SwissBorg ×100 or how to spot smart money moves

SwissBorg is financial mobile app with a native CHSB utility token. It has been ranging for months until it began gaining value in early 2020. Multiplied 160 times since then. And of course there are some entities profiting from it. 'Institutionals' in CHSB. What if we could follow smart money moves?

Today we noticed some specific onchain activity in SwissBorg tokens. Something making us to raise a yellow flag on CHSB. A sort of concern and signs of possible cooling down and short term correction.

What is it?

First, we noticed Swissborg on our Exchange Inflow Screener:

CHSB minichart looking relatively calm despite exchange inflow spike. Could this spike affect price very soon? In which direction?

Second, we checked CHSB exchange inflow chart:

How do we read this: a lot of CHSB deposited to exchange last day. And price hasn't moved yet.

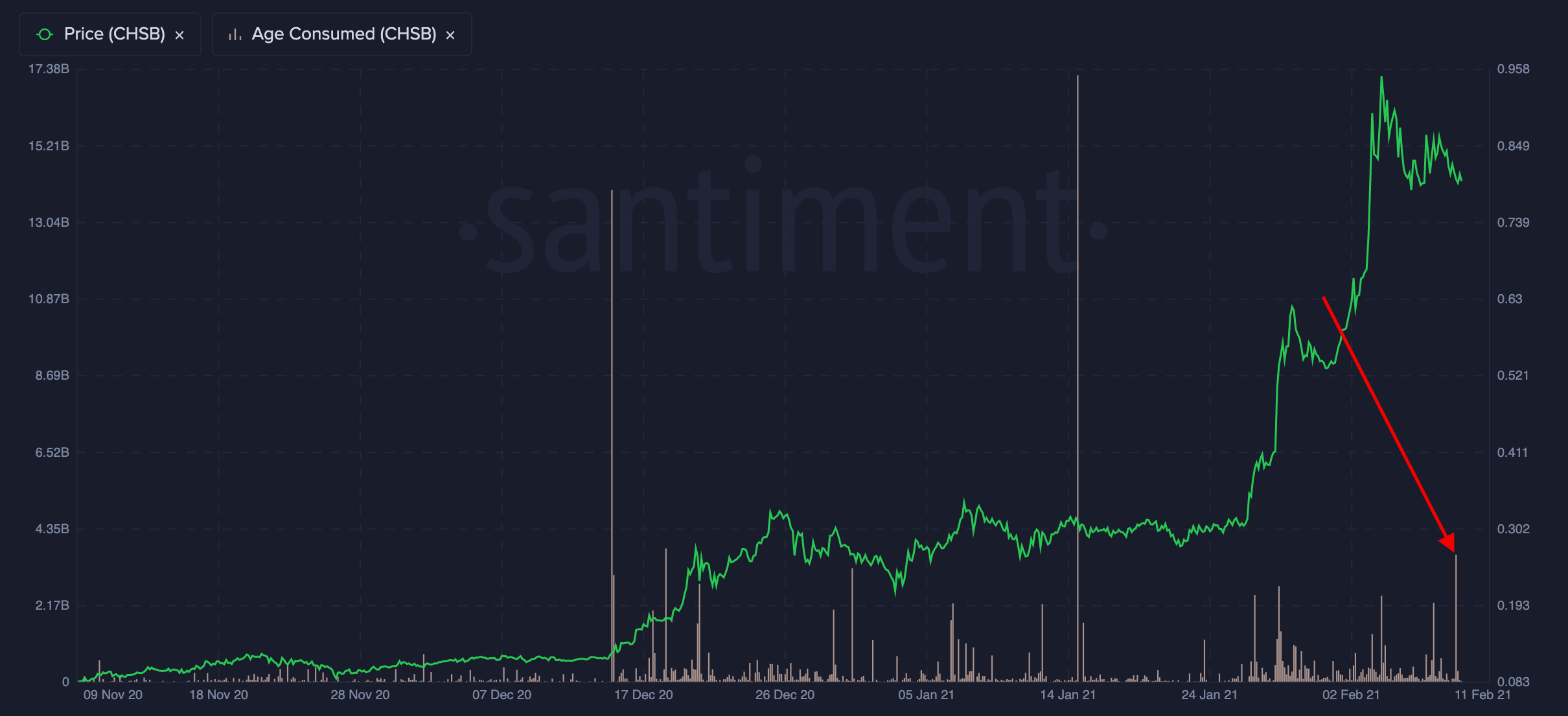

Third, checking age consumed:

Latest spike is telling us that relatively dormant tokens were involved in third high exchange deposit. Old holder cashing out on top?

Four, CHSB network profit loss chart:

Here we can see that tokens deposited to exchange have a huge profit potential if owner decides to sell (last spike).

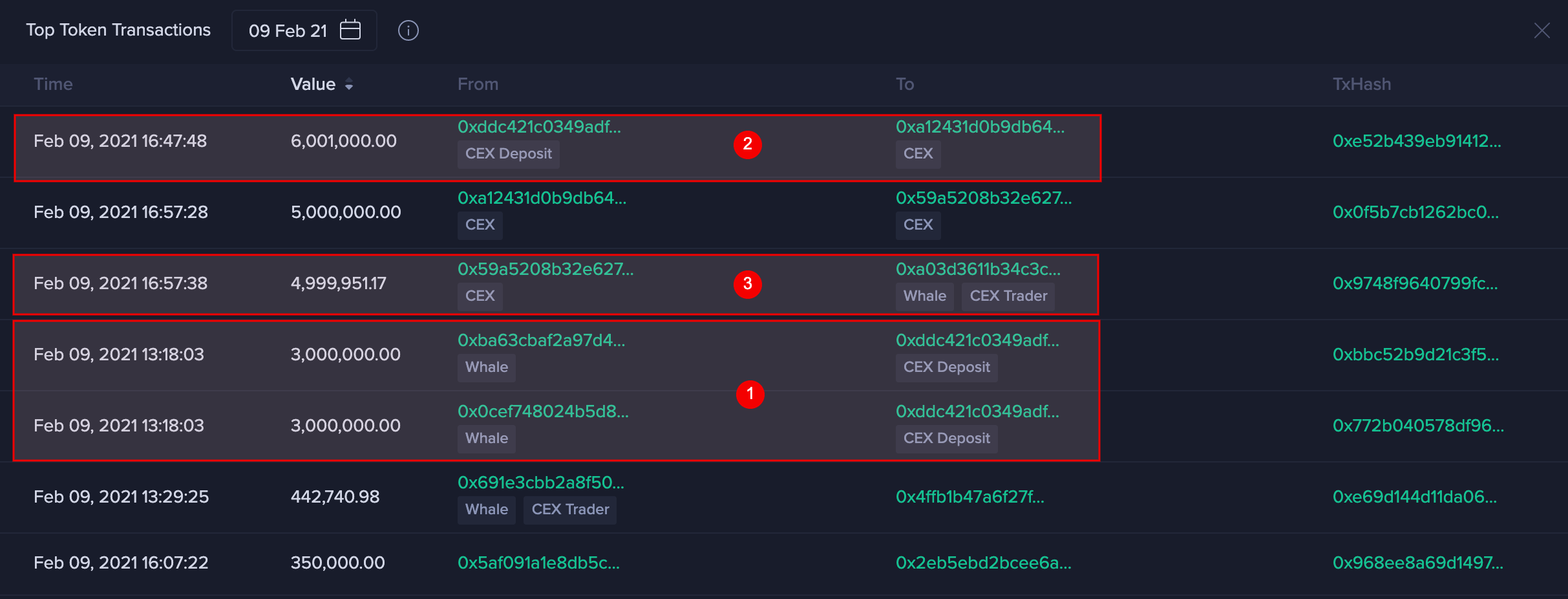

Summoning top token transactions table to find out details:

Above is the biggest transaction at the moment of finding this story. A "whale" moving 3,000,000 CHSB to "CEX Deposit" address. Who is this "whale"? Clicking on it's address:

Nice! This address obtains 4.23M CHSB at around 0.009 USD, cuts 3M CHSB and deposits to exchange at around 0.836 USD. Multiplier is x93 👏

Next, let me introduce you a tool vusualizing CHSB flow through an address. Scrolling down a bit and clicking "Show Money Flow Infographic":

Here we can see that:

- 4.23M CHSB were born in SwissBorg Deployer contract

- 4.23M CHSB took part in 2 Referendums

- 3M CHSB went to CEX deposit address and then to Huobi exchange

- 1.23M CHSB remains untouched

By the way, Nansen has a "BitGo Multisig" label attached to the same wallet. And BitGo is an "Institutional digital asset platform".

Next, a top transactions table has this story continued while I'm writing this:

- 1. "BitGo" multisig and one other entity moving 3M+3M CHSB to an exchange deposit address

2. 6M CHSB moving to Huobi

3. 4.9M CHSB returning from Huobi to "SwissBorg 2" vault, probably an internal project wallet.

So the whole story could be something like this:

- BitGo acquiring 4M CHSB at the very bottom

- BitGo taking part in SwissBorg governance twice

- BitGo selling 3M CHSB at the top gaining almost 100x profit

- SwissBorg successfully absorbing 5 of 6 millions CHSB on Huobi, minimizing sell pressure

Here we are. A single institutional exit noticed and uncovered using Santiment toolset.

Hope the above use case might be useful for your research.

CHSB network profit loss chart

Historical balance and money flow

—

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Conversations (3)

great, thanks for that research and a summary!

<3 amazing

truly amazing, bravo!