Things to keep an eye on Keep3r

Assets covered: Keep3r (KP3R)

Metrics used: Daily Active Addresses, Exchange Inflow, Network Profit/Loss, Daily Active Addresses, Network Growth, Transaction Volume, Amount held by top non-exchange holders

A lot of coins are ranging at the moment. Seems like they are waiting on the move of BTC to tell them what to do. In the mean time a lot of people tend to be moving into a new wave of DeFi projects like Keeper. Here's a few token fundamentals that seem to be flashing yellow signs near short term Keeper corrections.

Short term

- 1. 🟨 Daily Active Deposits & Exchange Inflow

The number of daily KP3R deposits (addresses used to move KP3R to exchanges) has ballooned a few days ago, suggesting a sharp rise in sell-side pressure alongside the coin’s pump. Keeper's exchange inflow has spiked as well: around 7K of KP3R were moved to exchanges.

2. 🟨 Network Profit/Loss

Profit taking spikes are usually seen around local price tops, holders taking profits on best levels. Moreover, a divergence between profit taking (going down) and price (going up) is a worrying sign. It mean traders confidence increases, 'no need to sell now', and market punishes traders with a correction.

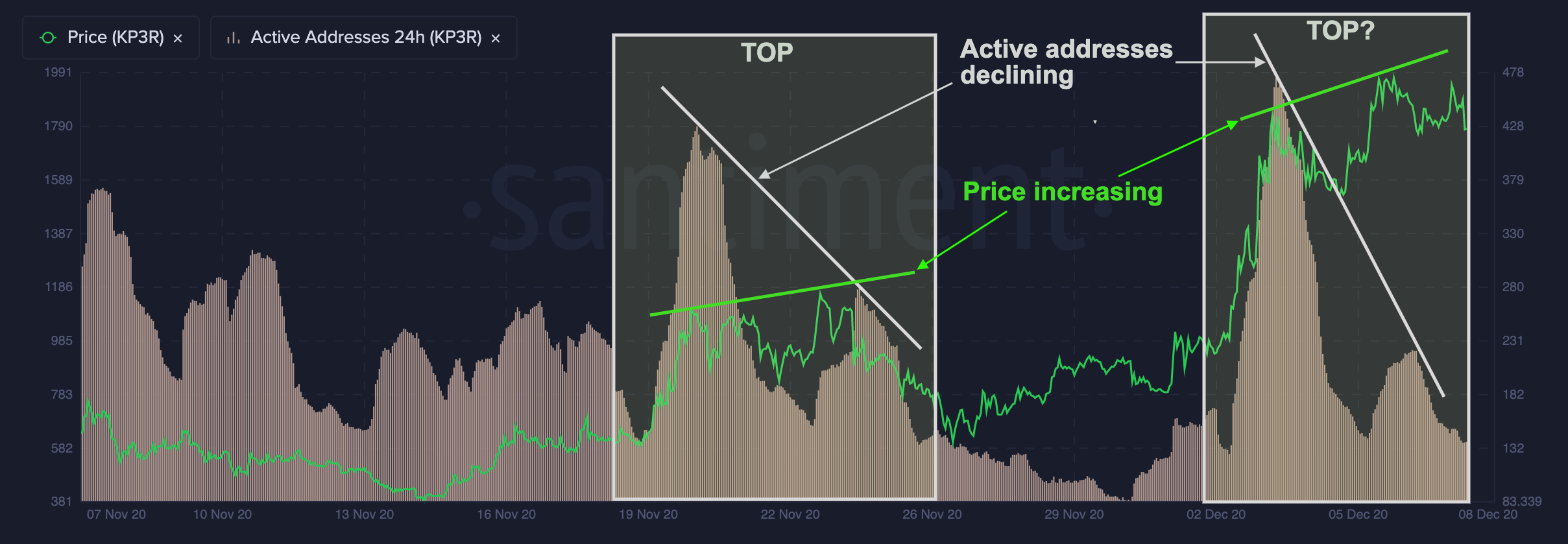

3. 🟨 Active Addresses

Same worrying divergence is seen on the chart above. KP3R active addresses amount is declining while the price keeps pushing up. At some point a decreased network activity will not be able to support price momentum and Keeper could drop. We've seen it many times before.

Above are network activity markers that we are tracking and that seem to have a correlation with it's short term price action. Seems to be an interesting markers to keep an eye on. All charts on a single page.

Long term

If it's long term potential, we'd suggest to look at it's Daily Active Addresses, Network Growth and Transaction Volume - metrics showing the utility of the coin. What we want to see is growth over time.

Not there yet. All on one page - https://app.santiment.net/s/00sQHJfC

Oh. Whales! Of course this is nice long term indicator as well. Are they increasing KP3R holdings? Not really, there's a slight decline in top-20 Keeper non-exchange holders:

Who knows what Andre Cronje could announce tomorrow. Looks like almost any token he touches pumps immediately. And Keeper, a Yearn ecosystem fundamental token, could follow.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.