Stablecoin Activity Should Have Drastic Impact on Crypto's Next Moves

Major stablecoin activity is often largely ignored when it comes to analyzing where crypto prices will be heading next. But more and more, we are uncovering evidence that a key move by a top stablecoin can hint at when markets are about to have a dramatic turnaround.

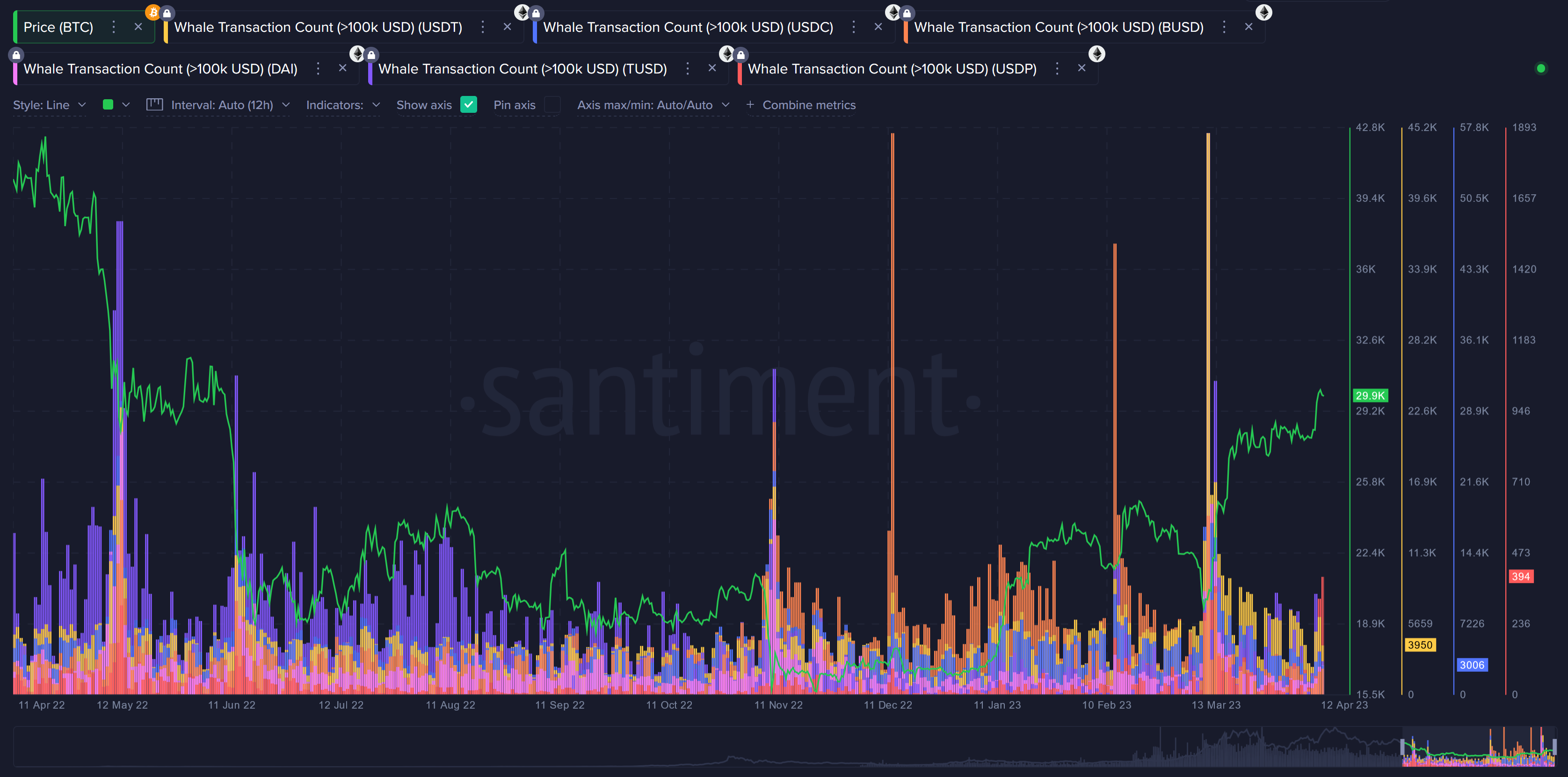

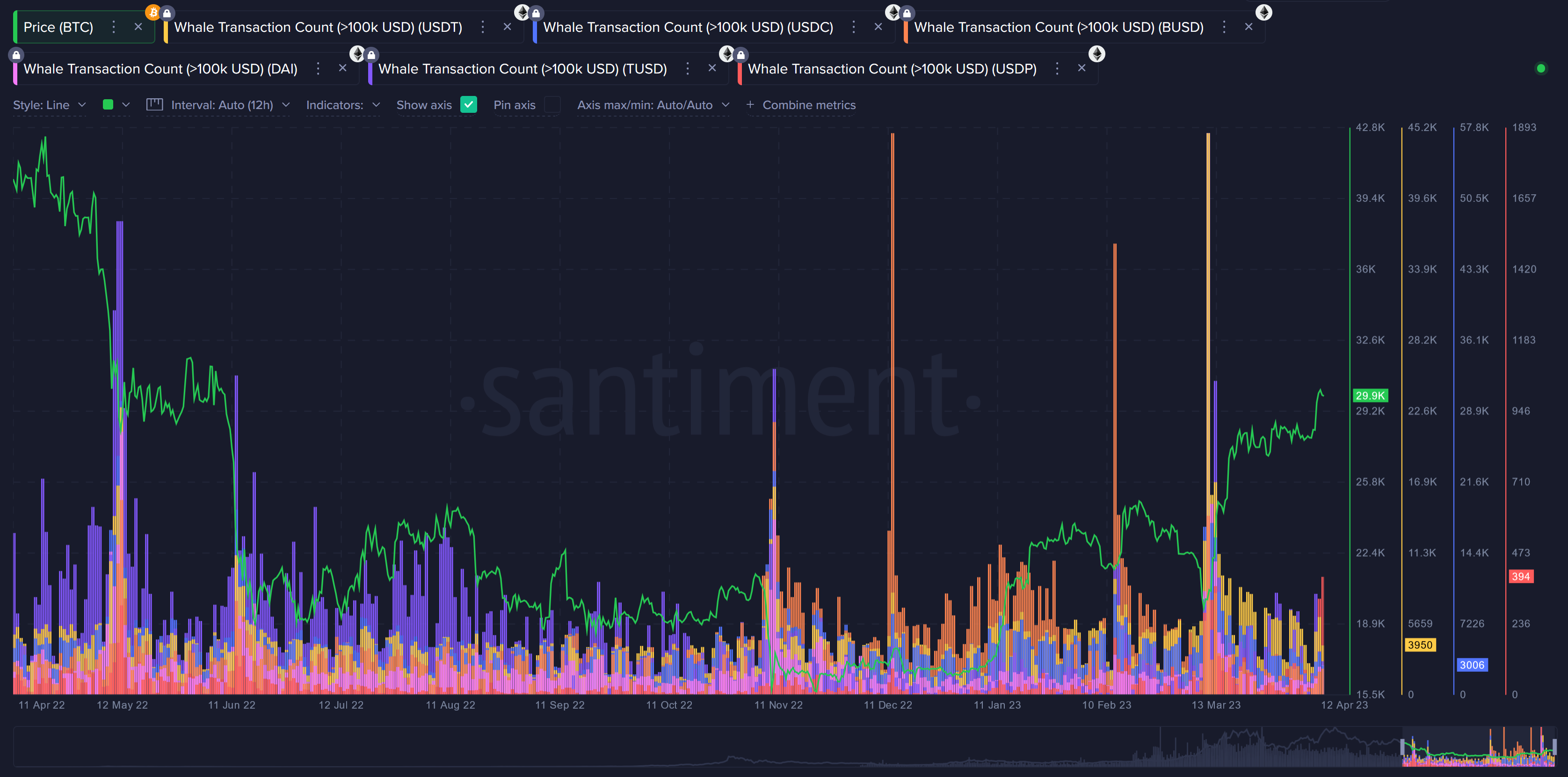

Take, for example, the levels of $100k+ whale transactions happening for the 6 largest stablecoins by marketcap (USDT, USDC, BUSD, DAI, TUSD, and USDP).

We can see that in most instances on the above chart, key bounces in Bitcoin's prices occurred almost exactly when there was a spike in these whale transactions. For example, Tether (in yellow) saw its biggest spike by mar on March 11th, and Bitcoin immediately blasted off. And on February 13th, we can see that prices had a more short-term recovery after Binance USD was flooded with massive transactions.

And going back even further, November 10th (in the midst of the FTX collapse) was clearly a time with tons of stablecoin activity, which inevitably marked (more or less) the past year's local bottom for Bitcoin's price.

Today, you can see that there has been a bit of an uptick in USDP whale transactions. Since stablecoin whale transactions are most common when there is an interest in big money moving to exchanges to buy, we wouldn't be too concerned about this marking a local top for crypto. But there have been rare instances where stablecoin whale transactions can mark a bearish turnaround.

In terms of big money stablecoin holdings, this below chart shows the percentage of supply held by the top 6 stablecoins in terms of the tiers holding $100k to $10m. Generally, Santiment has found that these are the most telling levels of active traders that show how much buying power is available. When buying power is moving up, it's a positive sign that Bitcoin and crypto assets can move higher.

As of now, we are seeing some encouraging accumulation signs from BUSD (orange line) and DAI (yellow line) holders. TUSD (pink) and USDP (purple) are moving down, however. And Tether (red) and USD Coin (blue) have both been neutral for a few weeks now. The larger the stablecoin market cap, the more importance can be placed on it. So with Tether and USD Coin being flat, this overall picture points to neither a bullish or bearish argument as of now.

And finally, there is Mean Dollar Invested Age of stablecoins. This metrics can always be a sneaky good reflection of when some of the older, dormant addresses are finally waking up to make big moves that can have a dramatic impact on crypto prices.

TUSD (yellow) and USDP (teal) are the two stablecoins that have seen major dormant movement. USDP's line, especially, seemed to have a huge mean dollar age drop right as Bitcoin's price began bouncing up in early March. There is a case to be made that these big stablecoin moves were directly correlated to crypto's turnaround.

Overall, stablecoins can paint a very helpful picture as to how much buying power is going into crypto at any given point. Even with Bitcoin whales continuing to dump since mid-February, our stance is that prices were able to continue rising because stablecoin buying power was increasing. The scenario in which BTC and stablecoin whales are dumping simultaneously is the one you need to look out for, because this implies that big money is cashing out of crypto altogether.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.