New York AG sues Bitfinex and Tether, alleges $850 million fraud

The New York Attorney General’s office has alleged that the cryptocurrency exchange Bitfinex lost about $850 million and tapped into Tether’s reserves to pay out customers demanding withdrawals from the exchange.

According to the civil case brought by New York Attorney General Letitia James, Bitfinex delegated over $1 billion in co-mingled client and corporate deposits last year to a Panamanian firm, Crypto Capital Corp:

“Despite the sheer amount of money it handed over, Bitfinex never signed a contract or other agreement with Crypto Capital,” the attorney general wrote. Per the suit, by mid- to late-2018, Bitfinex executives started suspecting that Crypto Capital had lost or stolen the money, and they haven’t been able to recover roughly $850 million. “None of that has been disclosed to investors.”

In its filing, the attorney general says an investigation in the matter has been underway for months, and has requested numerous documents to learn whether New York investors are being exposed to ongoing fraud from Bitfinex and Tether.

In a joint statement, Tether and Bitfinex denied the claims that the funds were lost:

“The New York Attorney General’s court filings were written in bad faith and are riddled with false assertions, including as to a purported $850 million ‘loss’ at Crypto Capital. On the contrary, we have been informed that these Crypto Capital amounts are not lost but have been, in fact, seized and safeguarded. We are and have been actively working to exercise our rights and remedies and get those funds released.”

The two companies say they’ve been fully cooperative with New York prosecutors, calling on the Attorney General to “focus its efforts on trying to aid and support our recovery efforts.”

The news sent shockwaves through the market, as Bitcoin plunged by seven percent almost immediately after the announcement. As a result, most crypto assets have been painted red for the past 24 hours.

Due to the lawsuit, various non-Tether stablecoin pairs saw a sudden uptick in price, as Paxos, TrueUSD, USDC and StableUSD were able to trade at as much as 4% premium. On Binance, PAX and USDC have started to account for a relatively large portion of the exchange’s daily bitcoin volume.

Meanwhile, the crypto community has been trying to determine the full scale of the issue at hand, and its potential impact on the market. While some are taking a more measured approach, many have already proclaimed the end of the bull market:

While there’s been plenty of FUD to go around, some have also treated the news as a good opportunity to accumulate:

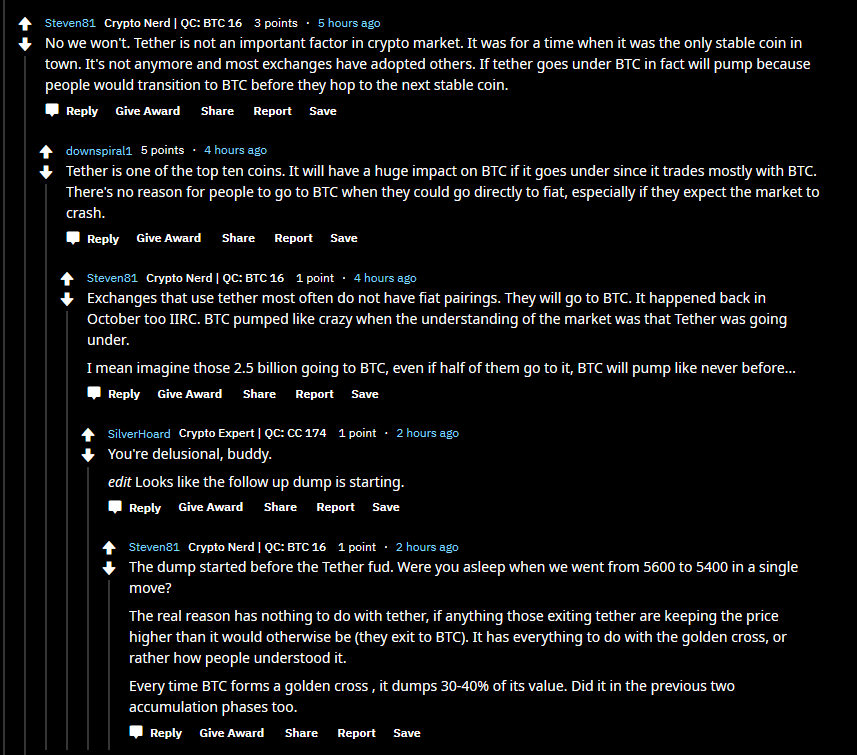

Apart from the suit, much of the talk has been about what this means for Tether and Bitcoin going forward. On that front, two divided fractions are beginning to emerge:

Interestingly, the news has also been embraced by some Tether enthusiasts as proof that the stablecoin is actually backed by real money:

For the time being, Bitcoin has slightly recovered since the initial wallop, and is now back up to $5302, or down 3.35% for the day. The mid and long-term ramifications of the news, however, remain to be seen.