Whale Watching to Help Your Portfolio End the Year Strong

What is the 'Smart Money' doing as cryptocurrencies have fluctuated in a big way around the holidays? Which group of whales appears to be accumulating to end the year, and which ones appear to be dumping their bags on the smaller, unknowing traders? We've highlighted three projects with accumulating whales (in their key respective high stakeholder trading address size tiers), and three with dumping whales below:

⬆️ Increasing Number of Whale Address

Crypto.com ($CRO) - 100k to 10m CRO Address Holdings

Crypto.com has been one of the big gainers, and the major purchase of the naming rights to Los Angeles' sports arena has likely had a ton to do with this. If you've kept up with the news on this, you've likely been handsomely rewarded.

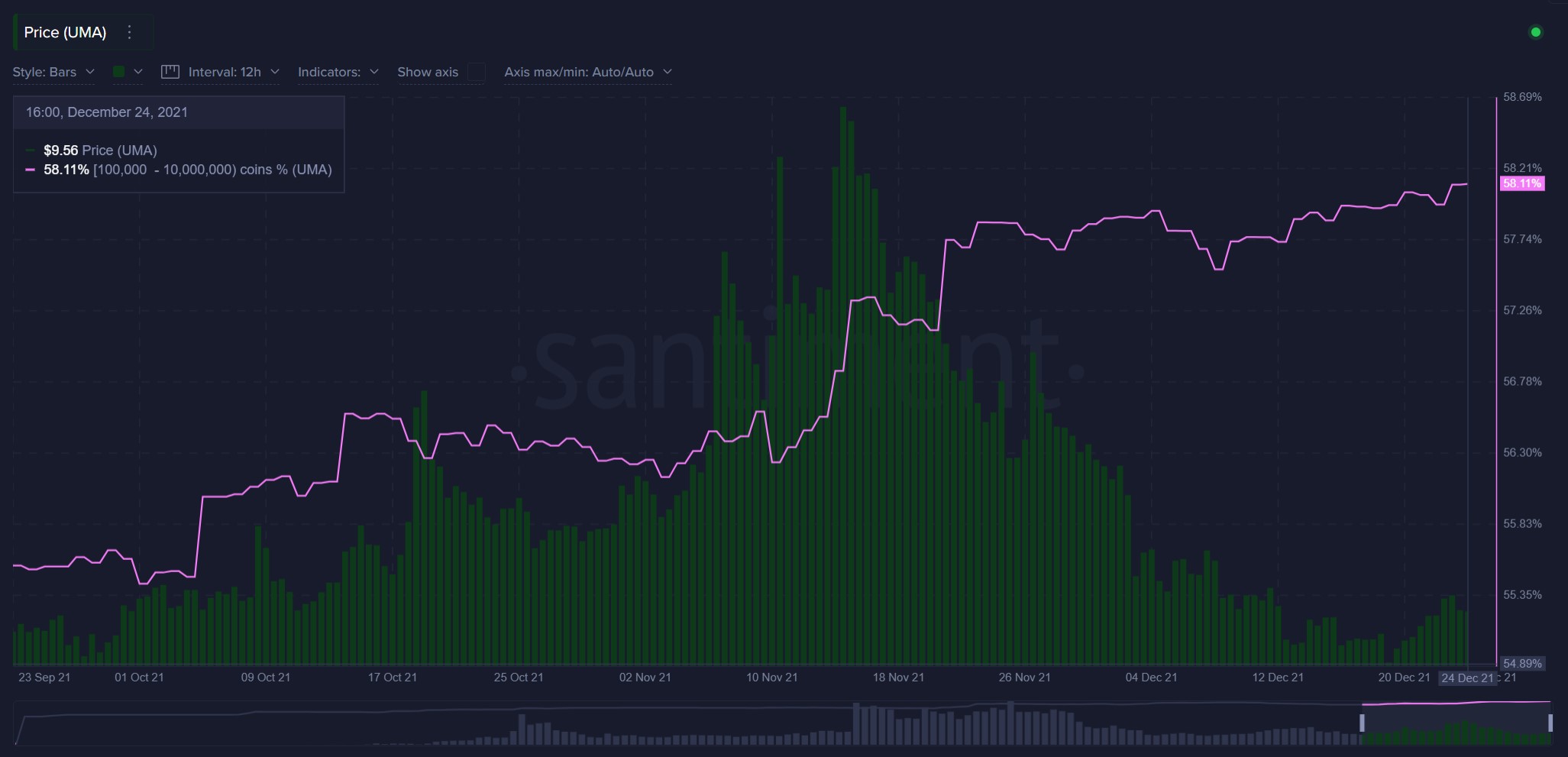

Uma ($UMA) - 100k to 10m UMA Address Holdings

Uma has plummeted -53% since its major local top six week ago, yet the key large stakeholders for the ETH-based project have continued to add more to their bags. When a price drop like this occurs, but large holders have actually ADDED +2.3% more coins to their bags, its a promising sign that it can pump when markets begin to turn positive.

Uniswap ($UNI) - 10k to 1m UNI Address Holdings

Uniswap is one of the key defi projects that really saw a great surge in the early half of 2021, but fell off in the later one. In spite of the correction, large addresses have only been adding more and more to their bags, with +4.1% more held in December alone.

⬇️ Decreasing Number of Whale Address

Synthetix ($SNX) - 10k to 1m SNX Address Holdings

Synthetix's 10k to 1m addresses have really stayed tight knit to its price, and is one of the better leading indications for an asset, based on our research. They have dropped -18.5% of their coins in the past 7 weeks.

Aave ($AAVE) - 100k to 10m AAVE Address Holdings

Although Aave is on our 'declining' list, you can see that its price has enjoyed a nice reprieve in the past week. With it, its 100k to 10m key stakeholder category has shown some accumulation signs. However, the price spike (+50%) has outgained the more mild accumulation signs from these whales, keeping us still a bit concerned.

Augur ($REP) - 10k to 1m REP Address Holdings

Augur's whales have shed about -5% of their holdings in the past three months, which is quite concerning when prices haven't really shown many encouraging signs as of yet.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.