MATIC gets a taste of the 'Coinbase Effect'

Few coins had as eventful full months as MATIC. Following a formidable two-week rally back in December, MATIC lost 70% of its value in just a few quick hours, prompting some to crown the coin as ‘the new king of PnDs’ and circulating rumours of it being an inside job (disproven so far).

Just 10 days later, MATIC staged another, smaller version of its mega pump, topping its 4-day uptrend with a 19.4% decline. Since then, the overall MATIC-related sentiment on crypto social media has - unsurprisingly - remained negative according to our data:

But it’s a new year, and Matic is back to retesting the trust of its community and remaining bag holders with yet another, 20.5% pump in about 24 hours, spiking the coin to a month-high 210 satoshi.

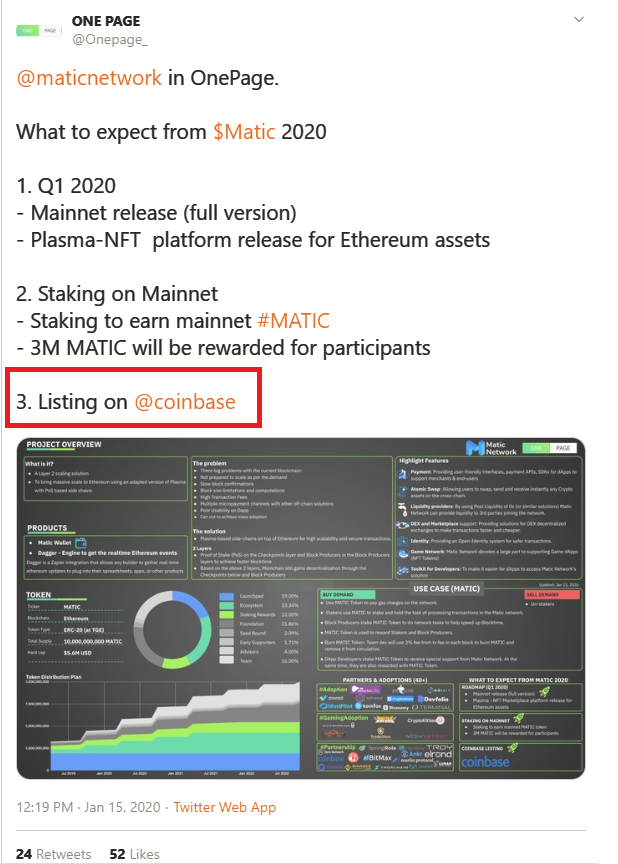

There is, however, one big difference this time around, which is that the pump may actually have some merit. And by merit I, of course, mean a coin listing on Coinbase Custody:

MATIC is not the first nor it will be the last cryptocurrency to experience the coveted ‘Coinbase effect’. In fact, almost at the same time as its listing announcement, another coin - ATOM - became available for purchase on Coinbase, prompting a 30% pump in several hours time.

As one enthusiastic reddit user put it, the Coinbase effect has proven more reliable than any ole TA:

So at least we’ve got a clear reason for the pump this time around - but what do the fundamentals tell us?

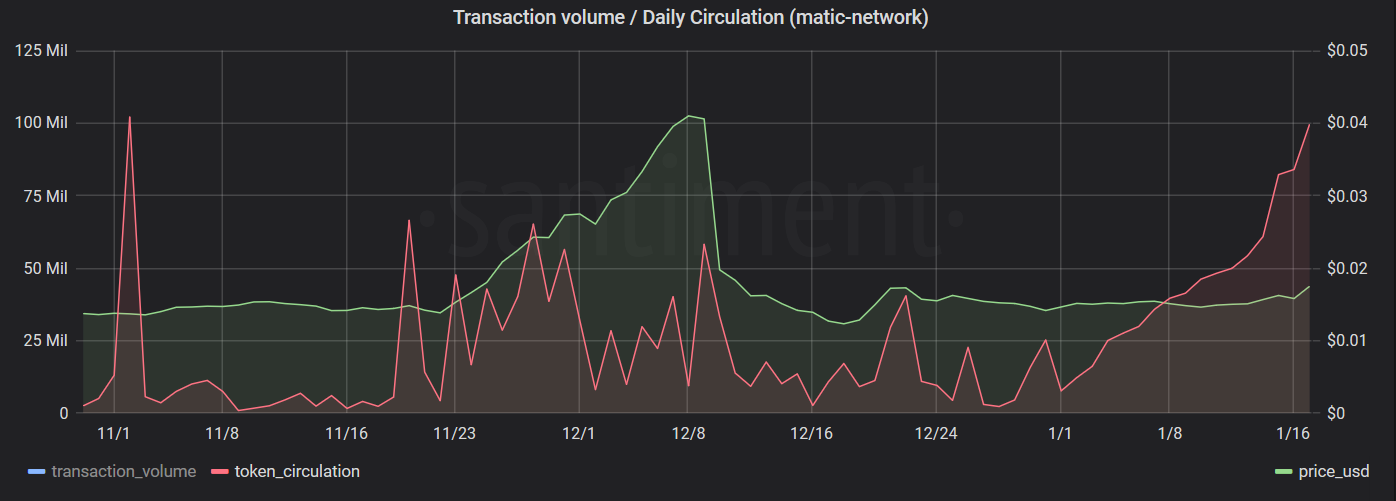

Well, as is tradition, the MATIC pump is not without its peculiarities. Based on our data, there’s been a massive spike in both on-chain trx volume and token age consumed some 36 hours before the announcement, eclipsing even the December pump:

This seems to be due to several reasons. For one, rumours of an upcoming Coinbase listing have been circulating around the cryptoverse in the past few days, even before any official announcement.

Like this community-made roadmap posted a day before the announcement:

Or this bullish poll published two days before:

This is not without reason, as Coinbase has been rumoured to be looking into a MATIC listing since last August.

So the spike in trx volume could have been - at least partially - a classic case of ‘buy the rumour, sell the news’ for some quick fingers.

It’s unlikely to have been the main reason, however. Looking into MATIC’s top transfers over the last week in Sandata, one participant keeps popping up time and time again - Binance.

It seems that the exchange has been doing some reshuffling of MATIC funds between their internal wallets right before the announcement. Below are 10 of the biggest MATIC transfers in the past week. The timing of the first four transactions correlates squarely with that massive spike in MATIC’s trx volume and token age consumed. Which of them do you think were transfers from one Binance wallet to another?

Trick question - they all are.

The biggest transaction of 20m MATIC (~$370,770) was from Binance 8 to Binance 1, with similar patterns in the other three.

Could the exchange have been moving MATIC from cold to hot wallets in preparation of the Coinbase announcement? Eh, perhaps. It also could be that this was just a scheduled transfer between Binance’s cold and hot storages.

There have been similar, albeit much smaller MATIC transfers between several Binance wallets back on December 15th as well, so this could just be periodical rebalancing done on every 15th in the month. Still, the size of the move is noteworthy nonetheless.

It’s also interesting that MATIC’s token circulation, or the amount of unique coins exchanged one the network, is now higher than it ever was during the December pump. While this too could be skewed by those massive Binance transfers on January 15th, MATIC’s token circulation has been on the uptrend virtually since the start of the year, which could be a positive sign for the coin moving forward, and for its likelihood of sustaining this Coinbase rally:

Another hopeful sign for MATIC’s short-term price action could be that we’re still not seeing nowhere near the same levels of social chatter and crowd attention as during its previous two dumps. Extreme social volumes - especially during an uptrend - can often indicate a looming correction, as we’ve seen happen during both previous MATIC rallies.

That said, we’re already starting to see a growing flow of MATIC to exchange wallets in light of the Coinbase news. Should this trend continue, like it did during the December pump, it could bring an elevated sell pressure that proves too much for the bulls to absorb:

Over on the Binance English Telegram group, however, those concerns are far from discussed, as bullish sentiment dominates the chatter:

So what are the chances this MATIC pump ends in the same violent fashion as the previous two? Well, one potential indicator would be seeing MATIC make our list of top 10 emerging trends, like it has on several occasions during the past PnDs:

If you want to be alerted when that happens, here's a signal that will let you know as soon as MATIC makes our Emerging Trends list. Stay safe out there!