Their Pain is Your Pleasure: Assets With Universal Short, Mid, and Long-Term Trading Losses

Much can be said about January, 2022. Mainly, not so great things for the crypto bulls out there who have watched markets continue to slide with every "buy the dip" call seeming to get wiped out in rapid fashion.

But as we've learned with the continued relentless cycles of cryptocurrency, every extended period of loss generally brings opportunities for traders who are patient enough, and have kept enough fiat & stablecoins on the sidelines in preparation for these corrections.

With Bitcoin dropping -21% and Ethereum dropping -33% in January, with the month coming to a soon close, the vast majority of projects are deeply in the red to kick off 2022. This means that average returns of traders aren't doing so hot as of late. And with that, opportunities to open positions and dip buy have come into play for those courageous enough to do so.

As we have touched on in previous content pieces and videos, MVRV is a great metric to gauge how deep traders are into pain or euphoria zones. We commonly like to look at an asset's 30-day MVRV, specifically, because it reveals what weekly swing traders can likely take advantage of, as far as mid-term trading goes.

But lately, our community has become more interested in methods to average several different MVRV timeframes together. 30-day timeframes can be a nice happy medium, but blending in how much pain short-term, mid-term, and long-term traders are experiencing all together, can paint an even clearer picture.

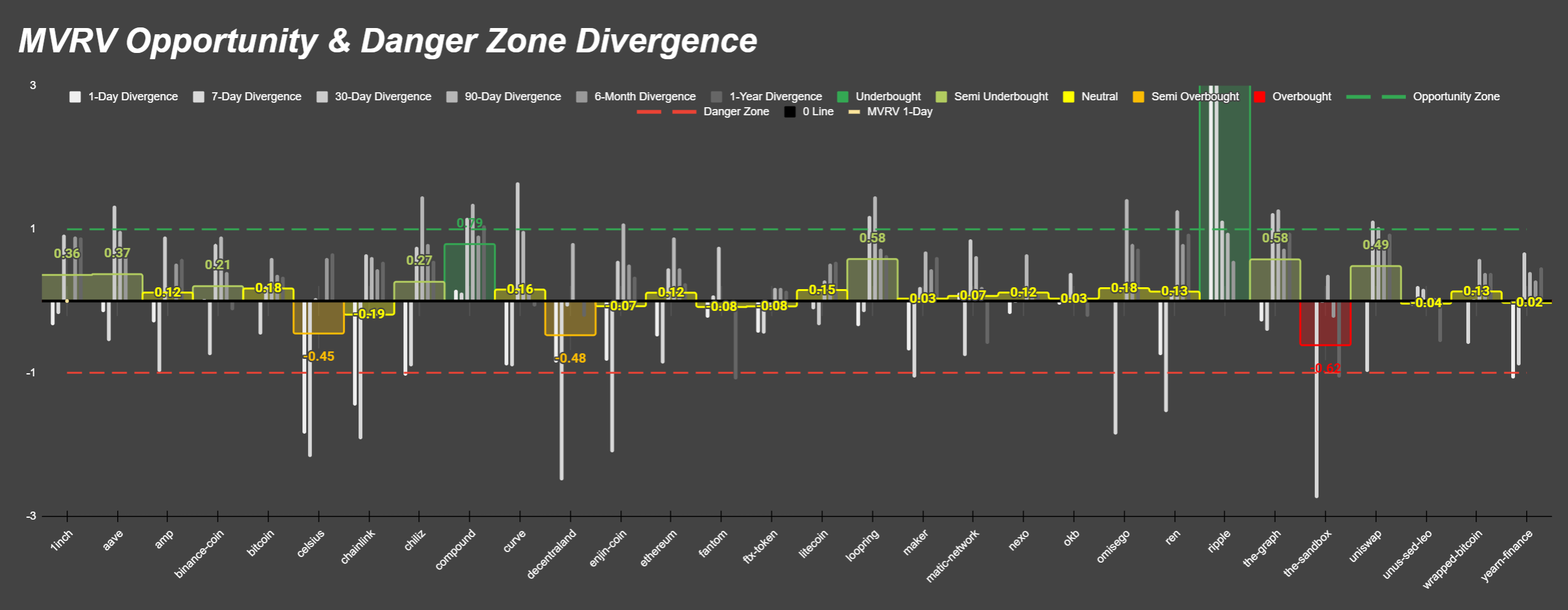

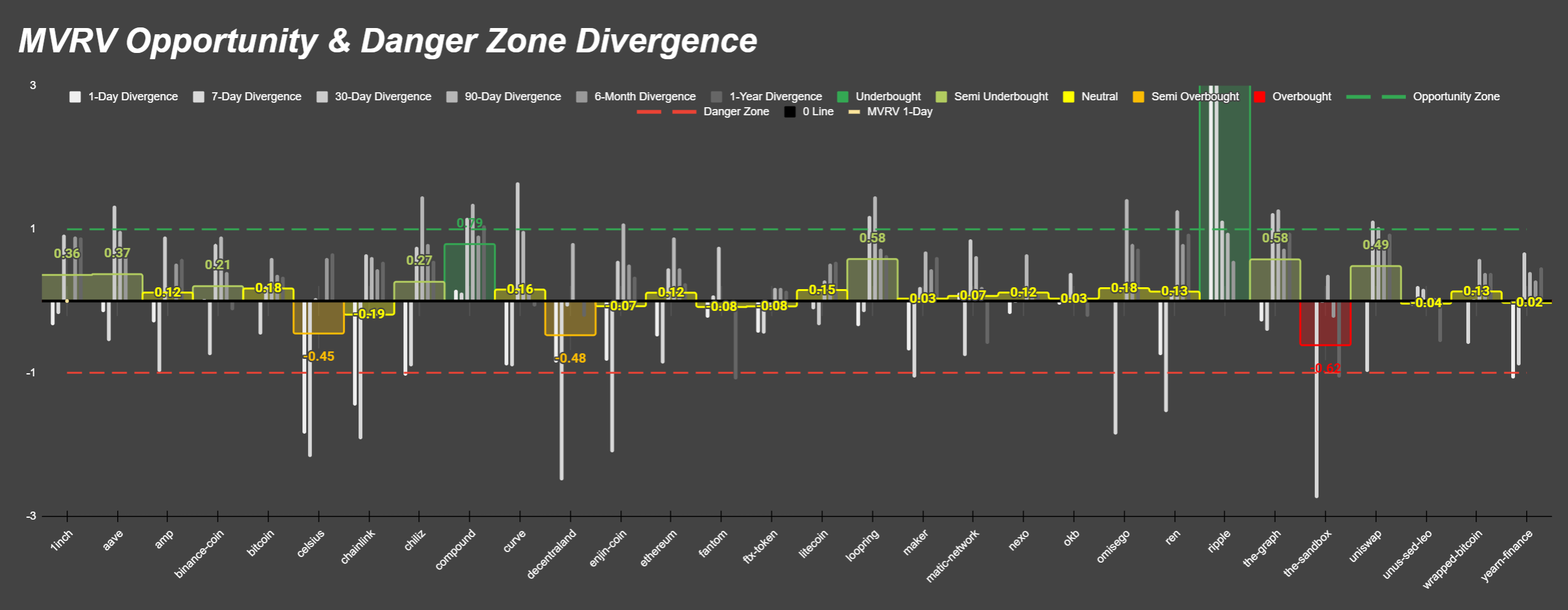

Above, we see some of the top 150 market cap altcoins, and how close they are to historical opportunity zones (highlighted by the dashed green line) and historical danger zones (highlighted by the dashed red line).

With crypto markets on a pretty major correction for the past 11+ weeks since Bitcoin's all-time high on November 10, 2020, the long-term returns for traders have been hit hard. However, this past week has seen a mild recovery for altcoins, so these have kept average returns at bay.

Here are some quick highlights of six top 150 assets that still have good justification for buys, based on buying low while other traders are feeling the hurt:

XRP Network ($XRP) - Market Cap Rank: 8

It's pretty shocking to see XRP down as the 8th largest asset by market cap now, after a multi-year stretch of being known as the largest crypto asset not named Bitcoin or Ethereum. The polarizing project is at its most negative average MVRV level since late June. It was last in positive territory in mid-December, making it a solid candidate to have a price upswing to bring traders some relief.

Compound ($COMP) - Market Cap Rank: 92

Compound is also at its most negative average MVRV level since late June. It was last in positive territory in early November.

The Graph ($GRT) - Market Cap Rank: 54

The Graph is at all-time low MVRV levels now, a stark contrast from where things were looking about a year ago, when traders were enjoying some gaudy returns! Its average MVRV was last positive in late November.

Loopring ($LRC) - Market Cap Rank: 31

Loopring has already been in the midst of a nice-sized bounce compared to the rest of the altcoin pack over the past week. It is still in a nice, deep negative average MVRV spot, although if you had come in last week, it would have been at an all-time best opportunity level.

Uniswap ($UNI) - Market Cap Rank: 68

Uniswap's Average MVRV is at all-time negative MVRV levels, and it's threatening going below $10 again after breaking below this threshold last week, for the first time in over a year. With average trading returns already so low, though, there's a good chance that there is no revisit. An uptick in the general crypto markets may go very well for a mostly respected altcoin like UNI.

Aave ($AAVE) - Market Cap Rank: 51

It may not be clear due to the massive skew in Aave's Average MVRV axis thanks to an enormous surge from last year that made it seem as though negative territory would never happen. But here we are... AAVE is sitting at near all-time negative levels, which is great to see if you're considering buying. It last visited positive average MVRV very briefly in early November.

Disclaimer: The opinions expressed in this report are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.