Metrics for UNI are Beginning to Look Loony

Uniswap has been on quite the tear in the past seven weeks, decoupling from the rest of the altcoin pack in several instances, and jumping +153% since June 18th.

The 15th largest market cap asset in crypto and popular DeFi asset has watched its daily address activity soar to above 1,100 per day as prices have risen. This is generally a good validator that utility is backing up and 'justifying' the rising market cap.

It's also great to see that shark and whale addresses have been accumulating heavier and heavier percentages of Uniswap's overall supply since May. The 100k to 1m UNI addresses, in particular, saw a massive accumulation spike just two weeks ago. And continued price rises soon followed.

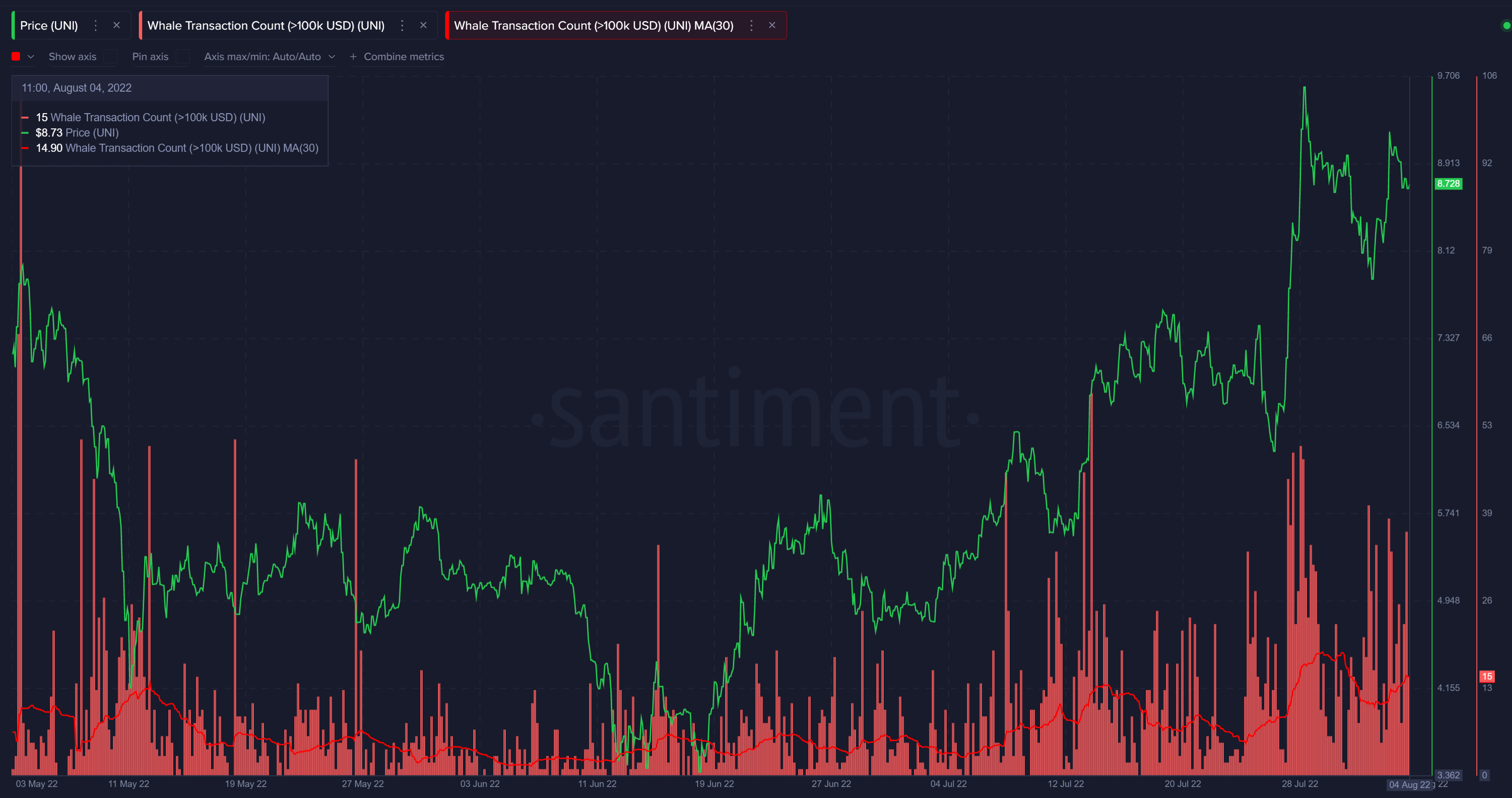

And speaking of whales, the amount of large transactions (which we deem to be transactions valued at $100k or more) are rising back to May levels as well. We can clearly see the major clump of big whale transactions that began forming one week ago, just prior to the major price rise up to $9.69.

And finally, an interesting pattern has developed among active average trading returns. We can see that the 30-day MVRV is currently up to +22.5%, which is well above the backtested 'Danger Zone' of +15% or more. But even with mid-term trading returns beginning to overflow, the good news is that long-term traders (in the 365-day MVRV) are still well under water. This means that there may be an upcoming downturn in the next week or two for UNI, but its future for the long-term still looks to be undervalued.

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.