The Unicorn strikes back - Part 1

Well well, it didn't take too long since our last post on Sushiswap where we mentioned it was only a matter of time that Uniswap launched something in response to the Sushiswap/Uniswap drama.

Today, UNI, a governance token for the Uniswap protocol was launched.

Let's take a quick look.

UNI Tokenomics

Below are the token details extracted from Uniswap's official announcement.

Allocation

Total supply for 4 years: 1 billion UNI (minted at genesis)

After 4 years: Perpetual inflation rate of 2% per year kicks

Current circulating supply: 59,761,093 / 1,000,000,000 (according to Coingecko)

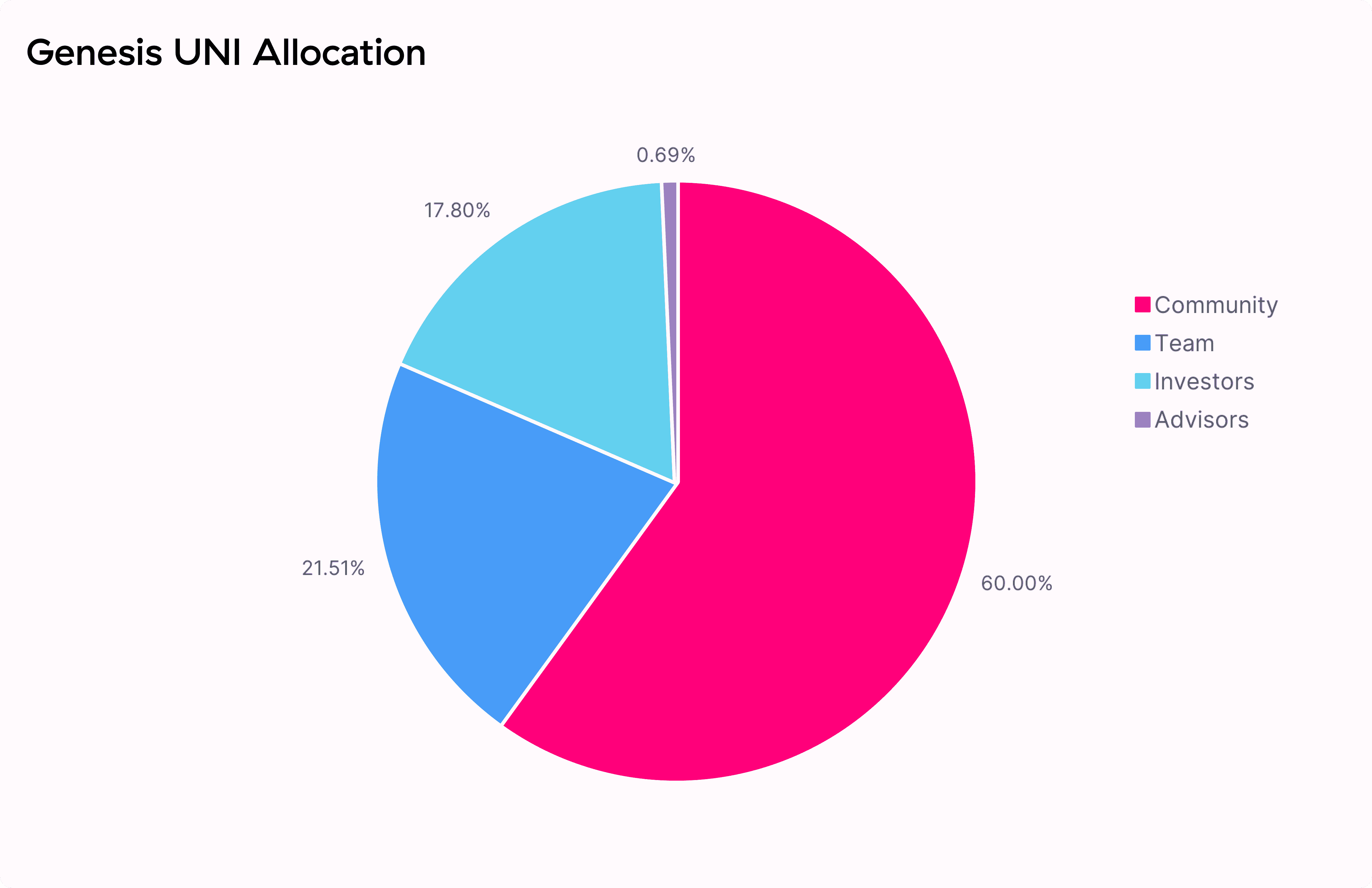

The initial four year allocation is as follows:

- 60.00% to Uniswap community members [600,000,000 UNI]

- 21.51% to team members and future employees with 4-year vesting [215,101,000 UNI]

- 17.80% to investors with 4-year vesting [178,000,000 UNI]

- .069% to advisors with 4-year vesting [6,899,000 UNI]

UNI is inflationary and has a perpetual inflation rate of 2% per year that kicks in after year 4 to ensure continued participation and contribution to Uniswap at the expense of passive UNI holders.

Release schedule

Community tokens will be split into three main batches:

1. 150,000,000 UNI can immediately be claimed by historical liquidity providers, users, and SOCKS redeemers/holders based on a snapshot ending September 1, 2020, at 12:00 am UTC.

Instructions on how to claim your UNI can be found in the Claiming your UNI section of this post.

2. 20,000,000 UNI is set aside for liquidity mining program that will go live September 18 2020 12:00am UTC. The initial program will run until November 17 2020 12:00am UTC and target the following four pools on Uniswap v2:

- ETH/USDT

- ETH/USDC

- ETH/DAI

- ETH/WBTC

5,000,000 UNI will be allocated per pool to LPs proportional to liquidity, which roughly translates to:

- 83,333.33 UNI per pool per day

- 54 UNI per pool per block

These UNI are not subject to vesting or lock up. Head over here to begin farming.

3. The remaining 430,000,000 UNI will be held in a governance treasury to distribute on an ongoing basis through contributor grants, community initiatives, liquidity mining , and other programs.

UNI will vest to the governance treasury on a continuous basis according to the following schedule. Governance will have access to vested UNI starting October 18 2020 12:00am UTC.

Head over here to participate in Uniswap's governance.

Team, investor, and advisor UNI allocations will have tokens locked up on an identical schedule.

Claiming your UNI

Head over to Uniswap , click on the "..." button and select "Claim UNI" to begin.

If the current ETH address you are using is eligible, it'll show amount of UNI in the popup. Else, just key in a wallet address that you think might be eligible into the Recipient box to check whether it is eligible.

Do note that gas fees are really high at the moment as everyone's trying to claim their token to sell. If you are not intending to sell it, there's really no point in wasting gas fees.

Otherwise, if you find yourself stuck with any pending transactions, here's a good tutorial to fix it.

Claims breakdown

According to this UNI Token claims dashboard, there are

Total UNI token claimers: 114,536

Total UNI claimed so far: 71,324,174 UNI ( $256,767,026.4 USD)

Amt of UNI unclaimed: 78,675,826 UNI ($283,232,973.6 USD)

There's probably quite a number of unclaimed tokens at the moment due to ETH's network congestion. Just look at the amount of pending transactions trying to interact with the distribution contract:

Top 10 UNI claimers

1,199,494.611096 - 0x274d9e726844ab52e351e8f1272e7fc3f58b7e5f

1,158,433.532808 - 0xd03f3e6c1b7272aa1f2336c1856a74d759fd0a6a

985,486.326243 - 0xf6b6f07862a02c85628b3a9688beae07fea9c863

909,281.912737 - 0x6fdabcd4c1b926310f5a8c4c00efefba3c8dbef4

866,651.105649 - 0x285306442cd985cab2c30515cfdab106fca7bc44

855,723.757191 - 0x46499275b5c4d67dfa46b92d89aada3158ea392e

739,141.602249 - 0x9c5083dd4838e120dbeac44c052179692aa5dac5

654,655.237089 - 0x741aa7cfb2c7bf2a1e7d4da2e3df6a56ca4131f3

638,395.452838 - 0x414a13329d426280567603c310f87b35eacb7e21

556,053.553474 - 0xd3a3eb0de0ffbb27fa32f2cebf38f8814b7af62f

What were the claimers doing after they got their UNI?

From the look of things, it appears that most 400 UNI ($1,440 USD) claimers are offloading it on Uniswap's UNI/ETH pool as soon as they receive it.

It's hard not to since most are considering UNI as a stimulus package airdrop.

Thank you Uniswap for the great gift!

So, what might you be doing with yours?

This wraps up The Unicorn Strike Back - Part 1. Stay tuned for Part 2 where we'll be taking a deeper dive into UNI and the price action.

Conversations (0)