Trader Sentiment Shifts After Prices Plummet

All traders, regardless of level of experience, are susceptible to emotion. And when big swings occur in either direction, this can often result in irrational behavior and presumptions about where markets go next.

In this 15 year-old sector, sentiment still drives markets as much as ever. So what has happened following the Bitcoin drop to $26.1K, and subsequent altcoin bloodbath? Let's take a look at some of our top indicators for these circumstances:

For starters, it's no surprise that we saw a huge rise in "buy the dip" mentions. This indicates that trader optimism was quite high that there would be a quick market recovery. But looks at how the wishful thinking has died down considerably in the past few days.

Believe it or not, it's a good sign that people are no longer certain that this is a dip buy spot. It means that pessimism is beginning to take over again as market caps fade.

And if we break down the dip buy mentions by social platform, it looks like Reddit is overwhelmingly the community that had the biggest consensus on prices recovering quickly. Even now, they are still a bit higher than others. Twitter had a small spike, but has essentially dropped back to neutral on their optimism.

When all four social platforms align and have settled back down to neutral mentions of buying the dip, this is when the actual opportunity has historically presented itself for patient traders.

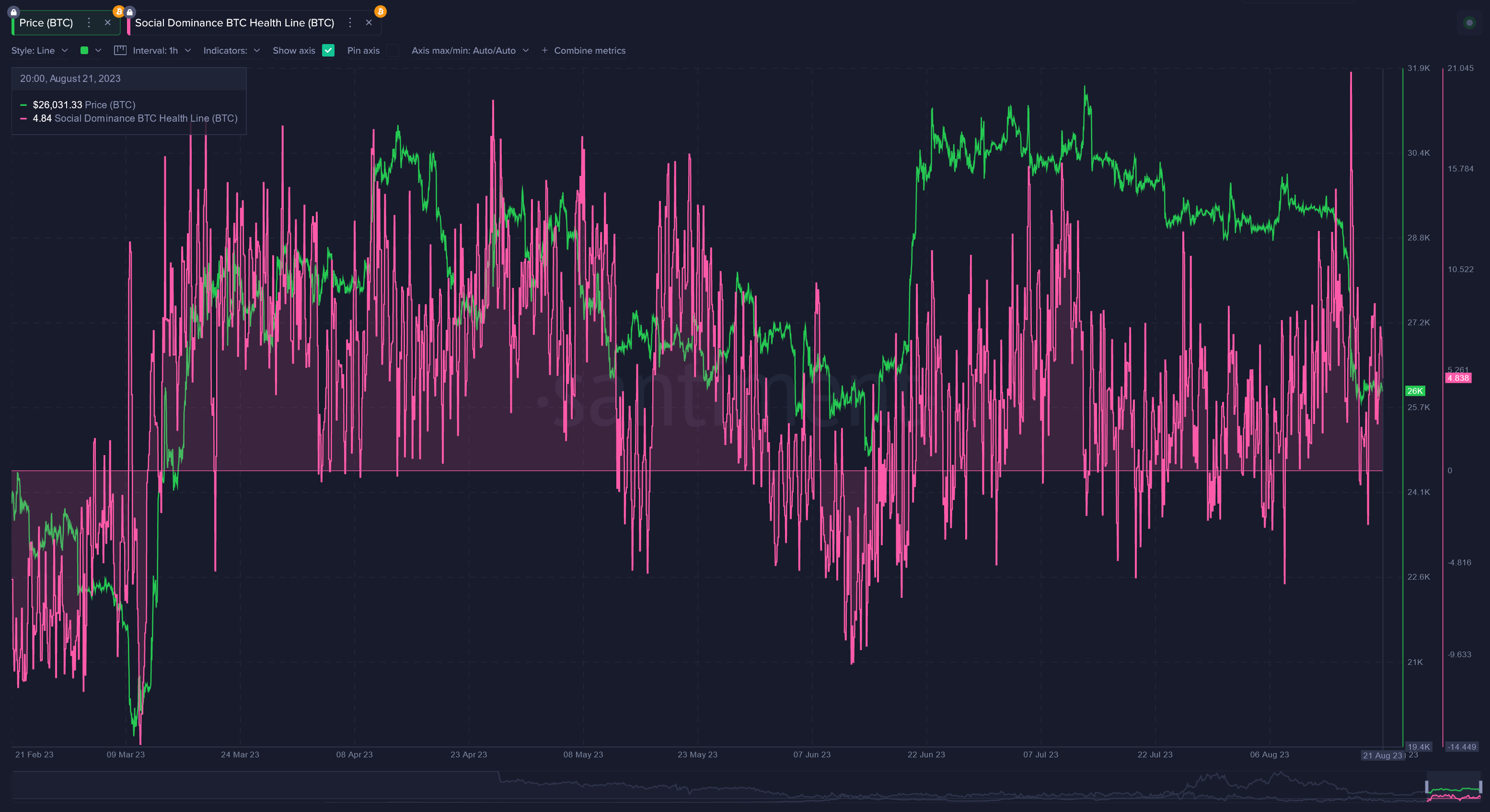

We can also see that the percentage of discussions related to Bitcoin spiked to its highest level of the year on the tail end of the market crash. However, instead of BTC social dominance staying high, it has quickly dropped back down to relatively normal levels as traders appear to be showing some "greed" in relation to whatever the hot altcoins on the block are currently.

We would actually like to see Bitcoin social dominance stay quite high, as this scenario is usually correlated with thriving and healthy crypto markets. High discussion related to the #1 asset coincides with fear, whereas discussions about more speculative assets tends to coincide with greed. Fear is when markets rise.

As far as average trading returns go, swing traders are feeling the most pain they have since early March. With average 30-day returns of -8.5% among active addresses, this is a strong sign that we are in a less risky spot than usual to add on to our positions.

However, we still need to be mindful of the fact that long-term 365 day active traders are still slightly in profit at +5.2%. When both the short and long term MVRV's are in the negatives together, as they were in early March, this is a very strong bullish signal.

Lastly, in terms of whether traders are "putting their money where their mouth is", it's actually quite encouraging to see that there are a large amount of shorts that remain open on exchanges right now.

The most we have seen in over 3 months is resulting in flat price returns thus far. But more often than not, there can be a rise to scare away the shorts and neutralize funding rates the longer traders try to profitably bet against markets.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.