These are January's Biggest ERC-20 Network Gainers 🌱

Network Growth - or the number of new addresses being created on the network - is one of the best fundamental indicators for measuring coin adoption over time.

Over time, this metric can tell us whether a token - and, by proxy, its underlying project - is gaining or losing traction, and whether its user base continues to expand or has, alternately, started to shrink or abandon the project.

For more on Network Growth and dozens of other on-chain, social and development indicators, check out Sanbase, our all-in-one crypto intelligence platform.

Looking at the biggest ‘winners’ in terms of network growth can tell us a whole lot - not just about those coins, but the current state of the entire crypto ecosystem. What type of blockchain projects are gaining steam and which are falling by the wayside? What use cases do these dapps facilitate and which of their features seem to resonate the most with their growing user base?

In this report, we’ll be highlighting the top 10 Ethereum-based dapps by network growth in January 2020 based on Santiment's data, and what might have contributed to their early-year traction.

Note: since low-cap assets can sometimes skew network growth data with their frequent airdrops and coin giveaways, we’re only looking at ERC-20 coins that have made the top 200 by market cap at some point, to try and put the onus on organic growth in active addresses.

And the winners are:

As the above table suggests, stablecoins dominated all other ERC-20 projects in terms of network growth, as they directly facilitate two of the biggest blockchain use cases in early 2020 - speculation and DeFi.

5/10 of the month’s biggest network gainers are stablecoins, spearheaded by ERC-20 Tether which accounted for over 1/4 million new addresses added to the network.

The biggest non-stablecoin ‘gainer’ in January was Basic Attention Token (BAT), as the privacy-centric Brave Browser continues to gain mainstream appeal and incentivize on-chain interactions with its underlying asset.

Here’s the full breakdown:

1. ERC-20 Tether (USDT)

ERC-20 Tether is still in full command of the stablecoin race, with 256,557 new addresses added in the first month of 2020 - almost 6 TIMES as much as the next entry on the list.

ERC-20 Tether exploded in use starting in mid 2019, and has at one point accounted for 40% of all ERC-20 transfers.

Its on-chain activity has somewhat subsided since, as evident by its amount of daily active addresses pictured below. Still, it remains by far the top Ethereum-based stablecoin - and all-around Dapp - in terms of month-by-month usage and network growth.

2. Paxos Standard (PAX)

First issued in September 2018 as a NYDFS-regulated stablecoin collateralized by the U.S. dollar, Paxos is the second-biggest network gainer on Ethereum to start the year, adding 43896 new addresses in January.

Paxos Standard remains the third biggest stablecoin by market cap behind Tether and USDC, its daily trading volumes regularly overshooting its total market capitalization. Unlike most of its contemporaries, Paxos has also experimented with white-labeling its protocol, and has partnered with major exchanges like Binance and Huobi to launch third-party stablecoin solutions.

3. USD Coin (USDC)

A joint Coinbase-Circle project, USDC has added 39109 new addresses in January, placing the stablecoin on spot #3 by network growth.

On January 8th, Kraken added support for USDC which likely contributed to the coin’s 30-day growth. Lending startup BlockFi also added USDC support on their platform last month, enabling users to earn interest on, trade and receive loans backed by the stablecoin.

4. Multi-collateral DAI (DAI)

Multi-collateral DAI has added 30491 new addresses to the network in January 2020, further cementing its position as one of the most promising ERC-20 stablecoins and DeFi gateways to date.

A lion’s share of MCDAI’s growth last month occured between January 14th and January 20th, with a single-day high of 3800 new addresses recorded on the 17th.

In other MakerDAO news, MKR token holders recently voted to increase the Dai Savings Rate (DSR) from the current 6% to 7.75%, which ought to provide additional incentive for engaging with the protocol moving forward.

5. Basic Attention Token (BAT)

The first non-stablecoin on the list, Basic Attention Token (BAT) onboarded a total of 24980 new addresses in January - much of it in the first 15 days of the month.

Outside of the crypto cocoon, the Brave browser continued to make important strides with the mainstream audiences in the last month. On January 7th, Apple recommended the privacy-focused Brave browser as one of its “New Apps We Love” on the Hong Kong app store. Similarly, just a few days back, Product Hunt named Brave browser the 2019 ‘privacy-focused product of the year’ in its 5th annual Golden Kitty Awards.

6. Chainlink (LINK)

A perennial crowd favorite, Chainlink has added 19310 new addresses in January, with a daily peak of 1091 new addresses recorded on January 17th.

The decentralized oracle network recently published a list of price reference data for 25 oracle networks live on Ethereum Mainnet - a significant uptick compared to the 7 networks available back in October.

“Collectively”, boasts the project, “these decentralized oracle networks secure over 100M USD in value for a variety of leading DeFi products across numerous financial markets, such as ETH/USD, BTC/USD, XAG/USD, MKR/ETH, and more”

7. 0x (ZRX)

Representing Ethereum-based DEXes in the top 10, 0x (ZRX) has added 8786 new addresses to its network in January 2020.

It’s been a big few months for the decentralized exchange protocol; for one, the ability to delegate ZRX tokens to staking pools was ushered in with (v3) of the protocol, following a community vote last December.

By the end of January, over 11 million ZRX had already been staked with 0x market makers.

8. Standard Tokenization Protocol (STPT)

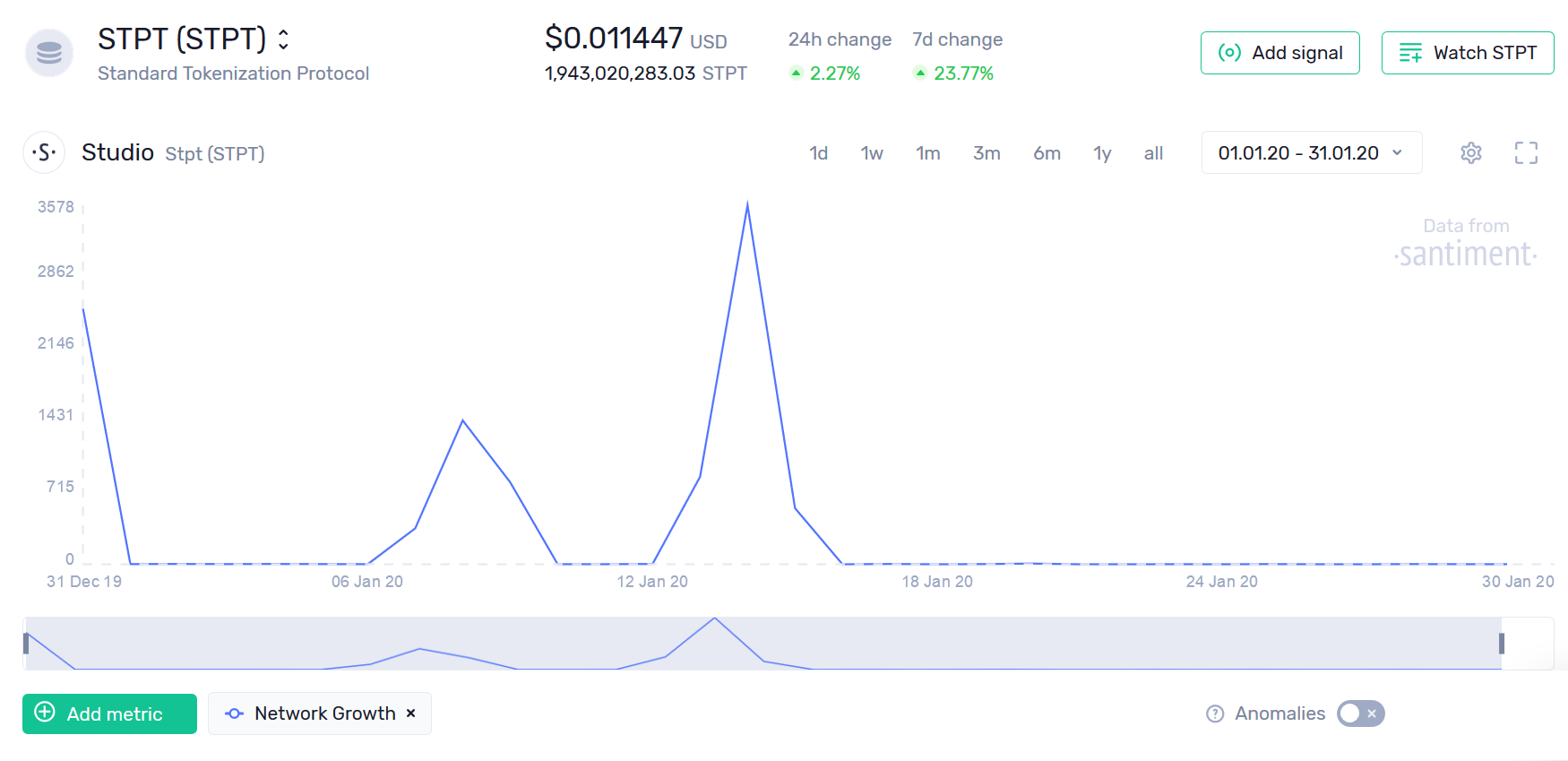

Probably the biggest surprise on thE list, the STP Network’s native token STPT claims the #8 spot with 7658 new addresses introduced to the network during the course of last month.

Compared to other entries on the list, STPT’s on-chain activity seems the least ‘organic’. 65% of its January growth occurred during two days - January 8th (1434 addresses) and January 14th (3578 addresses).

Looking through the token’s etherscan history, there are hundreds of 1 STPT transactions on said dates, stemming from two main sender addresses, possibly from an airdrop or a giveaway.

9. TrueUSD (TUSD)

Joining the other stablecoins on the list is TrustToken’s TrueUSD, with 4233 new addresses added to the network in January.

TUSD remains the fourth biggest stablecoin overall with the current market cap of just above $138m. Its January on-chain activity peaked on the 14th, with the addition of 257 new addresses.

- 10. Molecular Future (MOF)

Rounding up the top 10 erc-20 projects by network growth is Molecular Future (MOF) - a self-proclaimed ‘one-stop global digital asset investment service platform’ - with 4090 new addresses introduced to the network in January.

MOF’s address growth is likely exacerbated by several distribution events to start the year, like an OKEx airdrop in early January or the recent BiKi listing giveaway. Despite the growth spurt, the price of the MOF token has declined by 11.6% in January.

Finally, if you want to explore Network Growth and other fundamental indicators for 900+ coins, head over to Sanbase to get a fresh perspective on the crypto market and the behavior of its stakeholders.

Conversations (0)