Under the bottom. What could majors do

Quite a few alts broke the last bottoms.

For example, REN:

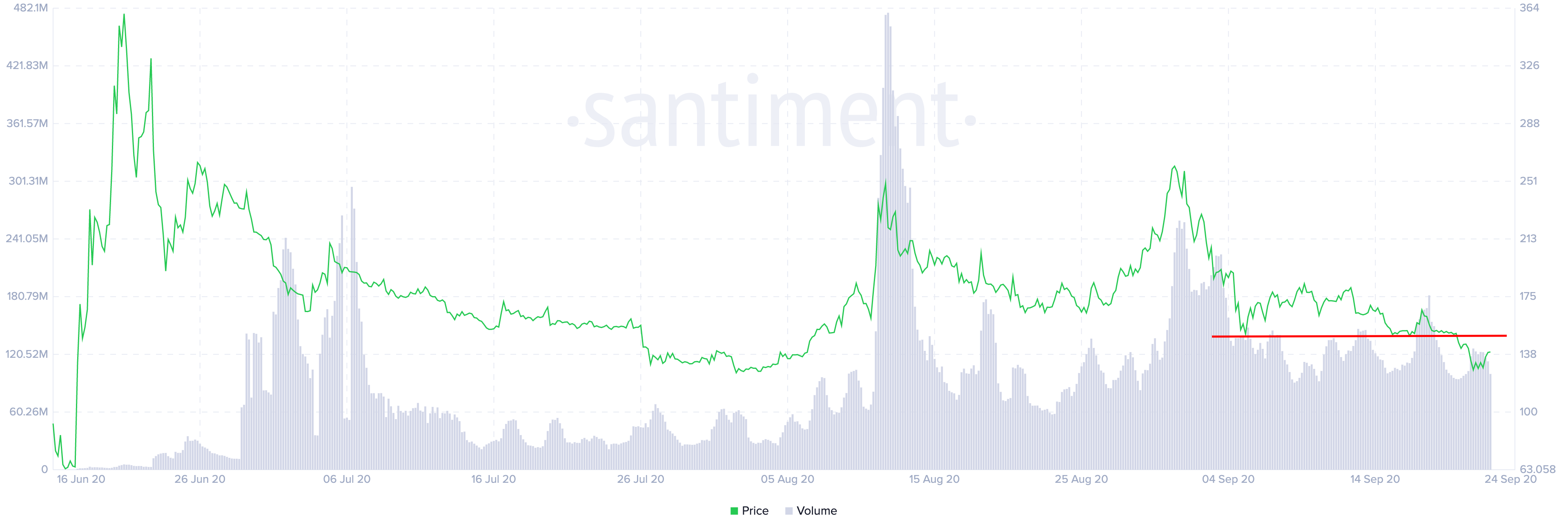

Or ZRX:

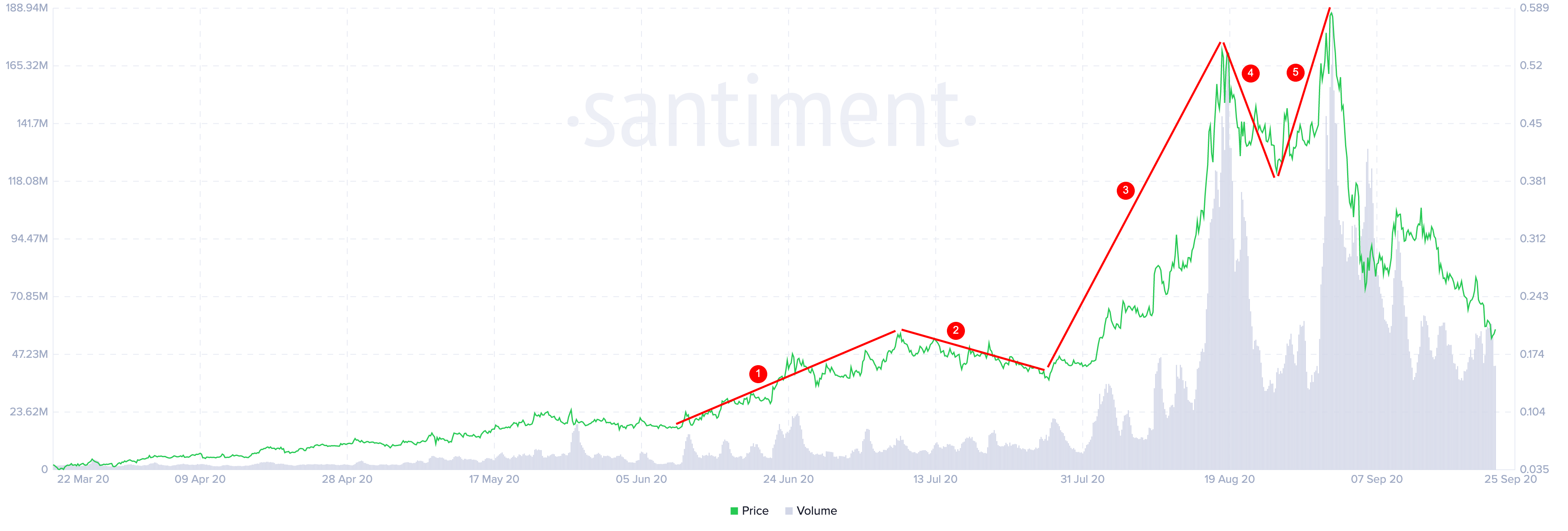

Or even COMP:

The key question now is

Will majors (BTC and ETH) follow the pattern?

The price structure (and behaviour of the main on-chain and social metrics) allows both rebound and the further decline.

When we look into the whole picture, however, then we notice few interesting things.

Alts are by definition more risky. That means more volatile, move faster (and earlier). They've made the push to the new low already.

BTC and ETH are now open to follow.

If we look at REN again, the pattern is pretty clear and a good example of when one can try to buy the lows:

Price is declining, yet the speculative activity is declining too (in this chart we've placed CEX volumes and on-chain "speculators" activity") this is so called "behaviour divergency" we often use it to catch the tops but it also works to catch the bottoms.

REN also shows "the full 5 cycle growth pattern". This is basically:

1. Growth (low volume), then correction;

2. Growth (explosive volume), then correction;

3. Growth (stagnating volume) - top.

For those familiar with Elliott Waves, it's called the 5 waves impulsive move.

We had to adjust the initial Elliott Waves theory quite a bit for the purpose of valuating cryptocurrencies. At Santiment, we tend to rely on behavior analysis more than the standard Elliott Waves, but the fundamental concept is very similar: everything moves in cycles, and these cycles have their own signature patterns.

In this case, the two questions you want to ask yourselves are:

1. Has the coin completed the full 5-cycle pattern before (like in the case of REN)?

2. Is there a clear "divergence" between the coin's price and its on-chain activity materializing since?

When both answers are "yes" - it could be a good time to look for an entry position.

Conversations (0)