Token Circulation Rates to Watch

When it comes to circulation rates in a bear market, they tend to really get all over the place. As we've seen since late June, some coins have actually shown some great recovery signs (like ETH) quickly while others are really lagging behind (like ADA).

Below, we break down some of the key NVT token circulation divergences that are showing on our Sansheets model, exclusively available to Sanbase PRO members.

As a reminder, if you'd like to check in on your favorite assets to see whether they're getting the appropriate utility to consistently grow their market caps, you can simply:

1) Download Sansheets

2) Plug in your API: https://academy.santiment.net/sansheets/adding-an-api-key/

3) If you're having trouble getting the data to load on a model, head to the 'Data' tab on the far right of the spreadsheet, and go to the yellow cell. Then delete the cell formula, then hit Undo. This should manually refresh the data.

Bitcoin ($BTC):

Bitcoin's token circulation has fallen considerably in 2022. After a run of 9 straight months of semi-bullish to bullish divergences in terms of network circulation compared to market cap, July suddenly turned semi-bearish. And three weeks into August, it's now back to being a bearish divergence for the first time since September, 2021.

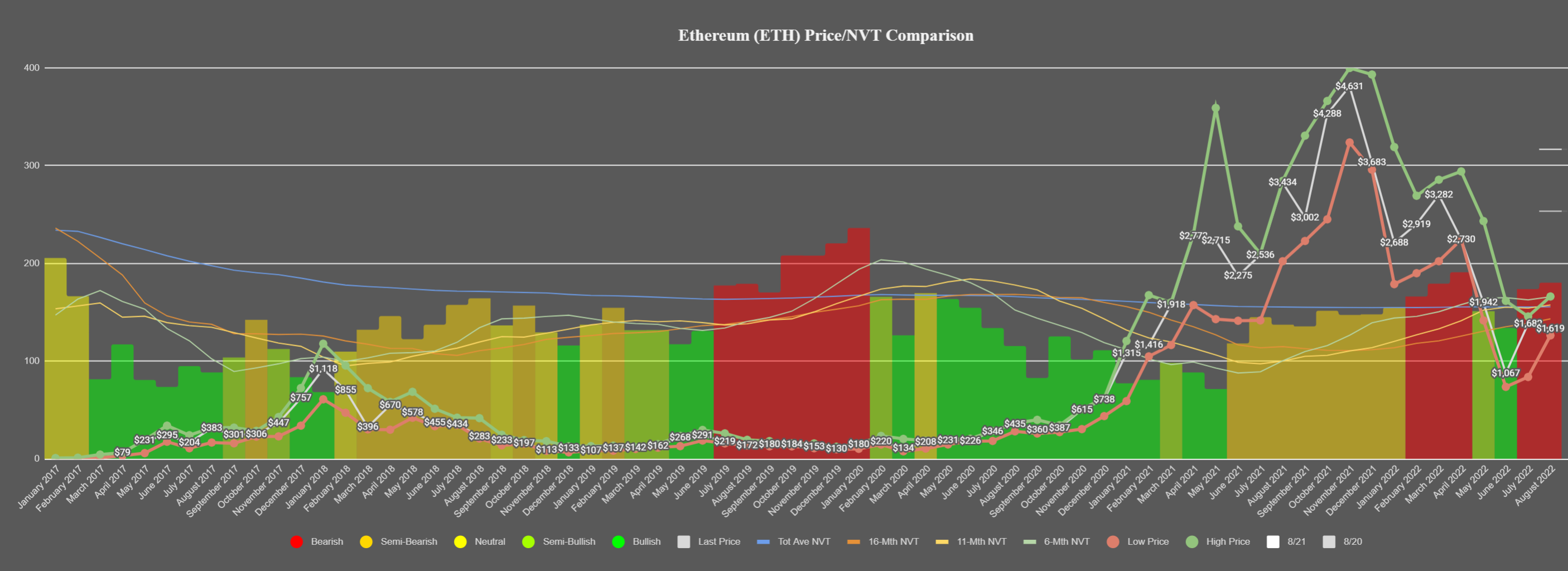

Ethereum ($ETH):

Ethereum has seen some very up and down circulation throughout its past two years really. May, 2020 through May, 2021 was clearly the #2 market cap asset's time to grow. And even once it hit some volatility from June 2021 to November, 2021, its shaky circulation was still enough to allow it to hit an all-time high. But outside of May and June of this year, which indicated that ETH was starting to get a bit oversold, there has been some pretty shaky circulation on the network and a lot of concerning red bars throughout 2022.

Chainlink ($LINK)

Chainlink began to attempt a recovery ever since its circulation finally turned bullish again in June. And though it has gained some market cap since, the semi-bearish signals quickly returned in July and August.

Litecoin ($LTC)

Litecoin's price may have slid for quite some time, but its NVT chart is indicating that it probably has been deserving a better fate. The oft ignored 2nd oldest asset in crypto is on its 12th straight month of a bullish divergence, so a breakout will be much less surprising than it would for most other assets right now.

XRP Network ($XRP)

XRP has actually looked to be one of the better NVT charts we see in crypto right now. Circulation suddenly picked up a lot of steam on the network in May, and like most assets, it was still pulled down a bit further in June. But August appears as though it's on its way to reveal a bullish or semi-bullish NVT divergence for XRP by the end of the month. And with four straight months in the green, this could be promising.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Conversations (0)