Nobody believes the Coinbase crash was an accident

Rumours run amok as Coinbase went offline yesterday at precisely the time that Bitcoin experienced what would become a 15-minute, $1,700 plunge.

According to multiple reports, Bitcoin’s price began to plummet following an 18-month high $13,796, just minutes before Coinbase’s first announcement of service denial issues. According to Coinbase’s status page, the outage affected the company’s website, its mobile apps as well as its API. Within the next hour, the king coin dropped to as low as $11,900, before recovering ever so slightly.

At about the same time, Robinhood also reported having issues with its crypto trading platform.

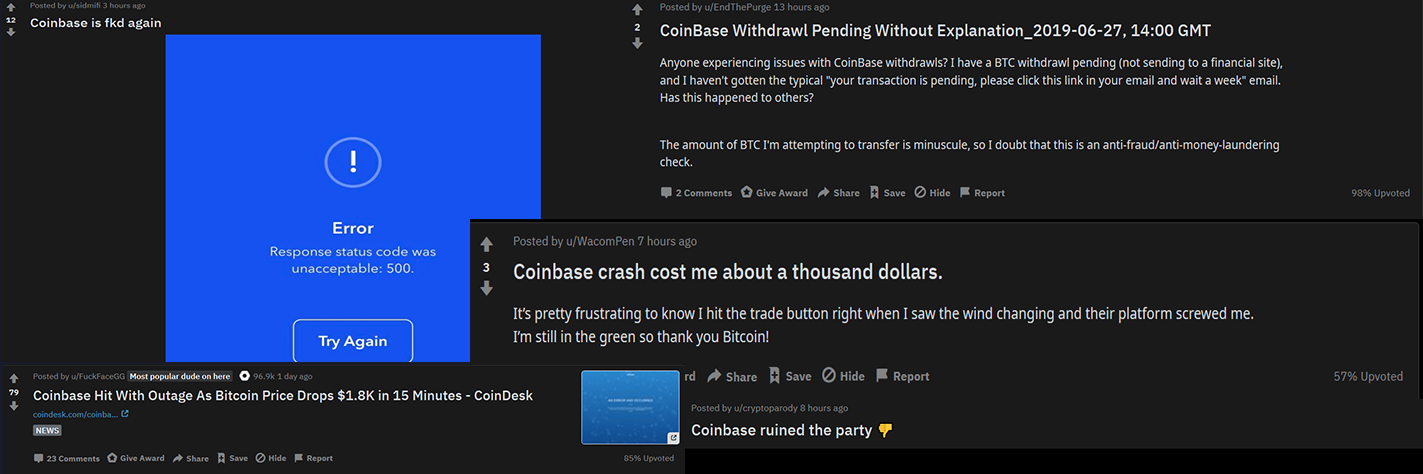

The outage news was received as well as you might expect from both the customers of the US-based exchange, as well as the wider crypto public:

“Reading a recent article in CoinDesk about how Coinbase "experienced a brief outage" yesterday when BTC went berserk.” writes one disgruntled customer:

“This grinds my gears because 1, it was the users who suffered the deterioration in "experience;" 2, saying that Coinbase "experienced" something makes it seem like it's some inert entity that did not have two plus years and fountains of VC and outside capital to prepare for precisely these types of high volatility scenarios. This is crypto, after all!?!?”

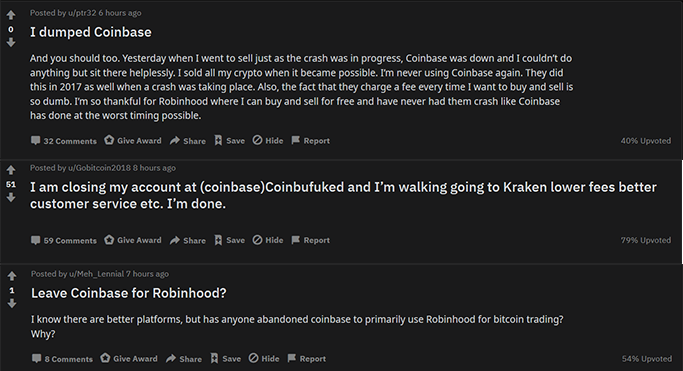

The community frustration was palpable, with multiple threads announcing or promoting departure from Coinbase in favor of one of its competitors:

This wasn’t a one-way street, either: some exchanges went into full recruiting mode, showing up in Coinbase-bashing threads to kindly assist the newly-converted:

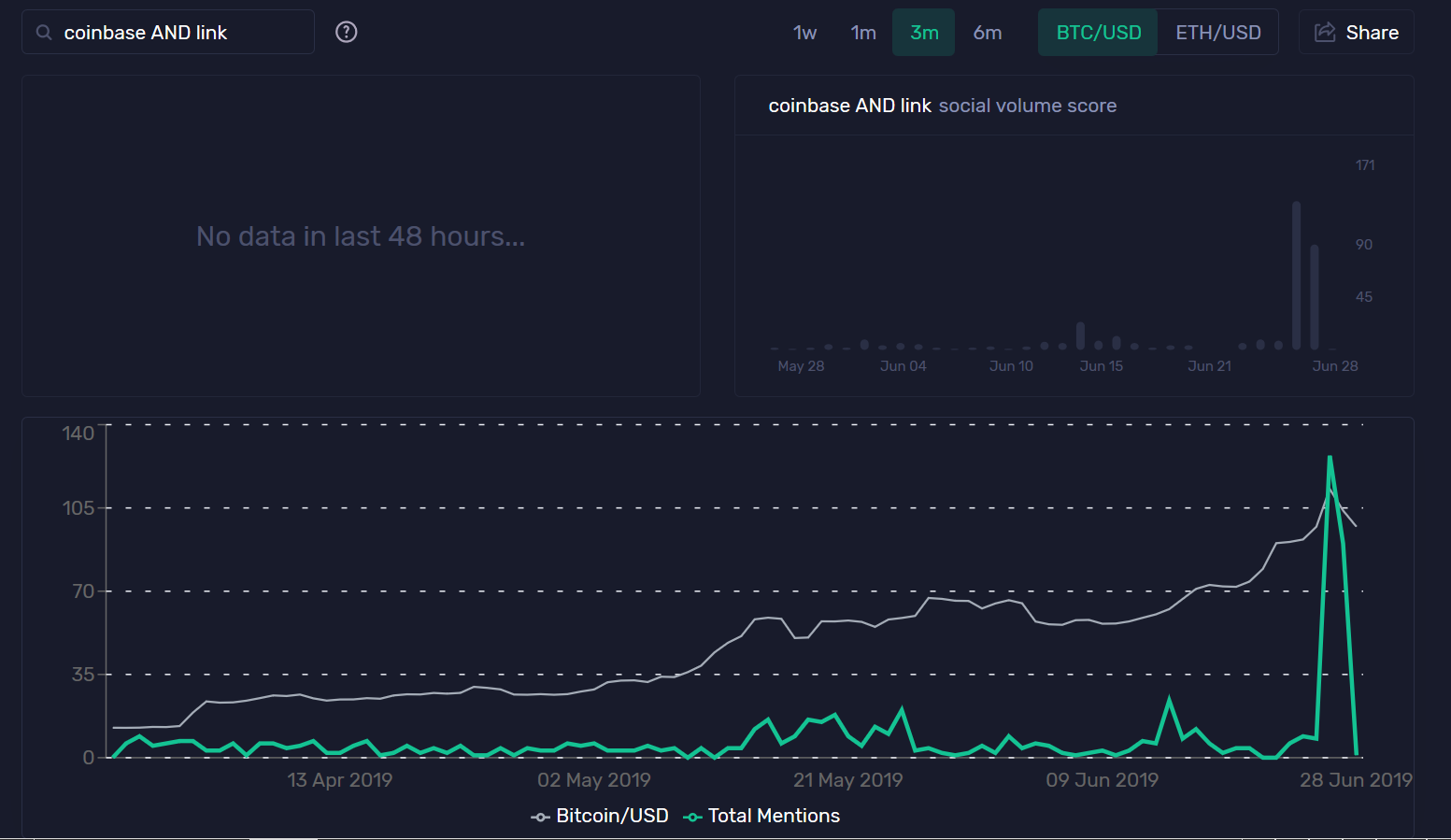

In light of the recent news, there was even a recorded spike in mentions of ‘kraken’ and ‘coinbase’ appearing in the same messages on crypto social media:

And while a few people claimed that the Coinbase outage was directly responsible for the BTC crash:

Most believe that it was in fact the other way around and that the exchange was reacting to the downtrend by intentionally suspending service to prevent panic selling:

- It stops their customers taking positions against the house which would bankrupt the house. All these crooks play their clientele all the time, sometimes they get caught with their pants down and have to pull the plug.

- I think they weren't really out of service. They just wanted to prevent even more mass panic selling.

- Out of service? You mean they kept your hands steady for you. Zero coincidences.

- Same shit happens all the time in retail forex markets. It’s called “slippage” or delay to cover the brokers ass when price moves too quickly such that it might lose money.

Which, according to some, avoided an even bigger market crash:

- Coinbase shutting down is what saved the course from dropping even further. It kept your noob-hands steady. You should be thanking them.

Regardless of the cause/impact, the Coinbase crash was not surprising in the slightest for many, given the company’s previous track record:

- Coinbase crashing during a massive swing? It’s been doing this since 2016. Welcome to the party.

- As per the norm

- It's like summer 2017 all over again.

That last one wasn’t an isolated comment either, as the crash seems to have reminded a fair few of the 2017 outage shenanigans:

All of that said, the peculiar outage timing is unlikely to have a serious or long-lasting impact on the exchange’s bottom line. Judging by the reception of yesterday’s news that Coinbase will soon list Chainlink, it seems the crowd is willing to forgive and forget at lightning speeds - for the right incentive:

And so the cycle begins anew.