New NY AG Memorandum revives Tether fears

Tether is in the news again, after a new set of allegations were levied against the company in a Memorandum of Law filed on Tuesday by the New York Attorney General.

Among other issues, the filing makes the claim that some tethers have previously been issued unbacked as loans to certain investors. As per article 22 of the Memorandum:

"The OAG's investigation has also determined that as late as 2019, Respondents entered into at least one written agreement to loan tethers to a New York-based virtual currency trading firm."

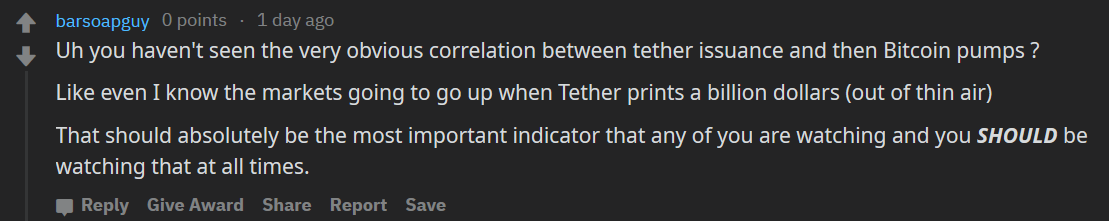

The news quickly made waves in the cryptoverse, as some took this as proof that USDT is being printed without proper backing. Others went a step further, positing that this entire BTC run is propped up by newly-minted USDT used to artificially inflate the coin:

”They are just printing USDt which is being used to buy crypto without actually getting paid for them. USDt out of thin air. No fiat entering the system, just USDt printed and used to trade.”

The AG Memorandum also coincided with another batch of 100M USDT being minted, adding extra fuel to the ‘Tether pump’ theory:

That said, not everyone was buying the Tether angle:

- tether printed $100mm and price is down $1500 in 12 hours? How does this prove your theory *at all*?

- Ok why does tether not affect alt prices? Alts have tether pairs too.

- lol, if there's anything more useless than 50 Japanese TA indicators it's stuff like whale alert and tether print notifications

In disproving the connection, a few have decided to employ some...uhm...graphic analogies:

"Every time I've taken a s@#t this year the price went up shortly after. Clearly my s@#ts are pumping the market. You can literally apply your thinking to anything over the past few months since price has been going up relentlessly. There's no correlation, anyway.. even last year when noobs tried to trade off of tether pumps it literally failed more than half of the time."

And while the crowd remains split on the merits of the Tether claims, Kraken CEO Jesse Powell recently said he believes the new Tether prints are in line with new fiat money entering the market:

“Recently, we’ve had massive inflows of fiat currency, so I believe the Tether prints are a result of new fiat coming in,” said Powell. “I don’t feel like Tether is artificially inflating the price of bitcoin. I think Tether is actually a small part of the total fiat supply among all the exchanges”

Pump culprit or not, the AG report also revived concerns of a potential Tether insolvency, with some already hypothesizing about the market-wide impact of such an event:

On very much the opposite side of the spectrum are those that believe ‘powerful people’ are keeping Tether afloat, and will ensure the coin’s stability for the foreseeable future:

Meanwhile, Bitcoin continues its 2-day downtrend, losing over 13% since it’s 3 week-high $13,129 on Wednesday afternoon. Where’s the deep state when you need it?

Conversations (0)