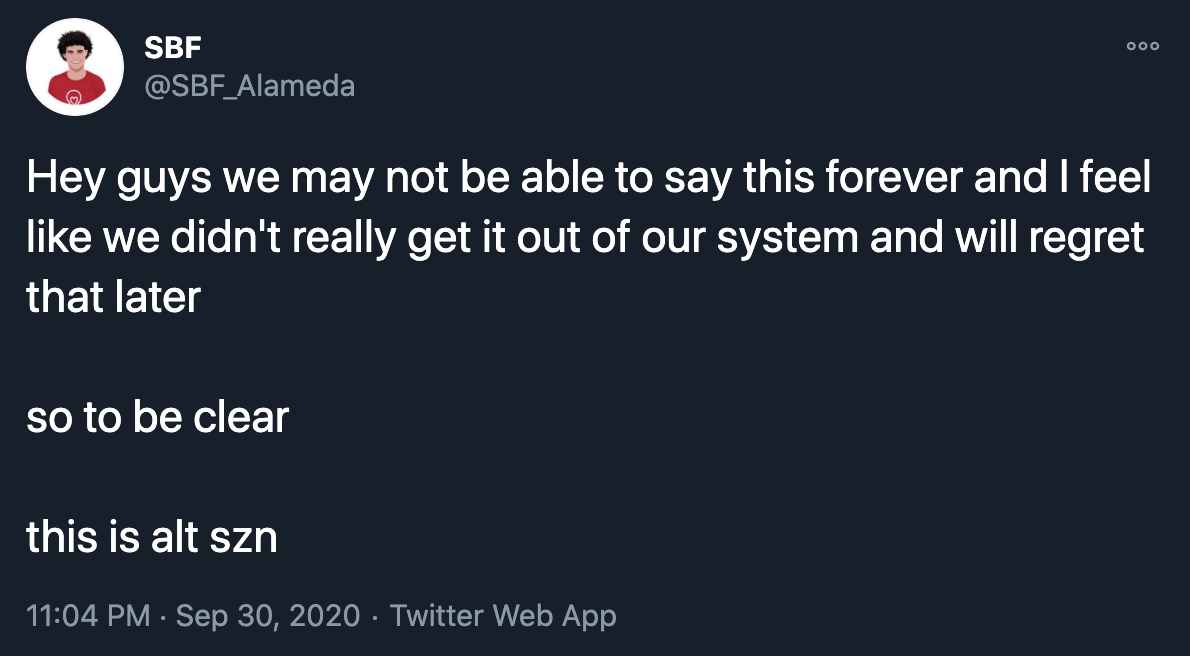

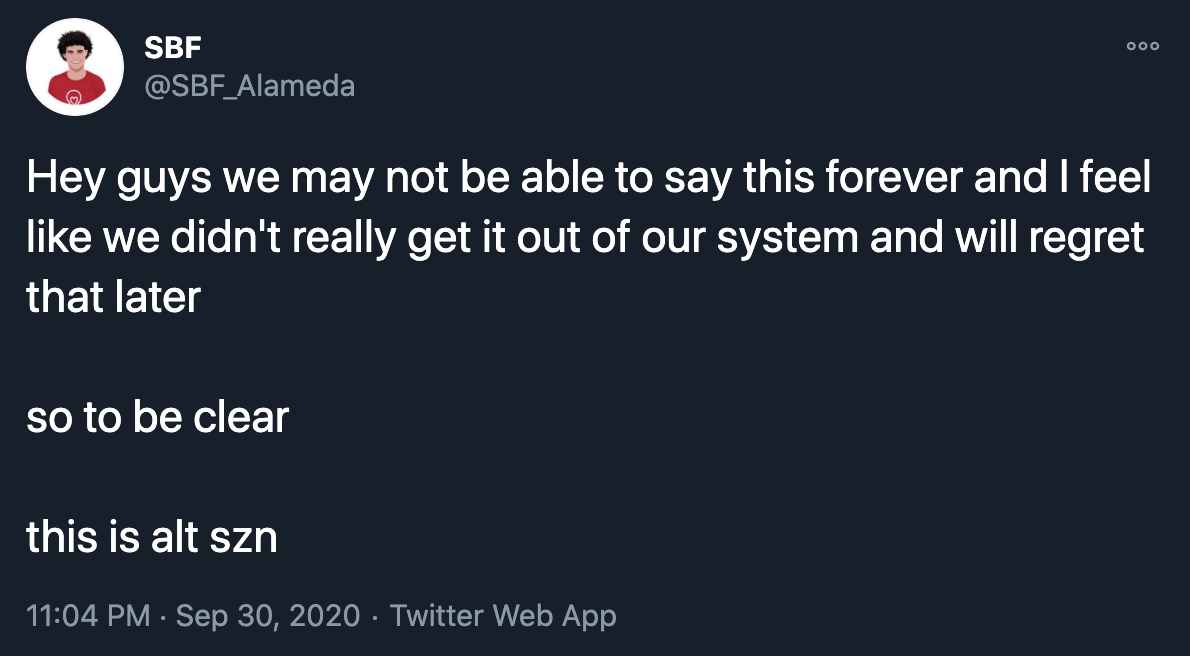

Let's say we are SBF Alameda and looking for profitable trades on this market.

What should we do.

Step 1.

Alts go down.

Step 2.

Borrow bleeding YFI

Namely deposit funds to Cream and use it as collateral to borrow YFI:

Step 3.

Sell YFI on Binance (18,000 USD each token).

Step 4.

Wait for YFI to go down enough:

Step