UNI - Perhaps it's time to chill

Assets covered: UNI

Metrics used: Price, Social Volume, Coin supply on exchange, Dev Activity

Summary:

UNI's been on an impressive rally that really accelerated over the past 2 weeks. Now that it has hit $20 USD, is the local top in?

Let's take a look at how things are.

DEX volumes and number of trade

Uniswap continues to be the market leader in the DEX category, dominating both Volume and number of trades.

This traction doesn't seem to be slowly down either as more market participants enter. It's important to note that this is happening with no yield farming incentive either as it ended in September 2020.

That said, it can be switched on again by governance, should the community vote for it.

The closest competitor would be Sushiswap and you can read more about a recent comparison of the two here.

A price/volume divergence is observed with the recent rally, indicating weakness in the rally and a price reversal might be happening soon, setting in place a local top.

UNI's social volume has spiked to its highest in 3 months, indicating that the crowd is getting rather excited and naturally so, given the crazy rally before them.

As usual, the crowd tends to FOMO in at the top, suggesting that this might be a local top is forming for UNI.

Looks like the UNI team was very very busy during mid-late December 2020, seeing the highest spike in Dev activity since it launched.

Interesting to note that shortly after the dev activity spike, it signalled the start of the UNI rally. Something's cooking and speculators sure got the scent of it.

So what could it be? Perhaps the much anticipated Uniswap V3?

Whatever it is, there's consensus so far that it is likely so. Chatter around "Uniswap V3" also saw increased mentions lately, suggesting that the market is pricing in this release.

Some keen eyed twitter folks also noticed that Uniswap had a nice Twitter handle and a new landing page, adding further speculation to the V3 rumours.

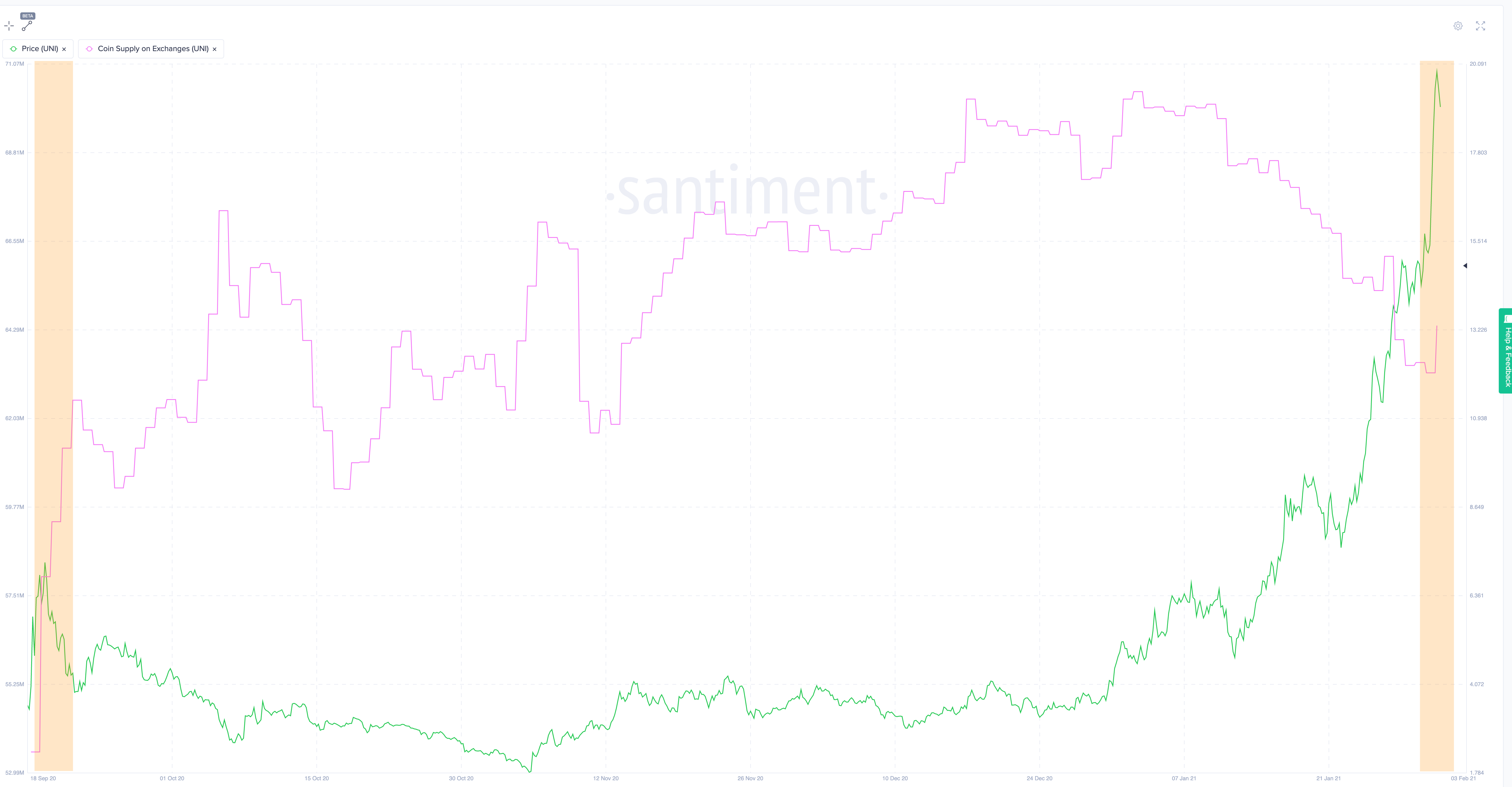

UNI's coin supply on exchanges been steadily decreasing since Jan 10th 2021, suggesting that market participants are buying it up for hodling, thereby relieving any sell pressure.

With the recent price rally, we are seeing a spike in Coin supply on exchanges, this should act as sell pressure for now but the next few days should show us a clearer picture of how things will do.

Price tends to dip following any sharp spikes up in Coin supply on exchanges as observed in the past.

Going forward

Market participants are pricing in the rumours of Uniswap V3's release, given that it could released at any time in Q1.

A temp top might be forming as the crowd FOMOs in and some market participants sending their UNI to exchanges.

Given the rise in UNI's price, the community treasury is now a very sizable one (it was previously $500M). It should be more than $1Bn now at their disposal.

What it'll eventually be used for though is still up for discussion as Founder Hayden Adams recently engaged the community on what to do with it.

Once the warchest is active, we should also see more UNI circulating, which should also result in some sell pressure eventually.

But for now, the market will have to work with 28.7% (circulating atm) of the total supply.