Whales, debt and liquidations

Assets covered: BTC, WETH

Metrics used: Holders Distribution, Maker DAO Collateral Liquidation Amounts, DAI created (Debt Created)

–50% from all time high. This is where BTC is now. Quite frightening, right?

Meanwhile there is a couple of optimistic signs we'd like to share.

1. Bitcoin whales behavior

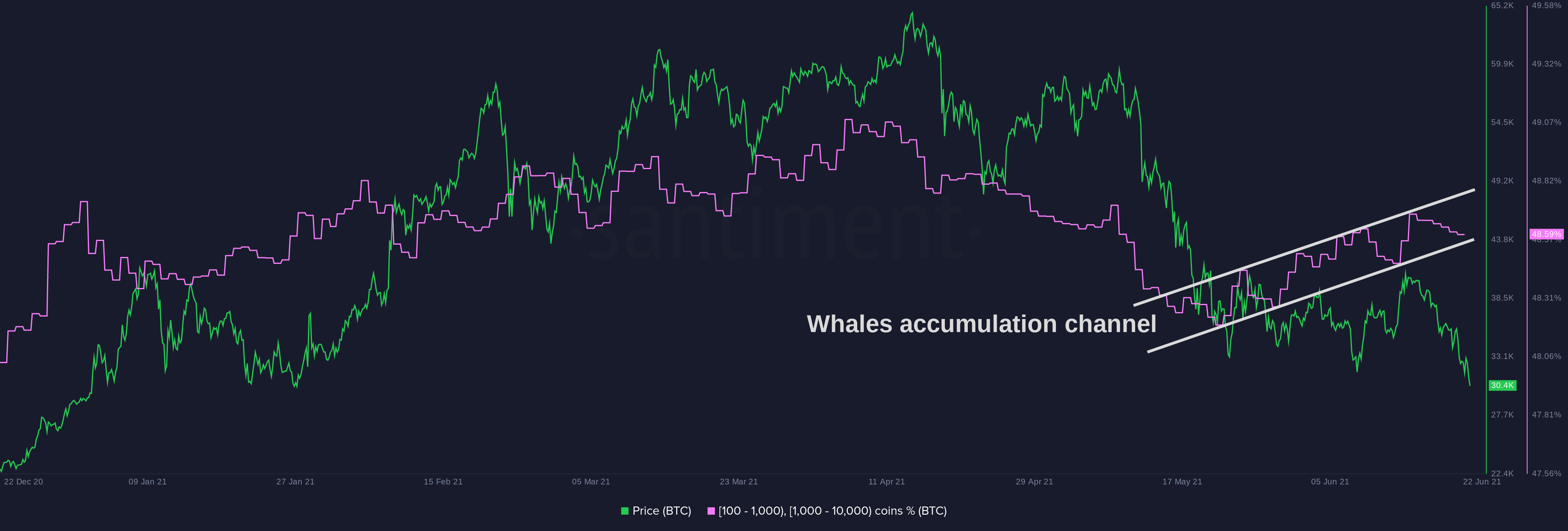

We are watching closely a group of BTC whales holding between 100 and 10,000 BTC. It's more than retail and less then exchanges. Say, BTC investors. And they keep buying:

We can see that the whale trend is continuing to be accumulating. Over the past couple of days it hasn't been, but since the start of the crash they've been moving up. They could afford to be early and that seems what they are doing.

The support line is not broken. They are buying. They are fine