Top Social Gainers for Tuesday, May 7th, 2019

Here are Tuesday's biggest developing stories in crypto based on Santiment's data:

- Stiglitz/Nobel/Economists (130+ combined mentions in last 48 hours)

Tis the season to trash crypto, apparently.

Only a day after Warren Buffet’s dismissal of Bitcoin as ‘a gambling machine’ that ‘hasn’t produced anything’, yet another financial heavyweight opted to pick a fight with digital currencies. This time, it’s Nobel laureate and former chief economist of the World Bank, Joseph Stiglitz, with, if nothing else, one of the weirdest crypto takes of the year:

“I actually think we should shut down the cryptocurrencies.”

Absurdity of the claim aside, Stiglitz’s main gripe with the crypto market seems to stem from the illicit use of digital assets, and the lack of transparency associated with crypto transactions (though he remained pretty vague throughout his remarks):

“It disturbed me a great deal – the attention that was given to cryptocurrencies”, lamented Joseph, “Because those were moving things off of a transparent platform and into a dark platform.”

Stiglitz also reiterated his support for the financial status quo, and praised the ‘very stable’ US dollar:

“We have a very good currency so far; the currency’s been run in a very stable way, there’s no need for anyone go to a cryptocurrency,”

And so, after a long hard day yesterday of bashing Buffet and everything he stands for, the crypto reddit was forced to turn into the ‘Ah s#%t’ meme and tear into Stiglitz anew:

And so they did. First point of attack, as expected, was Stiglitz’s inane notion that one can simply ‘shut down’ crypto somehow, as if he’s talking about a toaster:

Next, some pointed out that Stiglitz’s main argument against crypto - namely that it’s used by baddies - could also warrant the imminent shutdown of pretty much all commodities in existence, from the US dollar to shoes and event tickets:

Much like with Buffet, Stiglitz’s age was brought up a number of times to essentially disqualify any opinion he may have about crypto:

For some, Stiglitz’s ‘argument’ was actually the most scathing criticism of Bitcoin available, and as such perfectly demonstrates the lack of viable counterpoints to crypto:

Either way, after lambasting Stiglitz himself, it was time to turn to the ‘Nobel laureate’ part of the story. The prized title was swiftly proclaimed meaningless, rooted in monarchy and politically motivated; one particularly woke redditor even wondered: ‘Is economics even a science?’

Finally, it was time to turn on economists in general, as almost anyone with a degree in economics was dubbed an unimpressive paid stooge:

Typical echo chamber nonsense aside, there were actually fragments of an interesting discussion tucked in between the memes and general vitriol. If you don’t mind a longer read, one user attempted to dissect Stiglitz’s comments in the broader context of 20th century policies, and current shifting political paradigms. Here’s the full comment, split in two parts.

Part 1:

Part 2:

Whether you agree with the above argument or not, i think we can at least agree that it’s heaps better than the ‘analysis’ offered by the ever-present ‘lol economists’ crowd.

You can find most of the Stiglitz discussion here and here.

- Fidelity/BTC (300+ new mentions in last 48 hours)

According to recent reports, Fidelity, one of the world’s largest investment firms, is expected to launch a cryptocurrency trading platform “within weeks.” The upcoming BTC trading service will be aimed at institutional investors, and will arrive complete with high-grade custody service.

The news helped propel Bitcoin to a 2019-high $6326, although it has slightly consolidated since.

With almost $7 billion in customer assets and about 24 million users, Fidelity’s interest in crypto is understandably making waves in the community.

The investment firm is a trusted and well-established presence on Wall Street, so some hope its involvement in crypto will serve as a proof of concept for other high-end players to enter the market.

Moreover, BTC trading is still dominated by retail investors, and it’s no secret that many crypto enthusiasts believe that the influx of institutional money will be what sparks the next bull run.

As you might expect, the reaction to the announcement was overwhelmingly bullish, with some even taking it as an ‘all-in’ signal:

And while most of the sentiment was decidedly positive, there were some that second-guessed if the Fidelity news is in fact ‘good for bitcoin’:

Some skepticism was also expressed about the reliability of the announcement, given historical precedent with Bakkt:

Meanwhile, r/btc was debating if the Fidelity trading service was better suited for the Bitcoin hard fork instead:

There are takes, and then there are takes.

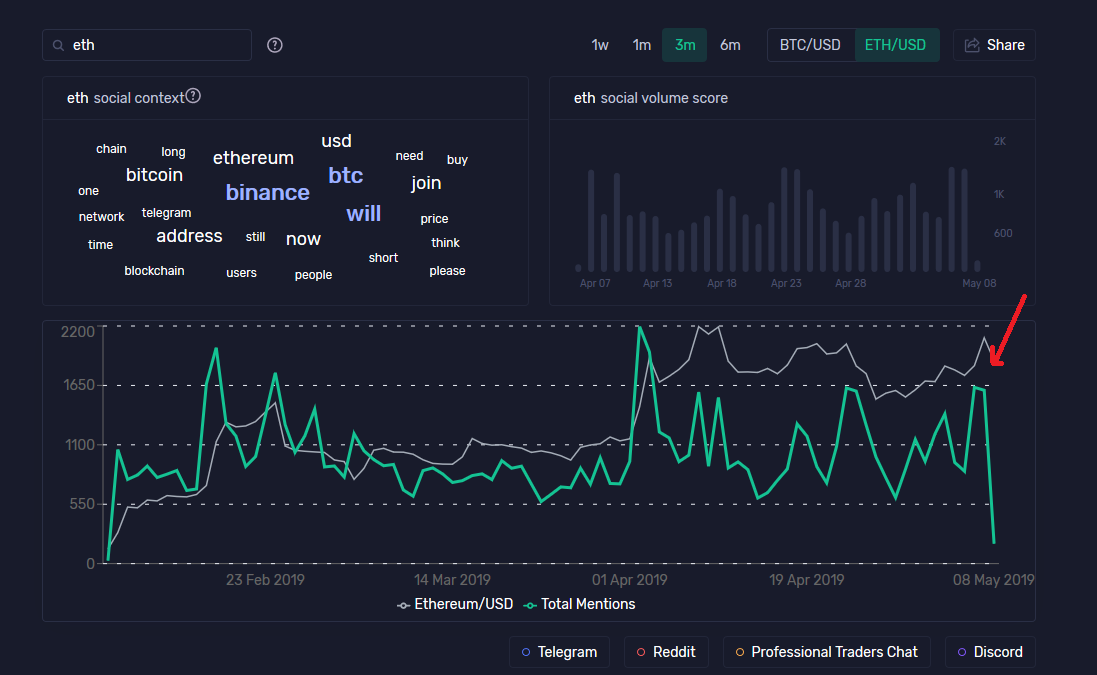

- ETH (1600+ new mentions in last 24 hours)

After a week of mostly trading sideways, the world’s second biggest coin jumped 13.4% in the early Tuesday hours, hitting a month-high 180.53 before heading back south.

The rally was triggered by rumours that the US Commodity Futures Trading Commission (CFTC) is now ready to consider an Ethereum futures contract. Apparently, an anonymous ‘senior official’ recently told CoinDesk that the Commision can “get comfortable with an ether derivative being under our jurisdiction”.

While he didn’t go into specifics, the CFTC official stressed that there are no inherent obstacles to approving an Ether-based futures contract:

“We don’t do bold pronouncements, what we do is we look at applications before us. A derivatives exchange comes to us and says ‘we want to launch this particular product.’ … If they came to us with a particular derivative that met our requirements, I think that there’s a good chance that it would be [allowed to be] self-certified by us.”

Up until now, the CFTC has sanctioned two Bitcoin futures markets: one by CME Group, and the other by CBOE Global Exchange. The news was welcomed with open arms by several crypto pundits, even dubbed ‘the biggest development in recent memory’:

Some, however, seemed a bit more timid about the announcement, given how the futures action (or more specifically, futures expiration) impacted the price of Bitcoin in the past:

According to some websites, including Hacked, those worries might be overblown:

“The impact of an Ethereum futures market is unlikely to have to the same earth-shaking effect as its Bitcoin predecessor. However, if the same pattern does play itself out, then the dump that accompanies the pump would make itself felt on all of those ERC20 pairs.”

Back in the present, Ethereum has dropped more than 7% since hitting the local top earlier today, and is currently trading in the $166 range.

As always, head over to our Social Trends page for the latest updates.

Conversations (0)