Recovery Schmecovery

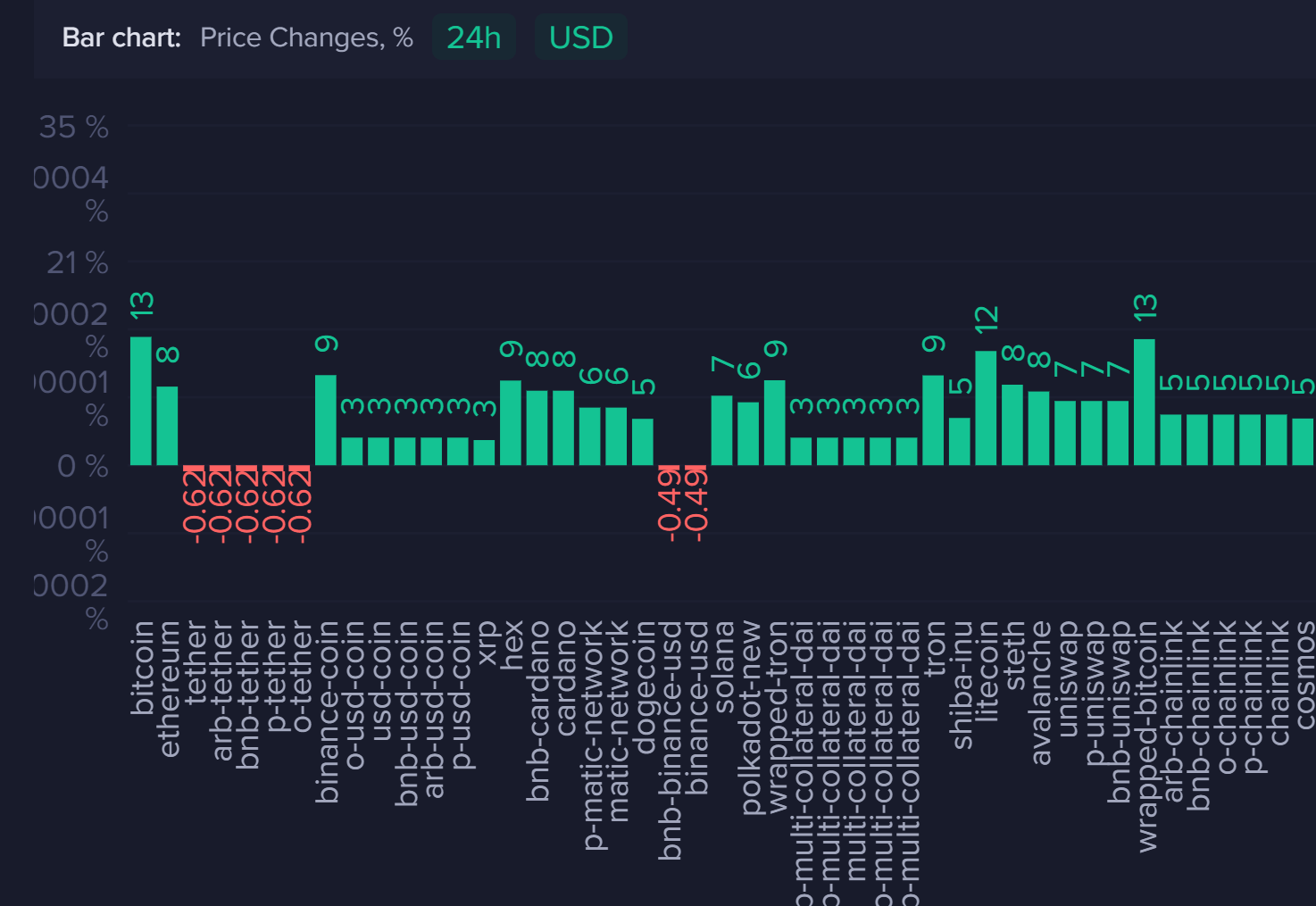

Is Monday's rebound actually legitimate? Or is this just a reaction to the Silicon Valley Bank fallout, general dropoff in bank valuations, and value of fiat falling?

Or could it be rumors that the Fed has pivoted from last week and may now cut interest rates? After all, prices had allegedly fallen in the first place due to expectations that the Fed was actually going to RAISE them.

And let's not forget about the massive flip between USDC and USDT whale holdings due to fears that USD Coin could potentially collapse. This FUD, at least for now, looks like it may have been overblown. But that hasn't stopped the large holders of these two stablecoins to have massively merged into Tether at the expense of USD Coin.

It's recommended to keep an eye on the price dominance of Bitcoin vs. other top cap altcoins. BTC had been giving up a lot of ground to alts to start the year, and this may be a nice signal of a trend change for the Bitcoin maxis.

And of course watch the excitement and FOMO levels around mentions of $25k. We did see a pretty huge spike when Bitcoin soared above $24k earlier today, which seemed to stop the price rally in its tracks. But if the euphoria tapers down a bit, it could be a good sign that we will indeed broach this level once again.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.