Welcome to crypto, Zuck: Facebook's Libra coin already facing regulatory scrutiny

All eyes in crypto are still on Libra, Facebook’s much-rumoured stablecoin that was finally and officially announced Tuesday, as you can tell from our list of top 10 trending words on crypto social media today:

If you’re still catching up on the news, check out our previous write-up on the basic structure and underlying mechanisms of Facebook’s new coin, as well as some first (profanity-laced) impressions from around the cryptoverse.

And while it’s only been roughly 24 hours since the big reveal, Libra has already met the #1 bane of many of its crypto cousins - the unsolicited attention of government officials and regulatory bodies.

A medley of European bankers and politicians have already chimed in on Facebok’s foray into crypto, with noticeably less optimism compared to the company’s press release.

In an interview with Europe 1 radio, French finance minister Bruno Le Maire said that “It is out of question” that Libra “become a sovereign currency. It can’t and it must not happen.”

Markus Ferber, a German member of the European Parliament echoed Le Maire’s sentiment, warning that the company could become a ‘shadow bank’ and calling for institutional oversight:

“Multinational corporations such as Facebook must not be allowed to operate in a regulatory nirvana when introducing virtual currencies,” said Ferber.

While perhaps not as stern, Bank of England Governor Mark Carney also called on G7 members to pay attention to Facebook’s new endeavor:

“Anything that works in this world will become instantly systemic and will have to be subject to the highest standards of regulation. We will look at it very closely and in a coordinated fashion at the level of the G-7, the BIS, the FSB and the IMF. So open mind, but not open door.”

And as the governments of Europe are putting Facebook on notice, the crypto crowd is still having heated discussions about all things Libra.

While the general sentiment seems to lean heavily anti-Libra at the moment, not everyone’s giving the stablecoin a pinkeye. Here are some of the many similar Telegram comments:

- cryptos dead , libra won 😄

- libra has 28 billion companys behind them. xlm and omg are basically dead

- why give libra a stage? should ban libra

vs

- libra will be the best thing to happen to bitcoin is what I think

- LIBRA INVESTMENT TOKEN WILL MAKE BTC GET TO 45K BY MARCH 2020...

- libra can threaten central banks though

- If just 1 in every 10 Libra users realize they are losing their purchasing power of Libra when they don't park it in BTC instead it'll pump BTC 5-10x already if FB is able to turn 5-10% of its active users into Libra users

Over on Discord, a similar dichotomy of opinions is emerging:

- libra is what btc wanted to be

- libra is to $$$ what email is to postal service

- everyone uses Libra in the future

vs

- The way things are looking..Libra isn't even gonna get off the ground.

- Why don't we stop talking about Libra now

- LIBRA is a polished version of the past BTC is the future

And finally, the reddit community has spent most of the past 24 hours trying to make sense of the Facebook news, with varying results.

While some have turned to compiling a grocery list of anti-Libra arguments:

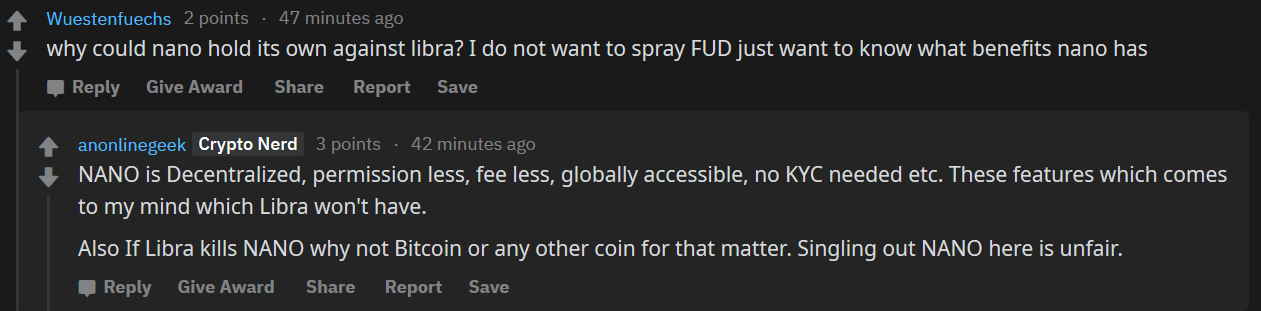

Others are already debating which coins Libra could make obsolete, featuring Nano:

Eos:

...and a few others.

That being said, however, not everyone’s boarded the Zuck-bashing train.

Many see value in Libra’s potential mass adoption, and a net positive impact on everyone from underprivileged communities worldwide to the crypto industry itself:

As it stands, it seems that the proverbial jury is still out on the Libra coin. And judging by Europe’s initial reaction to the news, the actual jury might also be in the cards.

Conversations (0)