This Week in Crypto: Whales in No Mood to Stop ACCUMULATING at All-Time High! (This week in crypto summary November 22)

Introduction

In this week's Santiment market analysis, Brian explores an extraordinary period for cryptocurrency markets, with Bitcoin approaching the historic $100,000 milestone. As market caps across the sector continue to surge, from layer-1s to meme coins, our data presents a fascinating picture of institutional accumulation, retail sentiment, and on-chain metrics. This analysis, powered by Santiment's comprehensive data tools, reveals why this rally might be different from previous ones and what metrics suggest about Bitcoin's short-term trajectory.

Market Overview: Unprecedented Growth Across Crypto Sectors

The past five weeks have witnessed remarkable growth across various cryptocurrency sectors. Bitcoin's surge has led to significant redistributions into altcoins, with market caps erupting across layer-1s, layer-2s, meme coins, AI tokens, and NFTs. The current all-time high sits at $99,354, tantalizingly close to the psychological $100,000 barrier, marking a historic moment in cryptocurrency's evolution.

Whale Accumulation: A Story of Institutional Confidence

Perhaps the most compelling narrative comes from whale behavior. Data shows that wallets holding at least 10 Bitcoin have accumulated an additional 56,197 BTC collectively. This accumulation trend has become particularly aggressive since October 26th, with no signs of slowing down. In fact, between November 20th and 21st alone, whales accumulated approximately 6,300 BTC, marking one of the most substantial single-day accumulations in recent history.

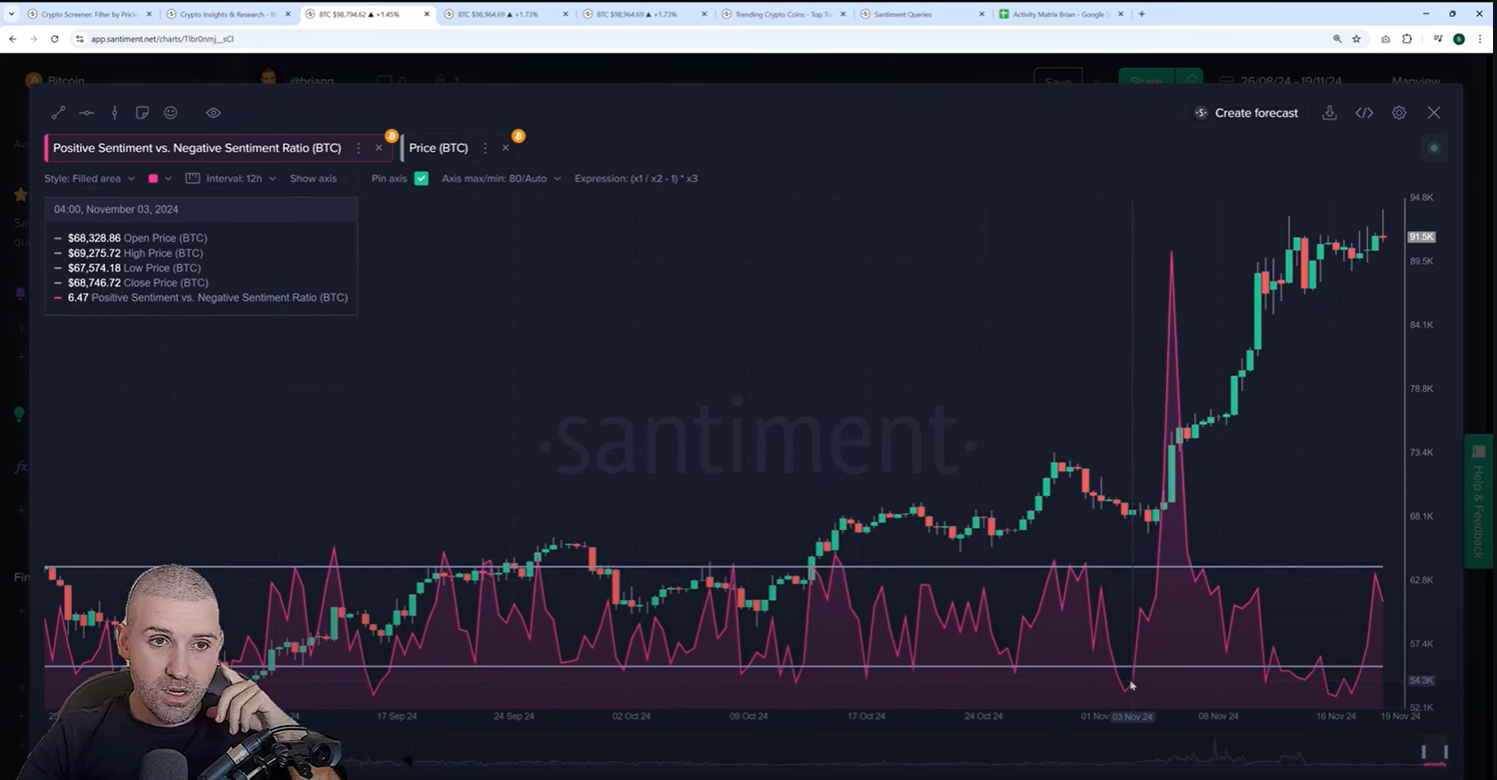

Sentiment Analysis: The Paradox of Fear at All-Time Highs

Interestingly, despite prices reaching unprecedented levels, market sentiment remains surprisingly cautious. The analysis shows that many traders are exhibiting disbelief rather than euphoria, which historically has been a positive sign for continued price appreciation. This "wall of worry" climbing suggests that the market hasn't reached the typical euphoria associated with market tops.

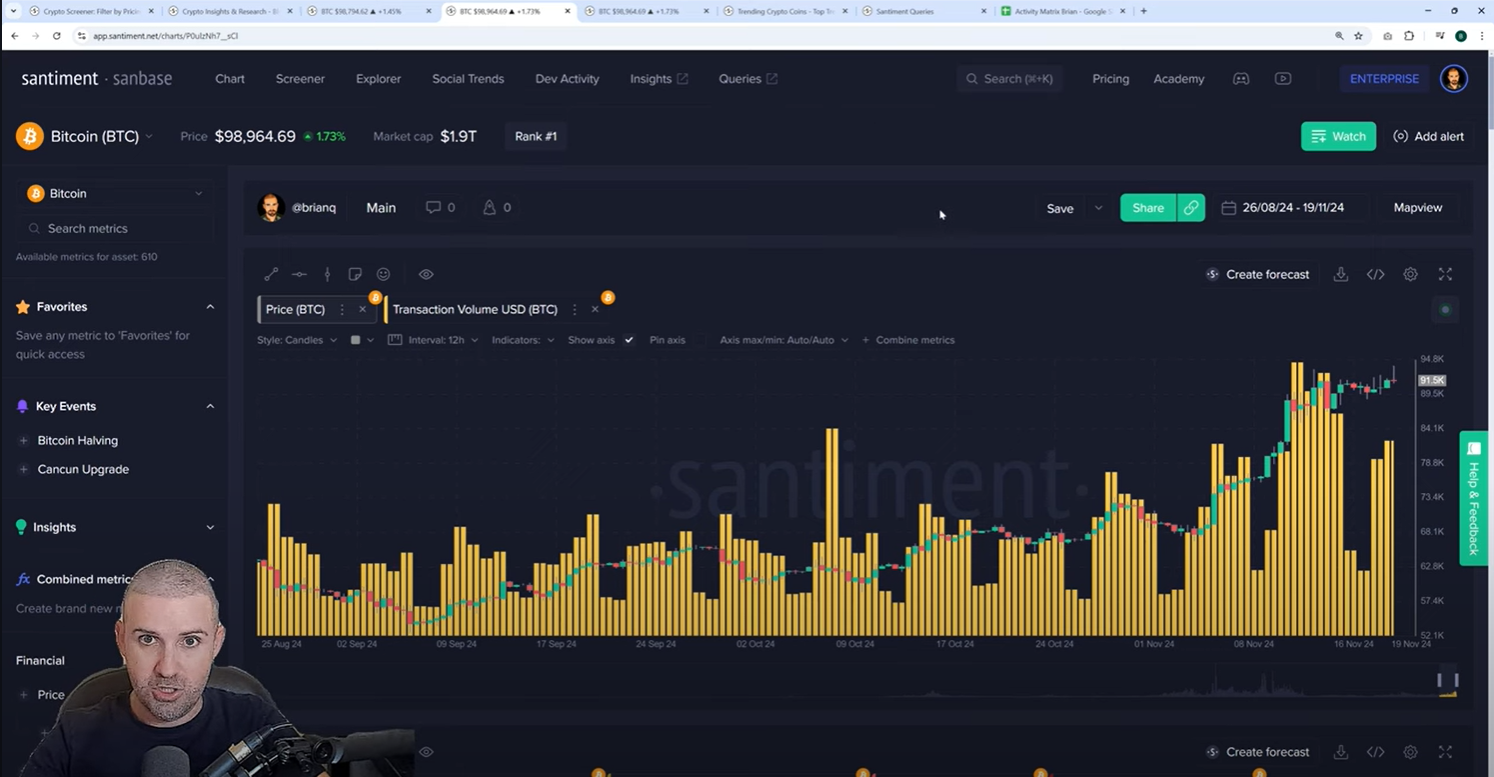

Network Activity and Transaction Volumes

Transaction volumes have reached levels not seen since November 2022, with recent daily volumes exceeding $55 billion. Daily active addresses have hit their highest levels since March, indicating healthy network utility. This isn't just isolated spike activity but rather shows gradual, organic growth in network usage.

MVRV and Risk Indicators

The Mean Value to Realized Value (MVRV) ratio shows average returns for active wallets at +15.8% over the past 30 days, just slightly entering the "danger zone" above 15%. While this suggests increased risk of a mild correction, it's not yet at the extreme levels seen during previous market tops.

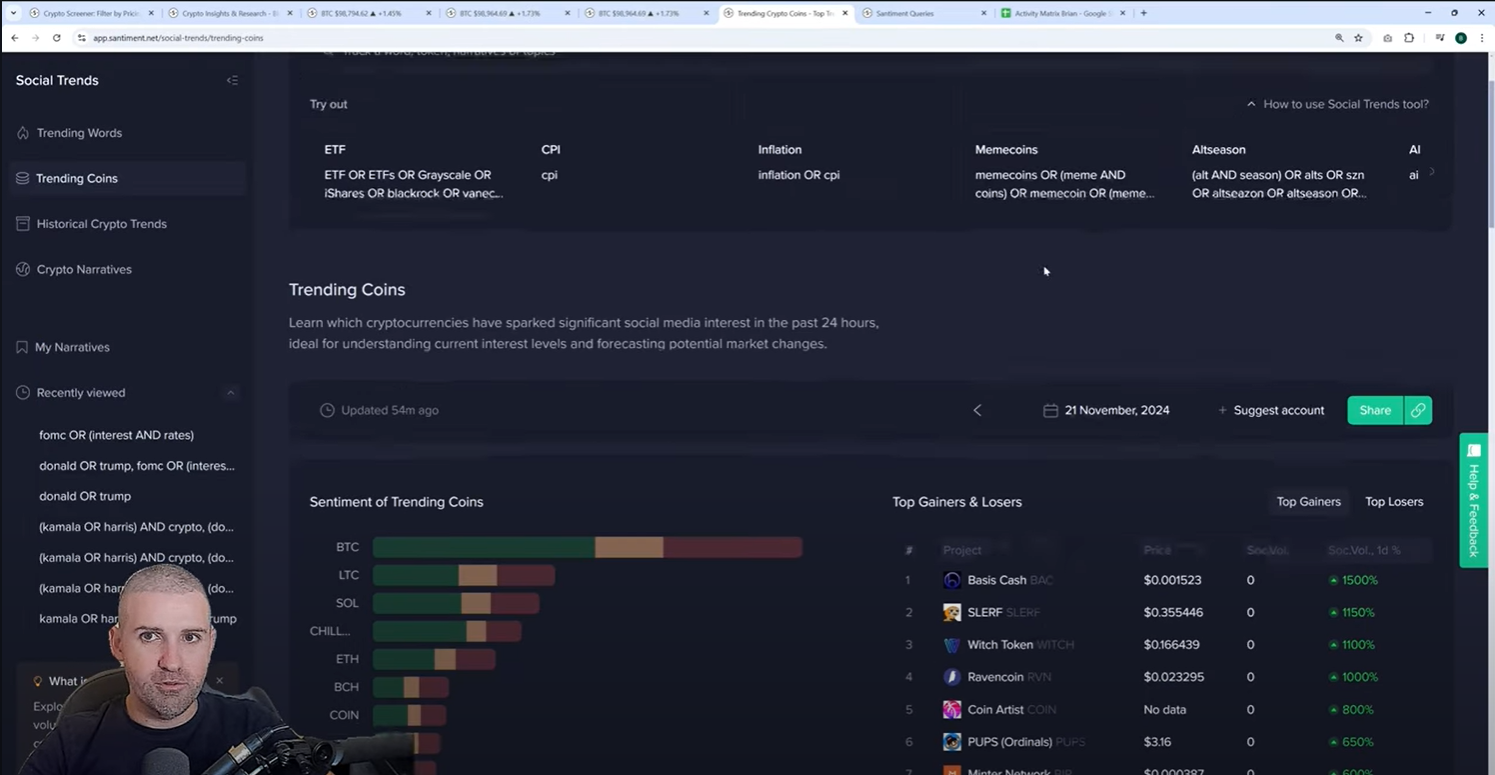

Trending Coins and Market Dynamics

Beyond Bitcoin, several altcoins have shown significant movement:

- Solana: Drawing attention due to potential spot ETF approval

- Litecoin: Performing well against Bitcoin

- Cardano: Up 49% in the past week

- XRP: Surged 75% over seven days

- Stellar: More than doubled with a 116% increase

ETF Volume and Institutional Interest

ETF trading volumes have reached their highest levels since March, though unlike previous high-volume periods, the current flow dynamics show a more balanced picture between inflows and outflows, suggesting more sustainable market participation.

Conclusion: A Data-Driven Perspective on Bitcoin's Rally

The current market structure presents a unique scenario where institutional accumulation remains strong, retail sentiment stays cautious, and network metrics show healthy organic growth. While some indicators suggest increased risk of correction, the overall data points to continued strength in the market, particularly given the persistent whale accumulation and balanced ETF flows.

For traders and investors looking to navigate these markets, Santiment's metrics provide valuable context beyond price action alone. The combination of whale behavior, sentiment analysis, and network activity suggests that while we may see short-term volatility, the fundamental drivers of this rally remain intact.

Stay informed and make data-driven decisions by following Santiment's regular market updates and utilizing our comprehensive suite of on-chain analytics tools.

Conversations (0)