Who Woke Up Crypto?

After starting off 2023 hot, it had been beginning to look like crypto was headed for another slump. From the April 14th Bitcoin price top until June 14th, the top asset declined a staggering 19%. And the crowd was beginning to get quite concerned, for obvious reasons.

To compound things, two of the top exchanges in crypto, Binance and Coinbase were under serious fire to open up June, thanks to some unfortunately timed news that the SEC was suing them both for illegal securities trades in the US. With the FTX debacle still fresh on many traders' minds, we began to see coins leave exchanges.

But over the past week, market caps have absolutely exploded throughout cryptocurrency. And this is mainly due to exposure from many new entrants pouring into the crypto space like it's 2021 all over again.

But why? Well, almost out of nowhere, we began to hear some positive news regarding Blackrock's rumored pivoting direction on the crypto markets. And this news wasn't just them becoming more optimistic... they wanted to offer a full-blown ETF. And before we knew it, the ETF announcement was official.

At first, the internet was quick to meme the company and its CEO, Larry Fink, by pointing out the obvious hypocrisy their stance has had over the years.

But in the past week, several other funds have hopped on board, with at least 10 now announced. And quite frankly, prices have been rising far too rapidly for people to care. When there is money to be made, it can often be a very sudden onslaught of copycats. Blackrock tested the waters, and within just a week, we have been seeing all sorts of new entries come in.

But why exactly are ETF's such a bullish, welcome sign for crypto? Two words: institutional investors. With the emergence of (theoretically) more secure and simple ways for large capital investors to have exposure to crypto without actually having to own any, this has allowed more capital to enter the markets that have been starving for more entrants.

Don't believe me? You can always verify exactly what the upside of the ETF's are by checking in with Santiment's AI Bot, and seeing what it has to say about it on our Discord server:

Other than the great news about ETF's, there are still a few other things that Santiment has been pointing out as bullish signals for quite some time.

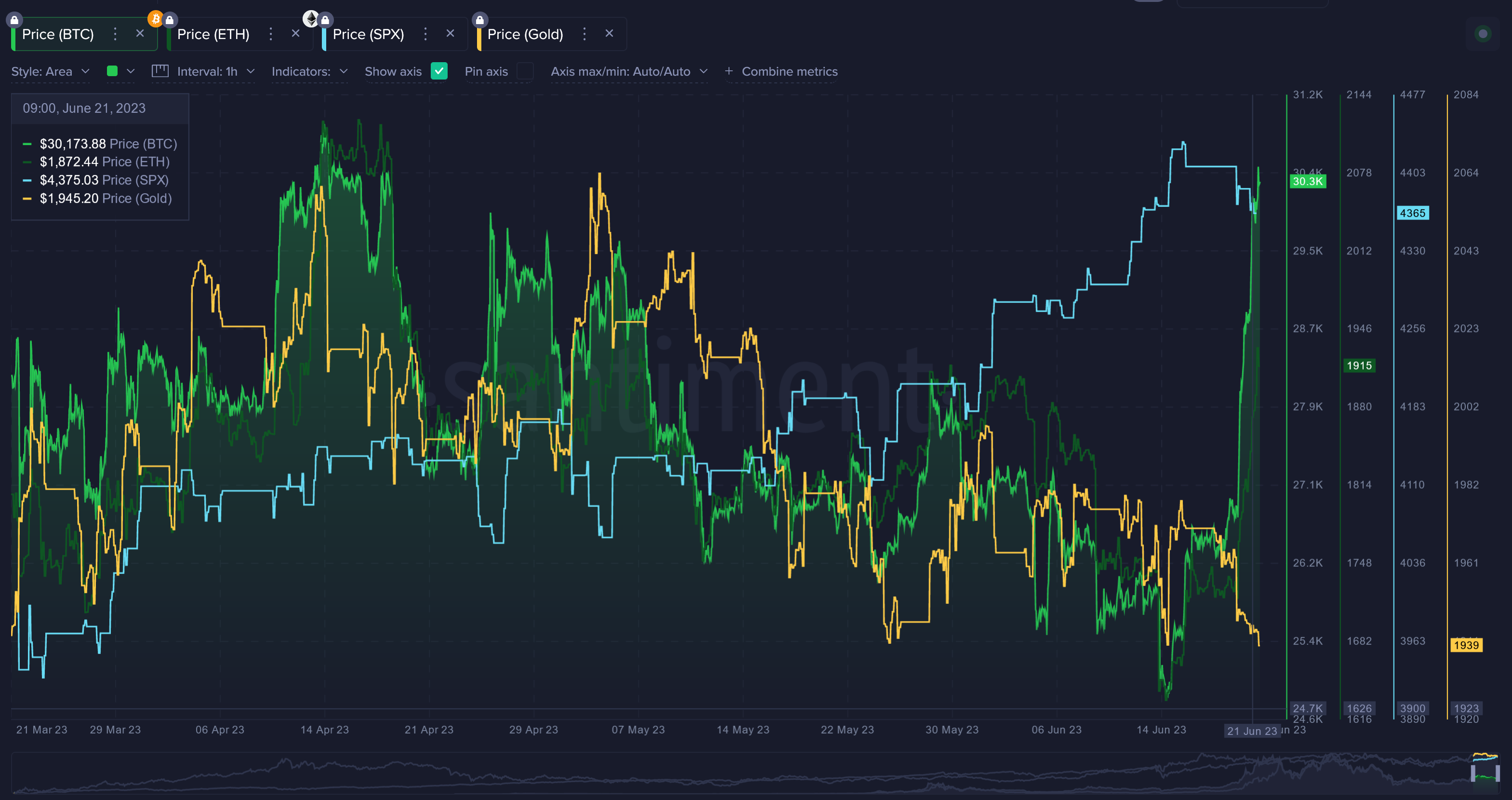

For one, equities had been veering far and away ahead of crypto markets. And considering how closely tied these two sectors have been to one another, there likely would have been a bit of catch-up time even without all of this added exposure for investors.

And we can also see that the average trading returns for mid-term traders are still much closer to opportunity zones than they are to danger zones. Traders are still well under water for most assets, and this surge has caught many off guard as they were taking profit. So even now, there could still be more "meat on the bone".

Regardless of all of this, we still should keep a close eye on the Binance and Coinbase lawsuits. Those certainly haven't disappeared just because of all of this ETF craze. Watch for the crowd getting too euphoric as a sign we may have topped for the time being as well.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.