Top Social Gainers for Wednesday, June 5th, 2019

Here are Wednesday's biggest developing stories in crypto based on Santiment's social media data:

- Kik/KIN/SEC/Complaint (900+ combined mentions in last 24 hours):

The biggest story in crypto today - as so often happens - comes to us courtesy of the SEC. The infamous US Securities Exchange Commission has filed a lawsuit against the messaging app Kik over its 2017 ICO that raised a total of $100 million.

It is the SEC's belief that the tokens issued in the initial coin offering - KIN - qualify as a security, which in turn means that the sale should have been registered with an appropriate government agency. Should the Securities Commission successfully make their case, Kik could be forced to offer the money raised back to their ICO participants.

Going into the legal intricacies of the suit would take ages and should definitely warrant a better source than me. For those interested, I suggest this thread by Jake Chervinsky, a lawyer and popular crypto pundit, as well as this detailed breakdown of the SEC’s case presented by X.

One important thing to note, however, is that Kik has consciously invited the SEC’s scrutiny, even launching a crowdfunding campaign last week to fight the upcoming case, all reportedly in the hopes that “a lawsuit would eventually result in a new Howey test for crypto tokens, to determine which ones are a security.”

The Kik drama spurred intense discussion within the cryptoverse, with half of our today’s Top Social Gainers list relating to the case:

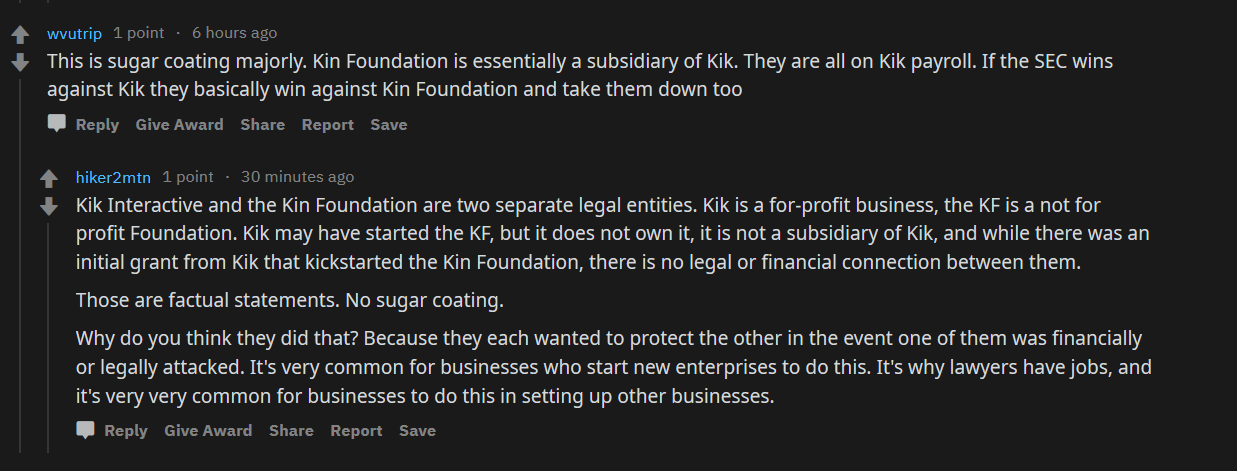

As a result, there has been an immediate and all too predictable uptrend in pseudo-regulatory analysis and half-baked legal arguments on crypto social media today. Here’s a few of my personal favorites:

Looking for a silver lining, some in the Kin subreddit point to the fact that the Kin Foundation has not been personally named in the suit as proof that the SEC is not interested in investigating the Kin ecosystem as a whole:

While others (including Chervinsky) believe this to be mostly a moot point, as it’s likely that the SEC was simply opting for brevity/clarity:

The anti-Kin crowd, on the other hand, claims the lawsuit is about much more than just a failure to register KIN as a security, and was actually prompted by Kik deceiving and/or defrauding their investors:

Again, Jake and a few other experts (including Nelson Rosario, a principal at Smolinksi Rosario Law) seem to disagree:

There were also shouts of selective justice:

...answered by various possible interpretations of why the SEC chose to traget Kin specifically:

Legal exhibitionism aside, some in the crypto community were generally worried about the impact this case might have on the rest of the ecosystem, from specific projects:

...to the ICOs at large:

And while the community is still trying to gauge the potential ramifications of an SEC-favored ruling, some have already declared open season on accumulating KIN:

Looking at KIN’s on-chain data, we can see a couple of significant spikes in Daily Active Deposits - one on May 31st (day after it was announced that Kik raised $5 million to fight the SEC) and another on June 4th, after the lawsuit was announced. It seems increasingly likely that these are both mass panic sells, prompted by the bearish news.

As you might expect, the price of KIN has taken a wallop since the SEC announcement, dropping over 42% in three hours yesterday on its way to a 4-month low. That said, it has actually managed to bounce back since, currently sitting at a clearly deceptive +20% for the day.

- GXS (70+ new mentions in last 24 hours):

It’s been a good day for HODLers of GXChain’s native coin, as GXS (or GXC) spiked 28.5% in an hour’s time earlier this afternoon.

The spike prompted a surge of GXS mentions on crypto social media, and a decidedly bullish sentiment especially on Telegram:

- Gxs towards 2500sat

- GXS another big pump

- Hugeeeee gxs soon 2500+++++

- buy GXS!!

The level of confidence is particularly interesting given there’s disproportionately little talk about the actual cause of GXS’ rally. A few TA enthusiasts drew a potential bull flag formation:

While others pointed to a just-announced initiative by GXChain to buy back more than $5M of their own coin on the secondary market:

“We strongly believe that GXChain has been undervalued” laments the project in their announcement, “so we decided to launch the plan of secondary Market Buy-back of More than 5 Million USD. The plan of buy-back will last for two months. After the plan is completed, the repurchased GXC will locked up for at least 6 months.

Per the announcement, the first round of back-buy is/was to be executed today, “with the GXC repurchasing of $250,000 in the secondary market.”

Those who believe the buyback to be the primary catalyst for the GXS rally have already started fishing for information about the next round on the project’s Telegram:

Whatever the cause, it certainly made for some choppy action on the GXS day chart. Although it retraced soon after the initial pump, the coin has mostly recovered since and is, at least for the moment, still trading in the post-pump range.

- ONE (3500+ new mentions in last 24 hours):

Just six days after it began trading on Binance and Binance DEX, Harmony (ONE) is already following in the footsteps of its IEO predecessors with a massive, seemingly unsolicited pump.

The latest graduate of the Binance Launchpad, ONE spiked over 25% today to reach an all-time (or six-day) high 379 Satoshi. The price action proved a rollercoaster since, with the coin quickly losing 7.5% before bouncing back again.

The crowd sentiment mirrored the price for much of the day, with bulls and bears trading seats based on the momentary trend.

During the pump:

- ONE WILL make you rich data trust me bro

- Buy harmony one people

- ONE is the new Matic

During the dump:

- One army rekt now😂😂😂 no one shilling One anymore

- ONE dumping

- One is done

While there’s no fundamentals-driven reason for the rally, some found the cause in Binance-hosted trading competition/ONE airdrop that’s scheduled to end tomorrow:

“As a celebration of the launch”, says Harmony in the competition announcement, “we will airdrop 25,000,000 Harmony ONE tokens to Binance DEX users in the next 5 days. Each day all the Binance Chain addresses holding a minimum of 10 BNB and reaching a trading volume of 100,000 or more Harmony (ONE) tokens (including buys & sells) on Binance DEX will equally share a pool of 5,000,000 ONE tokens.”

This is also why some are skeptical about claims that ONE already accounts for an overwhelming majority of trading volume on Binance Dex, referenced by CZ himself:

Unsurprisingly, not everyone’s convinced the volumes should be taken at face value:

Either way, it will certainly be interesting to revisit the $ONE chart after the trading competition ends tomorrow. Will the coin be able to sustain a prolonged rally without its training wheels? Watch this space.

As always, head over to our Social Trends page for the latest updates.