Top Social Gainers for Saturday, April 20th, 2019

Here are today's biggest developing stories in crypto based on Santiment's data:

- VTHO (260+ new mentions in last 48 hours)

Vechain CEO Sunny Lu says the price of VTHO is too high at the recent Vechain summit, splitting the community in half.

VTHO is the Gas equivalent for Vechain’s blockchain. It is received through staking by every VET hodler and can be used to run apps on the network. Some, however, have also come to see and expect VTHO as a sort of ‘dividend’ for investing in, and supporting the Vechain ecosystem.

As a result, Sunny Lu’s comments have rippled through the Vechain community. One of the project subreddit’s most popular threads yesterday, titled “Vechain Overpriced?” has sparked a lengthy debate on the true purpose of VTHO, and whether this is the project being pragmatic, or shooting itself in the foot:

“The 'vtho overpriced' statement was the disaster of the evening. Cheap vtho could (not will) lead to cheap vet and vet at $0.007 in 3 or 4 years time is a personal disaster for me.“

“VTHO is the oil, VET is the well. When price/value of oil goes down, what happens to oil wells? They too decrease in value, sometimes to the point of being shut down because they can't cover overhead.“

Others, however, were quick to point out that (relatively) expensive VTHO could hinder mass adoption:

“The entire point of the system is not necessarily to keep VTHO stable or cheap - but to make transactions stable and cheap. Businesses complain VTHO is too expensive because transactions are too expensive, and that's what's being remedied.“

One of the biggest talking points was certainly the true aim/objective of both VTHO and Vechain’s main coin VET:

“VET is the investment not VTHOR. If VTHOR gets to expensive all those MOU's and partnerships will dry up real fast. They will all jump ship to a cheaper blockchain. Large business is ALWAYS trying to cut cost. Sunny knows this. VET is the investment you want not VTHOR. “

“Oh no the ceo of the ecosystem want more development by making this ecosystem cheaper to develop on. Oh no what a disappointment“

Some, however, see VTHO as much more than just a Gas-like coin with narrowly-defined utility:

“This is misguided unless VET has another way to capture the network utility outside of VTHO. VTHO is essentially the network equivalent of revenue for stakeholders in a business. Those flows are what give VET it’s value - that’s how the tokenomics were designed. If prices are designed to remain low and manipulated for stability indefinitely without the input of stakeholders that means VET could potentially never really scale with network activity - no way to capture the value of network activity”

Even those developing atop the blockchain chimed in, sharing their concerns about the secondary token’s price action:

“As someone building on VeChain, I can attest that the biggest challenge I face is vtho cost. At the Summit I chatted with Luca about it. The consensus is that eventually over the long term, the price wont be as big of problem..”

As for Vechain’s main coin, VET has been dropping steadily since the summit, losing over 8% over the last 3 days before slightly bouncing back in the last few hours. Here's VET 1-week price action:

As for the reason for the downtrend, some are convinced this single comment is to blame:

- WTC (320+ new mentions in last 48 hours)

Waltonchain (WTC) has been on a steady climb all week, pumping by 29.5% ahead of its mainnet launch:

As a result, there has been a surge in WTC-related chatter recently, with over 320 new ‘WTC’ mentions recorded on crypto social media over the last 48 hours:

After more than 18-months on Ethereum, the project is ready to go at it solo, with “a fully operational mainnet“ now set to go live on April 24th (tho the project’s Mainnet was officially launched on March 31, 2018).

The last leg of the recent rally might be propelled by the April 19th update, detailing, among other things, staking rewards on the upcoming mainnet. Also, as per the blog post, more announcements from the project are likely to follow:

“Waltonchain will release a separate announcement on the details and time of the Mainnet Token Swap of WTC stored in exchange and personal wallet addresses.”

Looking at WTC’s recent on-chain data, we can see notable spikes in exchange-related activity in the days leading up to and even following the mainnet launch. Given the most recent spike (April 18th), it might indicate a similar pattern forming in anticipation of April 24th.

Furthermore, an additional 2.5% of WTC’s total circulating supply has entered exchange wallets over the last 40 days. The increased sell pressure, however, has done little to dissuade the price rise.

While a notable increase in the token’s supply on exchanges can have an adverse impact on price, mainnet launches and token swaps appear to be immune.

For example, here’s the same graph for ZIL, another coin with an upcoming token swap, over the last 3 months:

Interestingly, the percentage of both tokens on exchange is almost identical as well.

Still, given the circumstances, it could be deemed natural for a high % of both ZIL and WTC to be found in exchange wallets at the moment. How the price will react if the percentage remains high even after the token swap remains to be seen, so these charts might warrant a revisit in about a months time. Watch this space.

- STEEM (90+ new mentions in last 24hrs)

What's the first thing that comes to your mind when you see this tweet?

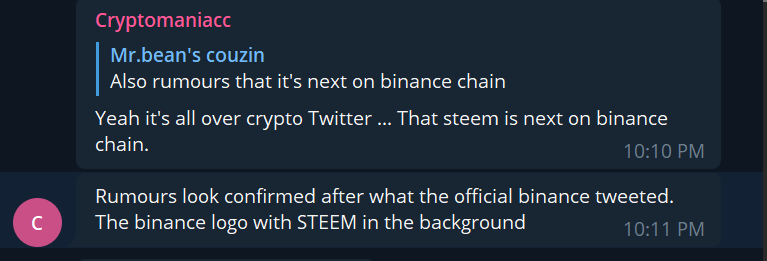

If your immediate reaction was to go and buy as much STEEM as you can, then you should probably join the Binance Telegram group:

Apparently, the crypto community went full Da Vinci Code on what is essentially just a photo of some vapor, and decided it was irrefutable proof that STEEM is migrating to Binance Chain. In other news, STEEM has gained 2.7% in the last 24 hours, and has exploded in social mentions.

I’ll let CryptoSnake explain what’s going on here:

Of course, there is absolutely no proof whatsoever that this is the actual meaning of the tweet. In fact, other twitter users have come up with alternative and IMHO equally or even MORE reasonable explanations of the image. Here’s just two of them:

- This could be a reference to ‘vaporware’, considering Binance has recently delisted BSV and CZ has publicly called Craig Wright a fraud.

2. This image was posted on 4/20. Sooo...yeah.

Regardless of its original purpose, I think we can all agree that the above image/tweet definitely means one thing: Binance has an astonishing influence on the crypto market.

P.S. There were also several repeat words from yesterday on today's list, including BAT and BNB - you can find out why they're trending in this post!