Top Social Gainers for Sunday, April 21st, 2019

Here are today's biggest developing stories in crypto based on Santiment's data:

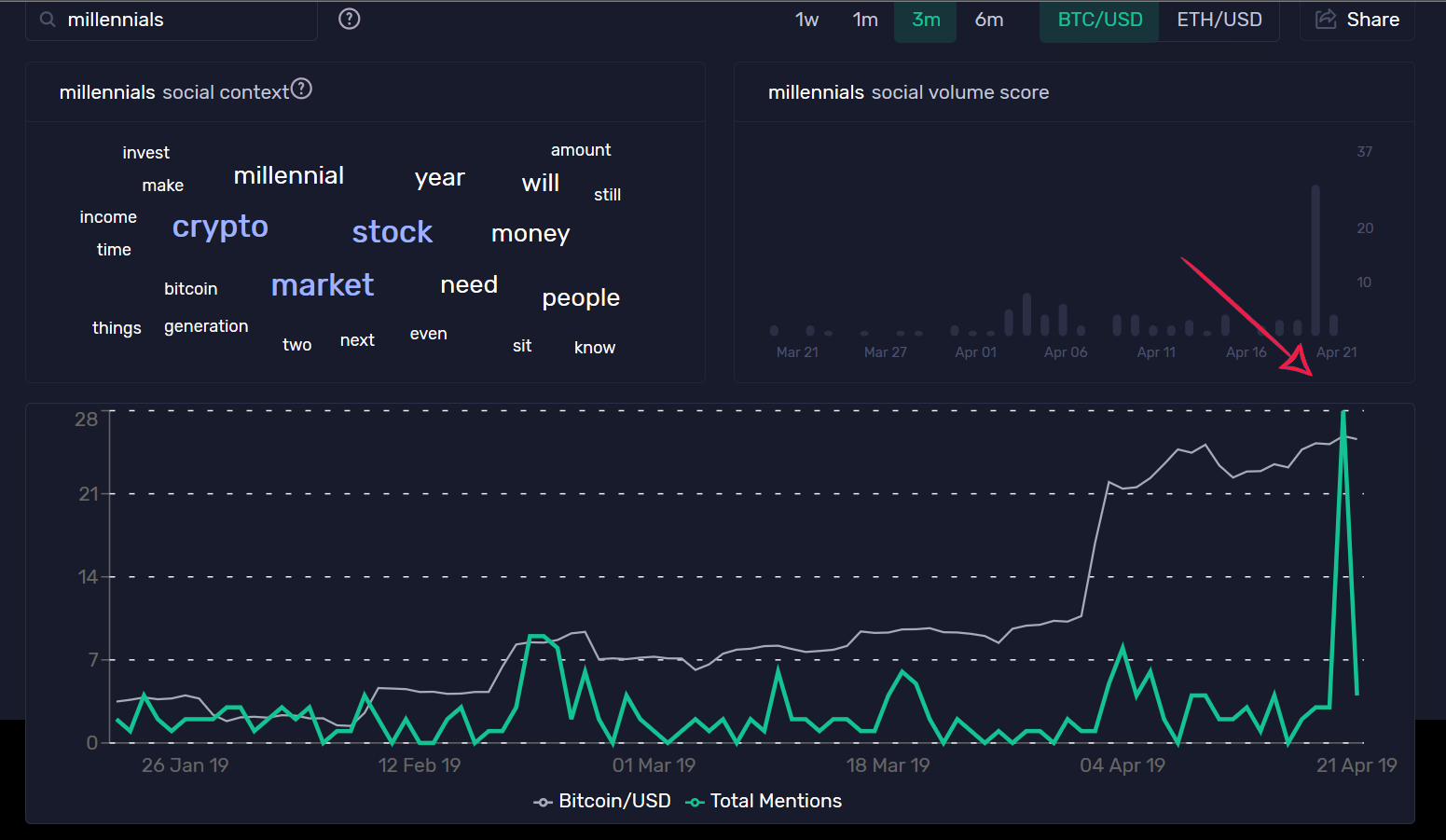

millennials (30+ new mentions in last 48 hours)

Today, r/CryptoCurrency debated a recent survey which suggest millenials are the most likely demographic to invest in crypto AND most worried of a stock market crash.

“thats because millienials are broke, they need to roll the dice on crypto making them rich, because $50 at 5% gains per year, won't be enough for retirement“

Prompted by the thread, the mentions of 'millenials' surged over the last 48 hours, sending the word to our Top Social Gainers list for April 21st.

The thread has already amassed over 350 comments so far, and has - perhaps unexpected for a crypto subreddit - split the crowd on the value and merit of traditional markets. In fact, there were many a defenders of the stock-and-bond alternative:

“If you’ve read any investment books, the statement that you can’t retire off just playing traditional investments is false. People just have limited investment knowledge, suck ass at saving money, or are greedy and want to be rich sooner rather than later.”

The big part of the debate centered on which of the two financial markets present a more sound retirement plan:

“You can retire off playing traditional markets, but you need a lot more initial capital to do so. With $50, after 2 years, you'll have $80 in traditional markets with crypto $50 could be life changing...if you bought $50 worth of ETH on January 1st, 2016, you paid 95 cents per coin. So you had 52 ETH. Two years later that was worth $75K.“

“You can’t rely on traditional investing if you have hardly any principle to invest. Crypto has proven there’s a chance that $1000 can turn into $1,000,000.”

Others, however, pointed exactly to crypto’s unparalleled volatility as a dealbreaker, and praised the prudency of the traditional markets:

“$50/month for 30 years with 6% annual growth gives you $48K. You get same $48K if you invest $300/month for 10 years. Buy low cost index funds. Easy and safe if your investment period is more than 20 years. As you can see time is the key. It is lot easier to save $50/month than $300/month but the end result is the same.“

“Honestly, that’s just pure greed to try and get rich quick. Speculators like those are the same that whine when the market nose dives. This is a purely speculative market. There is no such a thing as “investing” in crypto[...] People just don’t want to get wealthy slow which is what the stock market and other securities afford you.”

And while it may sound intuitive that crypto's more volatile, there were those that even claimed the opposite:

Eventually, while many tentatively conceded that stocks are a sounder strategy, they claim the initial capital investment makes it a gated community, available to the wealthy few:

“Investment advice is useful for people making $50,000 a year. It is not terribly useful for the majority of people making $30,000 because no matter how much they save it will not be enough once social security blows up.”

"The less you have, the less you can make with investments. Compound interest is a thing. It's fundamentally unfair. The problem is that the elite have a monopoly on good investments. “

“Step 1) Have a bunch of money to invest

Step 2) Invest it.

I think your average millenial is having trouble with step 1.”

As usual, there were also those that strayed away from the main debate, and questioned the legitimacy of the source instead:

“The survey was of 1000 people from 'bankrate' whatever the f#@k that is. People who would respond to something like this survey and actually do it seem like they'd be biased against traditional stocks and contrarian. That said I agree with them.“

And then there were those that somehow managed to make this a...left vs right thing?

You can check out the full discussion in all its glory in the original thread.

- FET (160+ new mentions in last 48 hours)

For the first time in a month, Fetch AI’s coin gave some signs of life earlier today, sparking rumours and intense shilling on both Telegram and Twitter.

FET gained almost 20% since early yesterday, reaching a 30-day high $0.249 before losing most of it over the last 12 hours.

The roller coaster price action also triggered a spike in ‘FET’ mentions on crypto social media: our Social Trends tool has recorded 160+ new mentions of the coin over the last 48 hours - its biggest spike since the previous local top almost a month ago.

Of course, much of the chatter came from Binance English telegram group, where the crowd welcomed the rally with open arms:

What looks like a classic pump and dump, however, has also prompted wide speculation on whether a big news might be on the horizon for Binance’s second-ever IEO coin.

Now that Binance is wooing projects away from Ethereum and to their own blockchain, some have wondered if Fet might be the next in line for a migration:

“Wondering if fet may be next coin in Dex 🤔 “

“Fet.. next binanace chain token !! “

“everyone on twitter shilling FET now”

Others yet rationalized FET’s rally from a purely TA standpoint:

“FET bounce off of support perfectly! Target back to 40cents. It’s headed towards the 0.786 Fibonacci area. Let’s f@$king go. All in baby. 🚀🚀 “

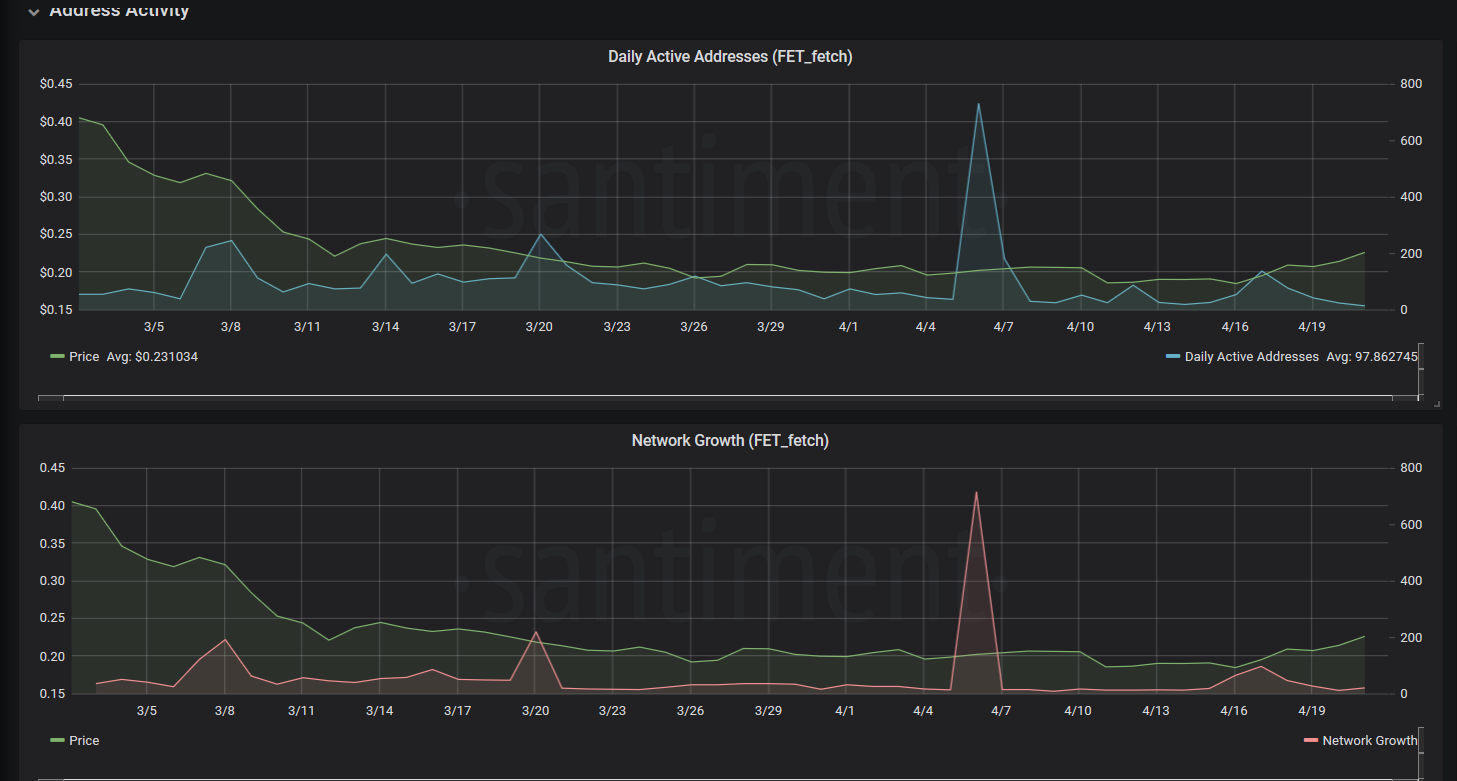

Looking at FET’s on-chain data since the ICO, it becomes clear that the latest price action did little to boost the coin’s usability. Both its daily addresses and network growth charts remain unimpressive:

There has, however, been some elevated activity in regards to FET’s Token Age Consumed (idle coins moving) and Trx Volume in days leading up to the rally:

And while this may look like someone ‘in the know’ getting into position before the pump, our exchange-related graphs tell a different story. In fact, both of these spikes correlate with FET coins moving OUT of the exchange wallets over the past week or so:

Meanwhile, FET’s number of daily active deposits remains low, further indicating that today’s top proved uninteresting for most traders:

Looking at our metrics, there's little indication that the recent pump is supported by the project's fundamental data. Furthermore, Fetch AI’s social media accounts have also been fairly silent, with no big news or partnership announcements teased and/or revealed.

In the meantime, FET has already dropped over 10% from today's local high. Seems like the P&D party’s over for now.

- Wage (60+ new mentions in last 48 hours)

If there's one thing crypto subreddits love more than anythning, it's roasting the CEO of JPMorgan Chase and notorious bitcoin opponent Jamie Dimon. Well, not today it seems.

The discussion about Dimon was prompted by a video recently posted to r/cryptocurrency, in which a member of US Congress grills Dimon about one of his bank employees' salary and living conditions.

The congresswoman describes the employee as a single mom accruing a monthly deficit of over $500, and tallies her monthly expenses, including a $1600 rent, $400 gas bill and more. In the end, she asks Jamie Dimon how he would manage this budget shortfall, and criticizes him for not providing ‘a way for families to make ends meet’.

While a few subreddit members were sympathetic to the employee’s cause, many have gone the exact opposite route, placing the blame away from Dimon, and on the bank worker:

“I can't stand Jp Morgan's CEO but why is it his problem? That job isn't meant for a single mom with dependants. Maybe she should be held responsible for her actions for having a kid without the means for providing for such. With as many govt handouts as there are today it's hard for me to feel sorry”

“From what the politician is describing, it kind of seems like the woman is really poor with her finances. Why does she live in a 1 bed and not a studio when she's constantly in the red? She can move further away. She's doing a starter job with a 6 year old and that's dimon's fault? If the politicians invested in public transportation in this country, she would be able to cut down 450$ worth of her expenses by not needing a car.”

This has also sparked a wider discussion on the merits of minimum wage laws, and the massive income inequality levels in the US:

“The corporate lead u.s. wealth gap has become so unbelievably gross that that the top 1% owns almost half and the top few percent owns close to two thirds. There's so little money left that lots of major U.S. corporations struggle to keep their workers off food stamps. [...] Other countries may have their own issues but for the U.S. to have the economy it does and still have these issues... It's inexcusable.”

Part of the discussion also centered on whether this has anything to do with crypto at all:

Which side of the debate are you on? Does Dimon bear some responsibility in this case, or should the onus be on the employee? You can check out the full discussion in the original thread.

P.S. There were also several repeat words from yesterday on today's list, including BAT and BNB - you can find out why they're trending in this post!