On-chain Overview #1: ImmutableX (IMX)

IMX is the top performing Layer 2 altcoin of 2023, leaving behind the likes of MATIC, OP, ARB and MNT and more. There are three ways to look at these abnormal performance and why IMX rallied so much.

- Fundamental perspective

- Technical perspective

- On-chain perspective.

In this insight, I will be focussing on the third aspect.

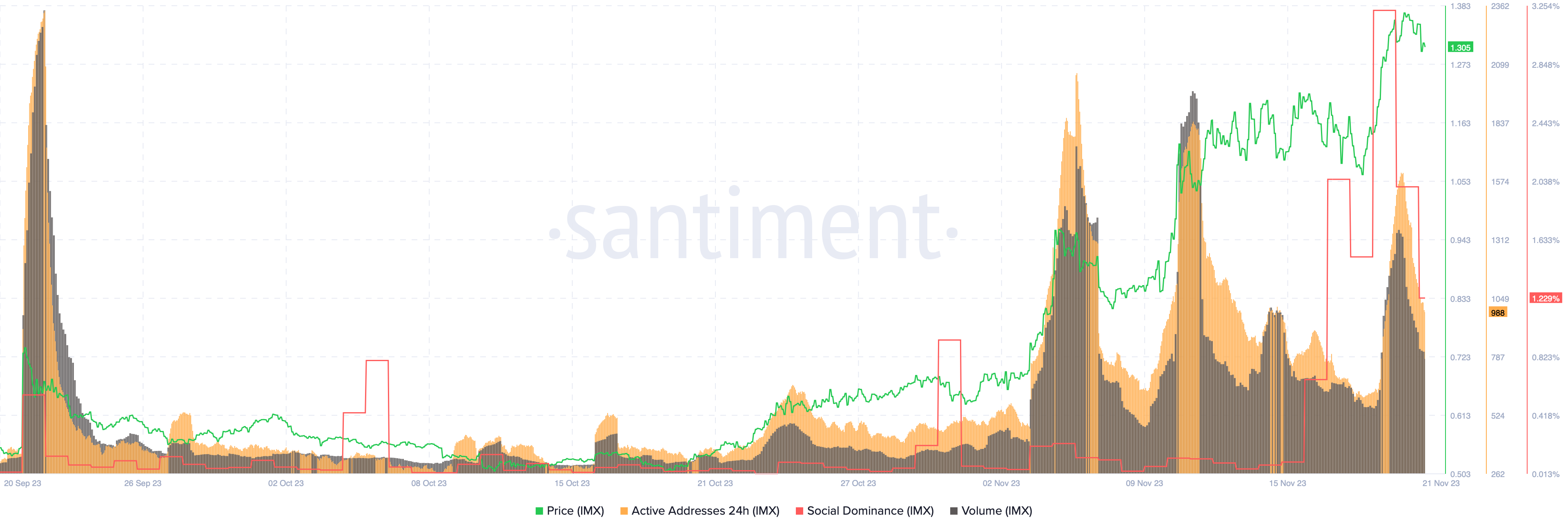

The Active Addresses, Social Dominance and Volume are all declining while the altcoin sets up higher highs. This is bearish divergence i.e., price rallies while the aforementioned metrics decline. It signifies a slowdown in the bullish momentum and signs of trend reversals.

Network Growth (NG), which shows an influx of new users. A drop in this metric clearly visualizes the declining in momentum and, in turn, the capital influx.

Between November 10 and 20, there is a bearish divergence between price and NG

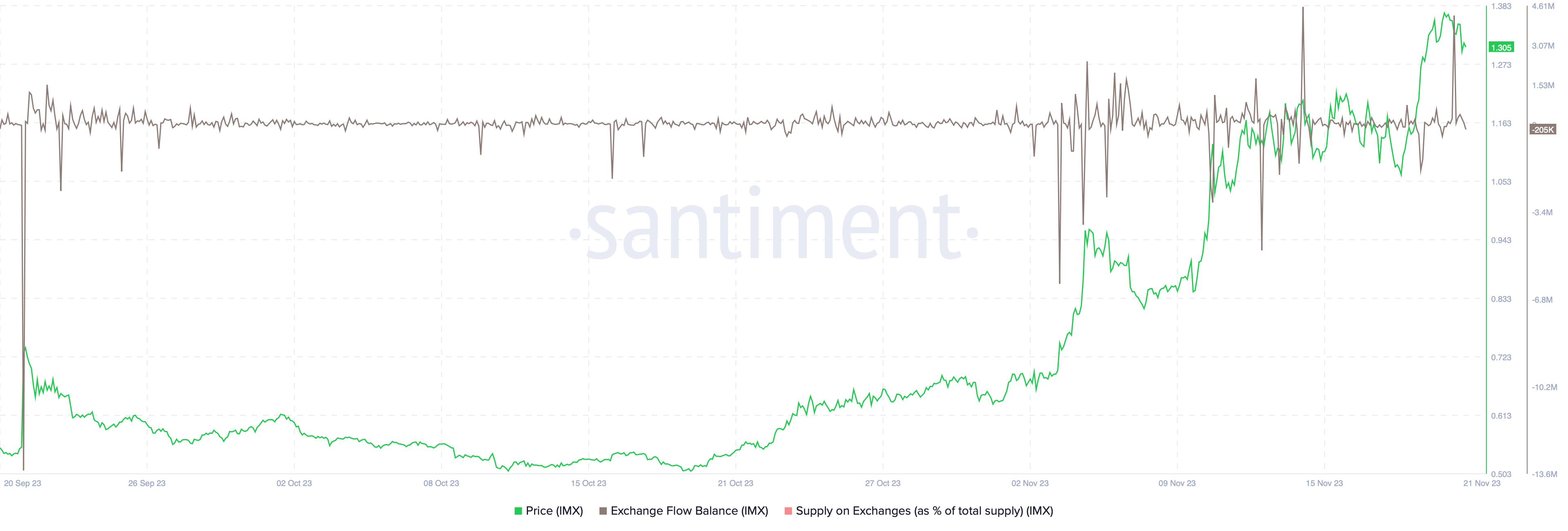

The Exchange Flow Balance has shown a significant spike on November 20. This uptick similar to the one on November 14, which triggered a 13% correction in IMX price from ~$1.20 to ~$1.09.

Will IMX correct now? Not really!

Read along to understand why?

The last time IMX's Exchange Flow Balance spiked on November 14, Network Realized Profit/Loss (NPL) and Whale Transaction Count (WTC) of $100k or higher also witnessed a similar uptick. The trifecta is what triggered a correction in IMX price.

The the 7-day MVRV is showcasing a bearish divergence, i.e., the 7-day MVRV has setup a lower highs on November 5, 11, and 19, whereas the IMX price has produced higher highs. This non-conformity hints at a potential trend reversal.

Lastly, a similar divergence is seen on the 30-day MVRV as well for the peaks produced on November 11 and 19.

Concluding thoughts

- Network-based metrics and holder profitability (MVRV) are both showing large scale bearish divergences hinting at a potential pullback/correction.

- But users are not looking to book profits, which means that they are expecting IMX price to move higher.

- Until NPL and WTC show considerable spikes, investors need to stay away from shorting the altcoin.

For technical analysis of ImmutableX's IMX token, check this - Link

For more on-chain analysis of IMX, check this - Link

Author: Akash Girimath

Thanks for reading!

If you enjoyed this insight please leave a like, join discussion in the comments and share it with your friends!

Never miss a post from FOREXSTREET SLU!

Get 'early bird' alerts for new insights from this author

Conversations (0)