Stakeholder Analysis: KNC pumps to 18-month high

Despite its minor weekend dip, KNC has been one of the top performing ERC-20 coins over the past 7 days. In a week where the entire crypto market cap shrunk by a collective 1.23%, Kyber Network’s native token gained 29.4%, hitting an 18-month high and briefly breaking its $0.6 resistance level in the latest stint of its 2-month long rally:

Regardless of its fundamentals (we’ll get into those in a minute), KNC’s latest push upwards has mainly been news-driven. On February 19th, Coinbase Pro officially announced the imminent addition of KNC to their trading platform:

“On Monday, February 24, transfer KNC into your Coinbase Pro account ahead of trading. Support for KNC will be available in Coinbase’s supported jurisdiction, with the exception of New York State and the United Kingdom.“

We’ve yet to see whether the coin is also to be listed on Coinbase.com or any of its retail-friendly apps, but that wouldn’t be much of a precedent given the platform’s track record with other coin listings in the past few months.

In either case, KNC appeared to be poised for correction prior to the Coinbase news, but has since gone ballistic to retest the $0.6 mark for the first time in over 18 months.

So where could we go from here? A day before the big listing, let’s check in on KNC’s fundamentals using a variety of Santiment’s on-chain and custom social indicators.

In this post we’ll break down the recent behavior of five different Kyber stakeholders:

- 1. KNC Token Users

- 2. The crypto community

- 3. KNC Speculators

- 4. KNC Whales

- 5. The KNC team

Let’s jump straight into it:

1. KNC Token Users

While it’s had itself a pretty solid January, Kyber’s on-chain activity has positively exploded over the last 20 days, mirroring the second leg of its rally.

The number of total network participants peaked four days ago (February 20th), when 902 daily addresses interacted with (sent or received) the KNC token - an 11-month high:

In a similar vein, we’ve seen a major spike in the coin’s network growth - the number of brand new addresses created on the network - over the same time span, ebbing and flowing with KNC’s short-term price action. On February 20th, a total of 482 new addresses were added to the Kyber Network - also an 11-month high:

In terms of the actual value being transferred on the network, the growth in KNC’s (on-chain) transaction volume hasn’t been quite as explosive. More and more tokens are being involved in daily transactions recently, but the overall activity has remained relatively consistent with KNC’s other recent tops. At its latest peak (Feb 20th), about 18.7 million KNC (~$9.78m at the time) have been transferred on the network.

A common indicator of a forming price top comes at major divergences in a coin’s network activity (telegraphed by its daily addresses, network growth and on-chain volume) and its price action. I’d definitely keep an eye on KNC’s on-chain behavior over the next few days - should we see a decline in the above metrics despite the price still trying to chart new highs, we might be due for a correction.

Another important signal is the massive spike in KNC’s Token Age Consumed, developing on the charts in the last few hours:

A spike in Token Age Consumed means that some dormant coins that haven’t moved in a long time - likely belonging to long-term HODLers or ICO participants - have started to change addresses again. This can often be a potent sign of upcoming volatility - one way or another; as you can see, previous spikes have often marked major trend changes in KNC’s short-term price action.

The above spike is further corroborated by a recent bump in the % of existing KNC coins that have been active in the last year:

We’ll look for clues as to where these coins might be headed in the ‘speculators’ section.

2. The crypto community

Judging by our social media data, the cryptoverse has also started to take notice of KNC’s recent action.

Santiment tracks over 1000 crypto social media channels (on Telegram, Reddit, Discord, Twitter and more), and calculates the total amount of coin mentions in messages, comments and discussion threads. Here’s the 6-month social volume for KNC:

As you can tell, the coin has been growing more and more popular on crypto social media throughout the rally. The amount of KNC-related chatter peaked on February 20th, with over 335 new mentions of the coin recorded by Sanbase.

The same seems to be supported on our Relative Social Dominance chart, which plots KNC’s social popularity against other top coins like BTC, ETH and XRP. We can see KNC (bottom grey) claiming a slightly bigger piece of the social pie in the second half of February:

Still, the Kyber hype seems to have been dying down a bit in the past few days, with just over 170 new mentions of the coin recorded in the last 24 hours.

Over on the Kyber Network Telegram group, however, the mood is still festive ahead of the looming Coinbase Pro listing, as you can see in our Social Data Feed:

Despite the Coinbase news, the overall KNC-related sentiment has been trending slightly negative over the past few days, according to our social sentiment algorithm:

Its most recent correction came when KNC-related sentiment was at a month-high, so a bit of FUD might actually prove useful for the coin’s continued growth.

3. KNC speculators

It’s fair to assume that KNC’s elevated on-chain activity over the past 20 days is mostly due to a growing speculative interest in the coin.

Looking at its Exchange Flow Balance - which calculates the difference between the inflow and outflow of KNC to centralized exchanges - we can clearly time the indicator’s rising volatility with the second leg of KNC’s rally:

Though the above graph is a bit noisy, the overall amount of KNC on exchanges has been growing rapidly in the past few days, from 55.8m on February 19th to 57.8m yesterday - a 2M increase (~$1,186,000).

A rising share of the coin in exchange wallets might indicate additional sell pressure for the bulls to absorb. That said, there has been a slight dip in exchange-bound KNC in the last 24 hours, with about 800,000 KNC being transferred off exchanges.

So how are KNC investors doing at the moment? Pretty good, it looks like. KNC’s MVRV ratio - which calculates the average profit/loss among its holders - has hit a 20-month high both for its long-term HODLers and ‘new money’.

Those that bought KNC within the last 365 days are, on average, currently up 84.7% on their investment. Conversely, those that got into KNC within the last 60 days, are, on average, up 9.6% on their initial investment.

As the MVRV ratio rises, so does the pressure for different holder cohorts to cash out and reap profits, which could crash the market. Naturally, MVRV always peaks with the price - the issue, however, is that one can’t be sure at which MVRV levels most KNC holders will finally decide to ditch their bags and call ‘bank’.

We can, however, look at historical MVRV levels to see how KNC’s holders behaved in previous rallies. Given that the current MVRV levels mirror, or overshadow KNC’s 2018 top (and all of 2019), investor caution is warranted.

Finally, we should spend a minute on KNC’s Maximal Mean Age chart, which calculates the average ‘age’ of all dollars invested to buy the coins. There’s been a major dip in KNC’s mean age in the last couple of days (meaning that the average ‘age’ of dollars used to buy KNC is declining), which has historically indicated major trend shifts for the coin and earmarked several price tops:

That said, most altcoins are still a whale’s playground - so what have the major KNC bag holders been up to recently?

4. KNC Whales

When your whales start dumping, you might be in trouble.

According to Sandata, several major KNC cohorts have been reducing their holdings as of late. The Top Holders chart shows the cumulative balance of top 100 KNC-holding addresses, separated by exchange and non-exchange wallets.

As you can see, the biggest non-exchange addresses (blue) have dumped more than 10m KNC since January 9th, offloading their holdings throughout the rally:

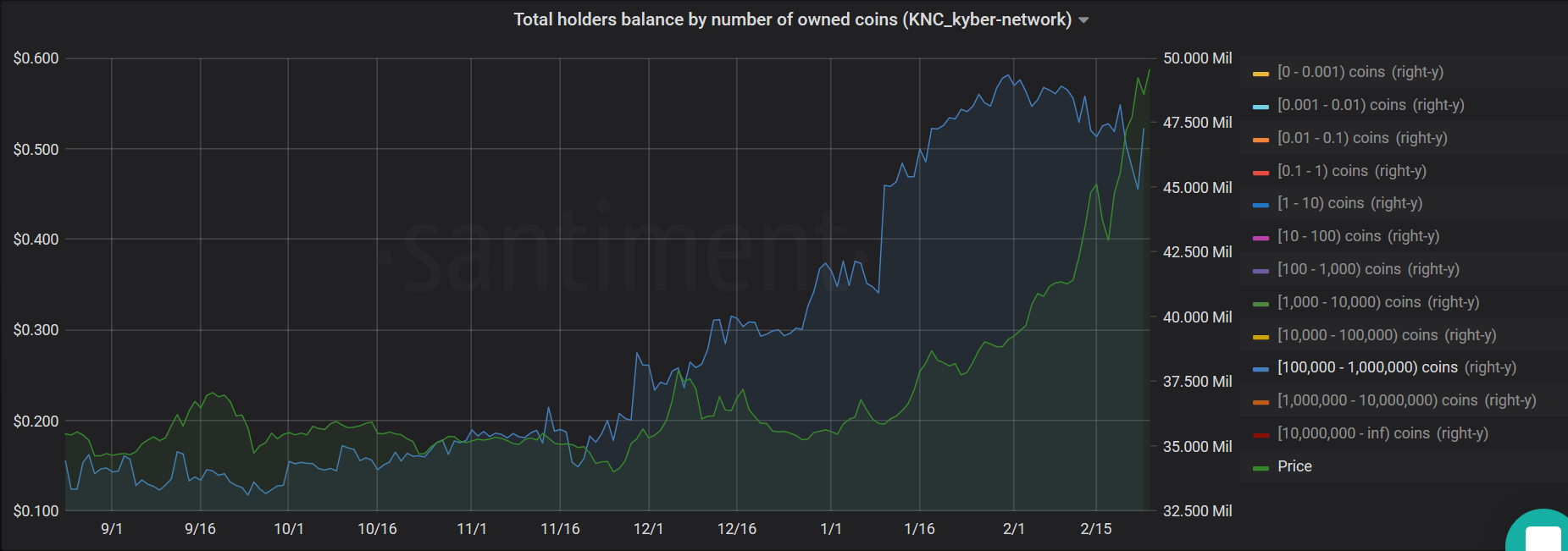

While they’ve been accumulating steadily for the past 6 months, we’ve also seen some recent dips in the cumulative balance of all addresses holding between 100k-1m KNC, which offloaded ~2.2M KNC before the latest top:

Finally, Sandata lets us get super-granular by looking at the biggest individual transfers of any ERC-20 coin for a given time frame. Here’s a snippet of some of the biggest KNC transfers in the past week:

By analyzing these transactions, we can find several whales who have been looking to dump or reduce their KNC exposure over the past few days, including:

- 1. This address, which sent 1.4m KNC (~$728.8k at the time of transfer) to an interim address before dumping it all on Binance shortly afterwards:

Pasting this address in our Historical Balance tool reveals that this is/was a long-time KNC investor, virtually HODLing since the ICO days before finally deciding to dump its entire position 3 days ago:

- 2. This address, which transferred 822,385 KNC (~$463,000 at the time) to an interim address and finally to a known Binance wallet:

Using our Historical Balance tool again, we can tell this address came into most of its KNC on December 23rd before dumping most of its stash early on Friday, and pocketing about 206.4% profit:

- 3. There are also some whales worth keeping an eye on, like this address that received 5M KNC (~$2.9m) about 9 hours ago.

What’s interesting about this address is that it has only ever interacted with one other ERC-20 coin - HXRO. In fact, it dumped 20M of it to Bittrex 19 days ago, right at the coin’s most recent top:

Judging by its past behavior, this address sure knows how to make its mark on the coin’s price action. It has yet to start moving its KNC bags - here’s a public signal to alert you when he does.

5. The KNC Team

Finally, there’s been a few interesting developments with Kyber’ own team that warrant a quick mention.

At Santiment, we track the ETH balances of all ERC-20 team wallets, as well as the team’s historical interaction with the raised funds. On February 17th, the Kyber team moved 10,000 ETH, the second-biggest transfer in the project’s history:

Examining the team wallet’s recent transactions, it’s not immediately clear where the funds are headed - around half of it found its way to this contract, while about 4k ETH ended up in this address.

If you have more information on what prompted the move or the nature of the receiving contract, let me know.

And finally, while it’s unlikely to impact the short-term price action of their native coin, it’s always good to highlight Kyber’s ongoing development activity.

The Kyber Network team continues to work on polishing and developing its platform, as evident by the fact that their Github activity has recently hit a 10-month high:

Regardless of where the current rally may end, it seems that the team is hard at work on the upcoming Katalyst upgrade, which will introduce a number of novelties to the Kyber ecosystem, including staking rewards, DAO governance and much more.